How Can AI Pharmaceutical Companies Break Through the Collaboration Barriers with Big Pharma?

-

The global top 700 pharmaceutical companies are among the world's largest and most influential organizations, with a total market capitalization exceeding $5 trillion.

For AI-driven pharmaceutical companies with cutting-edge technologies, gaining favor from big pharma to provide products or services can be a tremendous boost for business development and financing.

However, conservative big pharma has significant reservations about adopting new technologies, making it essential to understand their value orientation toward AI.

It's crucial to recognize that many large pharmaceutical companies set the following threshold when purchasing major software/services or selecting partners:

How will this help us secure specific drug approvals?

This is the key criterion for many big pharma companies when introducing vendors and forming partnerships. This article uniquely explores, from a BD perspective, what kind of AI products and services pharmaceutical companies need and how to expand their client base.

Big Pharma's Value Orientation Toward AI

Understanding that pharmaceutical companies ultimately seek approved drugs, there are three fundamental truths to grasp if AI is to create substantial value in drug discovery:

- The further removed from critical drug decisions, the less value is created.

- The less influence on clinical + commercial-stage decisions in drug discovery, the less value is created.

- The highest-value decisions involve selecting the right targets/phenotypes, reducing toxicity, predicting drug responses, and identifying the right patient populations.

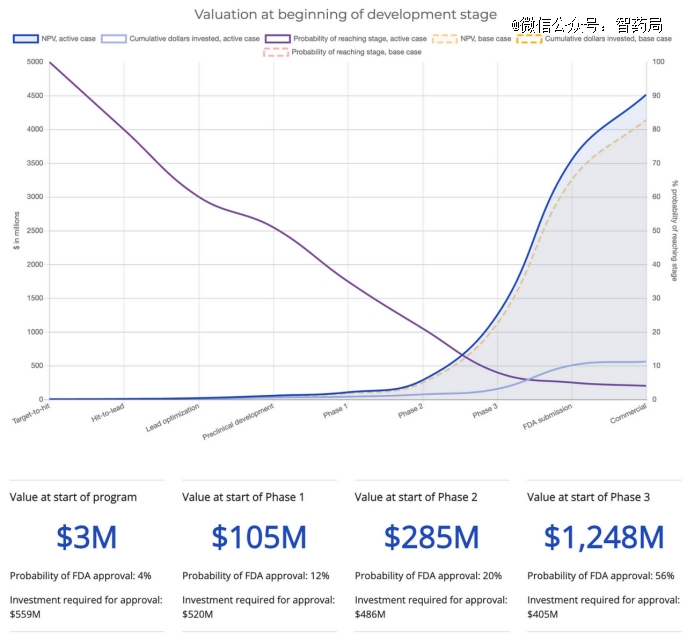

The drug discovery process can be viewed as a series of sequential, data-driven decisions. This sequence consists of three major phases: preclinical, clinical, and commercial. Each phase has important sub-stages, but the risk reduction and value increase between higher-level phases are substantial.

The chart above shows that the later a drug progresses in clinical stages, the higher the value created. This also explains why Veeva, a SaaS company creating software for commercial and clinical stages, has a market cap of $30 billion, while Schrodinger, a SaaS company focused on preclinical-stage software, is valued at $3 billion.

While the phase of decision-making matters, the type of decision is equally important. 90% of drugs fail in clinical trials due to lack of efficacy or safety. Efficacy issues often stem from selecting the wrong targets/phenotypes or the wrong patient populations.

Drugs fail because they don't bind to targets, developers lack protein structure knowledge, can't produce drug-like chemicals with desired properties, or have low expression rates, among other reasons.

None of these problems or decisions create significant value because addressing them doesn't change the failure rates between development stages. Simply put, this leads to losses of $50M-$150M rather than $10B-$100B.

Solving these issues is like casting supporting roles in a movie. If a startup is building an AI product/service, it must deeply consider what types of decisions it's impacting and whether it truly helps big pharma develop marketable drugs.

The Digital Revolution is Meaningless

If your pitch deck or website contains phrases like "ushering in the digital revolution" or "unleashing AI's disruptive power," you won't succeed.

