Apple's Market Value Plummets by 760 Billion Overnight: Why Is Apple Being Pessimistically Viewed?

-

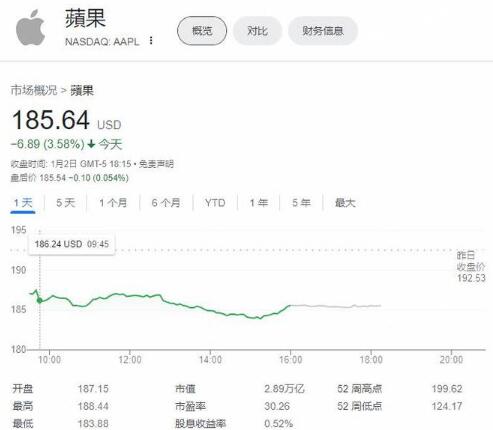

On January 3, investment bank Barclays downgraded Apple's stock rating from 'Hold' to 'Underweight' and lowered the target price by $1 to $160, implying a potential 17% decline in the company's stock price over the next year. On the same day, Apple's stock price fell by 3.58%, closing at $185.64 per share, with its market value dropping by $107.1 billion (approximately RMB 766 billion) overnight. This marks the largest single-day decline since August 4, 2023, and the lowest closing price since November 9, 2023.

Barclays analyst Tim Long wrote in a report to clients on Tuesday that the iPhone 15 series is currently experiencing 'lackluster' sales and expects the iPhone 16 to follow the same trend. Long predicts that the weakness in Apple's hardware sales will be widespread.

He stated in the report, 'We see lackluster iPhone volumes and mix, with no bounce-back in Macs, iPads, and wearables.'

Since early last year, Apple has been grappling with slowing market demand and has forecasted holiday season sales below Wall Street's expectations.

According to relevant data, Long's stock recommendation accuracy for Apple is rated 4 out of 5 stars.

Long also anticipates that the growth of Apple's lucrative service business will slow down, partly due to increasing regulatory scrutiny. The gross margin of Apple's service business is approximately twice that of all hardware products. Apple CEO Tim Cook emphasized in an earlier earnings call that the growth of Apple's service division was "better than expected."

However, Barclays clearly believes that the long-term growth of the service business may not be reliable.

Long wrote, "By 2024, there should be initial decisions regarding Google's traffic acquisition costs, and investigations into some app stores may intensify." He was referring to the fees Google pays to Apple to maintain its status as the default search engine.

Google CEO Sundar Pichai previously confirmed that the company pays Apple 36% of Safari browser search revenue. Regulators have been closely scrutinizing the partnership between Apple and Google.

Barclays is the second brokerage to issue an "underweight" rating on the stock. Prior to Tuesday, Itau BBA's "underweight" rating was the only bearish rating on Apple stock since July 2022.

Currently, analysts' average rating for Apple is "buy," with a median target price of $200. Apple's stock trades at a price-to-earnings ratio of approximately 28.7 times, significantly higher than the S&P 500's 19.8 times.