One of the World's Largest Tax Agencies Partners with Microsoft to Use ChatGPT for Tax Filing for 5 Million Users

-

One of the world's largest tax service providers, H&R Block, announced on its official website the official release of its generative AI tax assistant—AI Tax Assist.

This tool is powered by Microsoft Azure OpenAI and functions similarly to ChatGPT. Users can quickly complete complex business processes such as tax filing, refunds, and tax management/queries through text-based Q&A. Its accuracy is as high as 100%, as H&R Block uses nearly 70 years of proprietary data for pre-training and fine-tuning.

Currently, the product has been officially launched to serve over 5 million H&R Block users, with a monthly fee of $35 (approximately ¥250), offering 24/7 uninterrupted service.

Product experience URL: https://www.hrblock.com/online-tax-filing/

Heather Watts, Senior Vice President of H&R Block, stated that people are continuously exploring the application of generative AI in practical business scenarios to achieve cost reduction and efficiency improvement, but accuracy is a crucial standard for its commercial implementation.

Taxation is an industry with extremely stringent requirements for data accuracy. To ensure the accuracy of AI Tax Assist, we did not use publicly available data for training or fine-tuning. Instead, we have accumulated nearly 70 years of professional tax data.

Additionally, AI Tax Assist incorporates the expertise of over 60,000 professional tax personnel to provide tax-related Q&A services. Through text-based Q&A alone, users can obtain all tax-related information, supported by multi-round in-depth conversations.

When users encounter difficulties while using AI Tax Assist, H&R Block's professional tax personnel will assist them in resolving the issues.

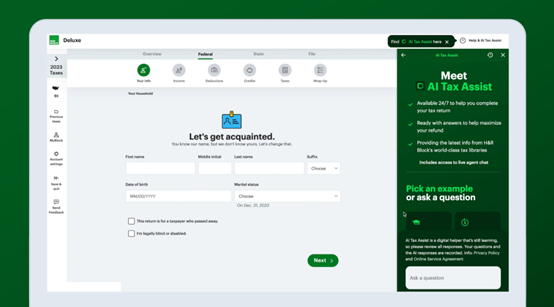

AI Tax Assist user interface

According to the introduction of AI Tax Assist on H&R Block's official website, its main functions are as follows:

Tax Information: AI Tax Assist can provide information about tax forms, deductions, and credits to maximize potential refund rates and reduce tax liabilities.

For example, I earned $50,000 last year and contributed $5,000 to an individual retirement account. How much is my tax refund?

Tax Preparation: AI Tax Assist can guide individuals through issues encountered during tax preparation and filing, answer tax theory questions, and provide explanations when needed. For example, how to fill out the U.S. individual income tax return Form 1040?

Tax Knowledge: AI Tax Assist can answer any tax-related questions, interpret tax terminology, and provide guidance on specific tax rules or general information about the U.S. and state tax systems. For example, what is the difference between deductions and exemptions?

Tax Law Changes: AI Tax Assist can answer questions about tax laws, recent changes in legislation, and tax policies. For example, what changes have been made to the U.S. standard deduction in 2023?

AI Tax Assist Pricing

AI Tax Assist not only provides guidance on specific tax rules but can also answer questions about which H&R Block DIY product is best suited for various filing scenarios to help individuals maximize their tax refunds.

Currently, the company offers multiple online tax filing options for DIY users. Those who use H&R Block Deluxe, Premium, or Self-Employed online versions can receive AI Tax Assist and Live Tax Pro support for free.

About H&R Block

H&R Block was founded in 1955 and is headquartered in Kansas City, Missouri, USA. With annual revenues exceeding $3 billion, the company employs over 60,000 people.

H&R Block has over 12,000 locations in more than 10 countries and regions worldwide, serving more than 5 million clients. The company primarily offers personal tax, corporate tax, and digital tax services.

In 2023 alone, H&R Block processed over 20 million tax returns.