Such phrases are meaningless. At BioIT World or any SaaS biotech conference, 90% of themes follow this same pattern:

- Develop drugs faster and cheaper with AI

- Discover better, safer drugs using AI

- Learn how AI will transform your R&D

- Accelerate scientific discovery with AI

- Break data silos and generate better insights with AI

- Integrate AI and scientific discovery at scale

As an AI startup, getting lost in these grandiose but empty slogans is dangerously easy.

For pharma executives, "digital revolution" doesn't mean $500K contracts with unknown companies - it means eight-figure cloud migration deals with Google/Amazon or multi-year partnerships with Microsoft's AI team.

Startups must accept they're insignificant when the digital revolution concept remains undefined.

To get big pharma's attention, startups must clearly demonstrate how they impact what matters most: helping develop approved, marketable drugs. Here are some examples of effective messaging:

Systematically and rapidly optimize AAV capsids to overcome limitations of natural viral capsids;

By applying revolutionary insights in 3D protein-ligand co-folding, we can target previously undruggable disease targets;

Combine human intuition with unbiased AI to make better discoveries through high-throughput drug screening;

Understand drug toxicity before running animal models;

These messages succeed because they clearly focus on specific areas of the drug discovery process and express how they impact that area in simple, powerful, direct language. This type of messaging immediately interests scientists working in these specific fields.

How to Get Scientists to Accept AI

Training Data

One of the main ways to build scientists' trust in artificial intelligence is to give them deep insight into what the AI has been trained on, including the foundational training data.

For clinical data, scientists want to know whether it's prospective/retrospective, collection protocols, testing protocols, quality control/review standards, how sites were selected, etc.

For preclinical data, they truly care about batch effects, dataset size, experimental parameters (e.g., model/cell type/exposure time/dose), number of chemicals/conditions tested, types of chemicals/conditions tested, equipment settings that generated the data, algorithms used to process the data, and more.

For scientists, these are extremely important details because they rely on this data daily to evaluate research outcomes and quality, which is why published papers need to clearly document them.

It's crucial to build robust data tables, raw tables, and training data summaries to share with scientists. They spend considerable time digging deep, asking questions, and developing a thorough understanding of training datasets. Hiding training data from clients will certainly lead to misunderstandings.

Interpretability

Machine learning researchers and drug discovery scientists have different understandings of what it means to interpret AI models.

For machine learning researchers, they typically view models through visualization results, feature importance, and statistical methods to understand model weights and functionality.

But scientists, with their rich knowledge base, see interpretability through the lens of biology/chemistry/physics/science.

Scientists are accustomed to interpreting and understanding controlled experiments by manipulating variables. Following this paradigm, they also evaluate AI models by studying their performance under controlled conditions.

For example, when using an AI algorithm to predict immune cell activation, scientists would want to understand how the algorithm performs under controlled conditions (e.g., TLR increases activation) versus control conditions (e.g., IL-10 is known to reduce activation).

If a startup is developing similar AI tools, the first thing to do is identify the control variables scientists need to see to build trust in the model. These control conditions are crucial for helping companies communicate the model's value and assisting scientists in understanding how to use it.

Additionally, don't waste time trying to create diagrams or fancy algorithms to explain neural networks—I've spent a lot of time on this without success. Here are some key talking points I use to help scientists understand and adapt to this phenomenon:

- We use a vast amount of diverse data...

- Teach AI to adopt an unbiased approach...

- Utilize all the information in the data...

- Learn the optimal function for the task...

- Compare this with biased human methods...

- Humans reduce data to a single feature they prefer...

- This may or may not be the best for the task.

This is how I summarize what AI is doing and help scientists recognize its value. I don't precisely explain what the AI algorithm has learned (after all, we don't know ourselves). Instead, I create a new framework where they don't need to fully understand what the AI is learning.

Benchmarks vs. Use Cases

Scientists don't care whether an AI model achieves state-of-the-art (SOTA) performance; they care about how the algorithm performs in real-world use cases they deal with daily. Instead of spending time discussing how your model improves by 3% over AlphaFold in CASP, talk about how it can help scientists discover the structure of a particularly challenging class of proteins that AlphaFold can't handle. Focus most of your time on discussing real-world use cases based on scientists' daily work rather than abstract benchmarks on curated datasets.

AI vs. Traditional Methods

Scientists are genuinely concerned with how AI models can outperform their daily tasks, yet benchmarks for this remain undefined. In this context, a solid benchmark involves solving problems scientists face daily and comparing their current methods with AI-assisted solutions.

For example, modeling diseased vs. healthy samples using histology images. To create effective benchmarks, compare classical computational methods with AI approaches, presenting concrete results to highlight differences between existing methods and AI-powered solutions.

Architecture

Scientists don't care about neural network architectures. Mentioning transformers, CNNs, attention mechanisms, or other advanced terms to make a model appear sophisticated is futile. Trust is built on the model's content and results—not its novelty.

Ease of Use

Usability is critical—it determines whether scientists adopt a product and integrate it into workflows. Three key stages matter:

- Inputting data for predictions

- Delivering predictions to scientists

- Enabling scientists to act on predictions

If any stage is cumbersome, trust erodes.

Reducing Error Rates

No AI company currently claims to significantly improve drug development success rates. Until then, interim evidence is needed. Approaches include:

- In vitro data: Testing AI solutions on real drug-discovery problems with verifiable outcomes.

- In vivo data: Costly ($100K–$500K) but powerful validation, often requiring months. Publish these results.

- Design partners: In vitro/vivo data should help secure partners advancing clinical trials. The ultimate validation is aiding their transition from preclinical to clinical stages.

Proving AI boosts drug discovery success is the hardest hurdle—where hype meets reality. AI firms shouldn't develop drugs but should conduct relevant physical experiments.

Acquiring Customers

Assuming the company has built an outstanding AI product/service that can create significant value by aiding in the development of approved drugs, it's time to start marketing and selling the product.

Networking is crucial in this process. Building a strong network funnel and engaging with various pharmaceutical companies is essential. One effective method is to expand your network either personally or through investors, advisors, or board members.

If the company is primarily technical or just starting with limited connections, what should be done? Here’s a thoughtfully ranked list of strategies by effectiveness:

- Publish groundbreaking scientific research in collaboration with renowned scientists.

- Leverage partnerships, including CROs, consultants, equipment manufacturers, CMOs, etc.

- Attend conferences and industry events.

- Hire industry professionals with 5-15 years of experience in biopharma.

- Lead or respond to current scientific trends (e.g., COVID-19).

- Share scientific papers and blog posts on social media.

- Cultivate a highly specialized niche community of experts.

- Provide free support to key academic opinions.

- Expand your network through investors, friends, employees, and other channels.

- Cold emails/calls.

Another critical aspect of sales is identifying strong, mutually beneficial supporters within large pharmaceutical companies. These supporters should not only be highly interested in the AI product/service but also capable of influencing internal decisions.

Employees in multinational corporations can impact drug projects in two ways: 1) making decisions or 2) supporting decisions. Therefore, it’s important to understand their roles and influence.

Drug Project Leaders

In large pharmaceutical companies, the individuals with the most authority and budget are the drug project leaders. These projects are typically divided by specific drugs or therapeutic areas such as neuroscience, metabolism, oncology, vaccines, etc.

Each drug project or therapeutic area typically has a * and is overseen by an executive committee. The two collaborate to make major go/no-go decisions, involving amounts ranging from $10 million to $100 million.

As a result, drug project leaders and their teams usually wield significant authority over budget expenditures, enabling them to directly procure products and services.

Additionally, these teams are under heavy workloads and pressure, often preferring the most practical, straightforward, and well-established methods to advance drug projects. This also means they generally have low tolerance for unproven services.

They typically invest time in new technologies only when they clearly understand how to apply them to solve specific problems or when they face a critical issue where the * solution involves adopting new technologies like AI.

Since committee approval is required for large budget expenditures, drug project leaders often cannot commit to long-term SaaS software purchases. Selling time-limited "fee-for-service" agreements to such teams is advantageous, as it allows for quicker budget approval.

Specialized Platform Teams

Large pharmaceutical companies have numerous internal platform teams supporting drug projects, each with its own expertise. These teams are typically organized by specialized fields such as sequencing, screening, high-content imaging, X-ray crystallography, proteomics, clinical data, antibodies, and other advanced domains, serving multiple drug projects.

Many drug project teams rely on these platform teams for progress. For example, a drug project team may decide they need to perform X (e.g., run high-throughput screening). To accomplish X, they approach the platform team specializing in X. This results in platform teams receiving numerous inbound requests to execute X for various drug projects, often serving 15–200 different drug project teams simultaneously.

Their budgets are usually tied to the number of drug projects they support and their impact on each project. Platform teams focused on sequencing, screening, and high-content imaging may be central to many drug projects, leading to substantial budgets. They encounter diverse use cases, making them highly familiar with their specialties and core challenges in drug development.

Platform teams are more open to experimenting with new technologies, as they often have additional budgets and resources for exploratory work and accept the risk of failure when trying new approaches. If a new technology can improve their performance by 100x, the payoff is enormous. If it doesn’t work, operations continue as usual.

This makes platform teams and their leaders an excellent customer base. High-content imaging, for instance, may be central to many drug projects, resulting in significant budgets.

Computational Research Teams

Currently, computational research teams are relatively new, and selling AI products/services to them is often challenging for several reasons...

Team budgets are typically small, primarily covering staff and basic needs.

Their value is measured by their impact on drug projects.

They have no authority to intervene in drug project decisions.

Such teams continue to develop within large pharmaceutical companies and are learning how to effectively influence drug projects.

They aim to provide computational value to the drug projects themselves, rather than relying on startups' products/services for computational value.

When startups pitch products to computational research teams, the responses are either: "This is great, but I need to convince project leaders X, Y, Z to see the value here"; or "We're building an in-house team to do this" (implying they don't need external help); or "This is great, but our team has no budget."

The current situation in large pharmaceutical companies is that computational researchers don't directly oversee drug development - compared to other platform teams, this is a service function with very little autonomy.

Computational research teams are learning how to integrate into organizations - this is a transformative process. Currently, computational personnel aren't core members of R&D projects, but the future looks promising.

IT Departments

IT departments face similar challenges. They typically focus on clear technical issues like data storage, security, and computing. They don't understand the core problems facing drug projects.

It's difficult to convince IT teams that they're solving core drug discovery problems because they're not deeply involved in frontline operations. They usually receive inbound requests from drug project/platform teams and make decisions based on internal priorities and budgets.

They rarely tell R&D teams "You need to use this technology to solve problem X" - instead, R&D teams approach them saying "I need to use this technology to solve problem X." They're not strong advocates for startups.

C-level Executives

C-level executives (CEOs, CSOs, CMOs, CFOs, etc.) typically rely on trusted relationships to filter viable opportunities from the many they encounter - this is natural behavior to some extent.

When it comes to supporting AI products/services, these executives may have the will but not the means, as AI products still need to be used by frontline personnel who best understand drug project decisions. Even if executives see the value, they need to convince their teams to use it in daily work. A bottom-up approach to gaining executive support is much more effective than a top-down approach.

Large Meetings

Once you've established good relationships with your supporters and communicated several times, they'll likely organize large meetings.

Scientists enjoy gathering groups to discuss novel results and technologies. When large pharmaceutical companies become interested, they typically organize major meetings with 15-30 participants.

These meetings are usually interdisciplinary, involving scientists, engineers, computational researchers, clinicians, executives, IT personnel, and others. This setting is crucial for showcasing products and services, requiring outstanding performance.

Nearly all remarkable meetings feature live demonstrations that let the product speak for itself. If the product is good enough, it can evoke instinctive reactions from clients - something that charts, data, and feature lists often fail to achieve.

For such meetings, prioritize presenting the following content:

- Live demonstrations or real product walkthroughs

- Examples of AI products/services solving relevant problems

- The values and ideals upheld by the startup

- Key points and markets the product can impact in drug development

The following content can be moderately reduced:

- Metrics like accuracy, R-squared error, AUC, F1 scores

- Comparisons with *advanced technologies

- Feature lists

An ideal interaction cycle during the meeting should be: "Wow, amazing!" → "But do you have data validating X?" → Presenting slides/publications containing data that validates X.

Well-prepared companies have all data ready to immediately address any doubts raised. Of course, this process is challenging, requiring significant time and iterations, especially in multidisciplinary meetings.

In my opinion, an ideal large meeting consists of:

- 25-30 minute storytelling to convey atmosphere and values

- 10-20 questions demanding validation data/facts to support the narrative

- Immediate, concise answers with strong supporting data for over 70% of questions

15-30 Minute Brainstorming Session

A 15-30 minute brainstorming session to discuss collaboration methods and next steps. If the meeting atmosphere is very positive, it is highly likely that both parties will proceed to the next stage.

Pilot Project

Through closed-door meetings, large pharmaceutical companies may be impressed by AI products or services. However, this does not mean the task is complete. Scientists are inherently skeptical and will not trust AI products based on a single meeting. They may get excited about new technologies, but this excitement will prompt them to think about how to validate the technology with strong data. Therefore, the two companies may initiate a pilot project to address any remaining concerns.

To prevent this, AI companies need to send a pilot template/proposal to potential clients within 24 hours after the major meeting. The proposal should include detailed steps, clear outcomes, and well-defined objectives. Below is an example of a proposal:

We would like to propose a pilot project to evaluate the ease of sending samples to us, the speed of processing samples, and the accuracy of AI predictions. Here are the suggested steps for the pilot:

- Begin by reviewing and finalizing the process with the legal team.

- You send us 20 blind samples, including 10 diseased samples and 10 healthy samples.

- We process and run the AI model on each sample.

- We send you the predictions for each sample, and you can evaluate whether they match the labels.

- If you are interested in proceeding with this pilot, could you let us know where we can send the legal documents for review and the sample shipping instructions?

This means you need to let the data speak for itself. If you try to embellish the data with any hype or sales tactics, scientists will completely reject it and lose trust. The *response to poor pilot data should be to face it head-on, identify the reasons, explain them clearly, and develop a serious plan to fix it in the coming months. If you are sincere, straightforward, and painfully honest, most scientists will give you a second chance.

Pay Attention to the Sales Cycle

For large pharmaceutical companies, the sales cycle for life sciences software is very unusual and differs significantly from other enterprise SaaS in the following ways:

Annual Budget

The annual budget in the pharmaceutical industry is set earlier than in other industries (9-12 months in advance), but there is often surplus funding that, if unused by the end of the year, will be lost. The situation is similar to selling products to the government, which also means that big pharma has a long sales cycle and pilot projects,

as well as a narrow window for upselling.

Project Timeline

When entering clinical development and selling to specific projects, companies are affected by study start dates and data statistics, which are often delayed (and sometimes accelerated). This creates significant path dependency, necessitating thorough preparation.

IT / Security

In large pharmaceutical companies, many contracts become void even after other stakeholders have signed, and there seems to be no unified security/privacy standard. Therefore, involving the IT team early can be beneficial.

Delivery/Deployment

Pharmaceutical companies are accustomed to purchasing services (from CROs and vendors) and rarely pay for self-service SaaS software. As a result, AI-driven pharmaceutical companies often bundle their offerings as professional services, making them more acceptable to pharmaceutical firms. Many AI pharmaceutical companies thus become service/NRE providers rather than product sellers, though Veeva's example proves it is possible.

Don’t Take It Lightly

If things go smoothly, it typically takes 3-6 months, or even 6-12 months, for both parties to enter a formal collaboration phase. While this process is generally straightforward, there are a few points to note:

- Ensure you know exactly what is required to close the deal (who needs to approve/sign, the legal procedures, potential internal obstacles, budget cycles, etc.).

- Schedule weekly calls or in-person meetings with clients to stay fully informed about ongoing developments.

- Remain patient and level-headed, avoiding excessive worry/obsession or complacency that could affect the partnership.