Decoding the 'First AI Drug Development Stock': Pharmaceuticals Remain One of the Most Capital-Favored AI Sectors

-

2020 was hailed as the inaugural year of AI-driven drug development, with tech giants like Alibaba, Baidu, Tencent, and Huawei entering the field, sparking a surge of AI pharmaceutical startups.

Three years on, while ChatGPT and large language models have captured the spotlight, AI drug development—once a darling of investors—has plateaued. Even as Insilico Medicine approaches its IPO, market sentiment remains cautious, a far cry from the exuberance seen in large model investments.

Following Insilico, another AI drug developer, XtalPi, recently submitted its IPO prospectus to the Hong Kong Stock Exchange. Boasting an even more impressive roster of pre-IPO investors—including Sequoia Capital, Mirae Asset, Alphabet, Tencent, and China Life—XtalPi has eclipsed Insilico's $408 million funding with a total raise of $732 million, cementing its status as the global leader in AI pharmaceutical financing and the de facto 'first AI drug development stock.'

Such a high financing amount indicates that capital is extremely optimistic about XtalPi's development prospects and expects to reap substantial returns from it.

The market's enthusiastic expectations for XtalPi are understandable. After all, it is the flagship representative of China's AI drug discovery field. If XtalPi cannot gain market favor, what hope would there be for other AI drug discovery companies?

Can XtalPi truly shoulder the responsibility of being the face of AI drug discovery? This will be the core question explored in this report. We will conduct a comprehensive analysis of the company, starting from its fundamentals and delving into its underlying logic.

It's worth noting that 'AI drug discovery' is not a specific industry, nor is it a professionally rigorous term.

Even though they are all categorized as AI pharmaceutical companies in the market, there are significant differences among them, with completely opposite commercialization paths. Across all AI pharmaceutical companies, they can be roughly divided into three major types: AI-Biotech, AI-CRO, and AI-SaaS.

As the name suggests, AI-Biotech refers to leveraging AI technology to empower pipeline development, hoping for efficiency breakthroughs brought by AI drug development to establish a first-mover advantage. Insilico Medicine, which recently disclosed its IPO prospectus, is a typical AI-Biotech company. Its core pipeline, ISM001-05, has entered Phase II clinical trials, not only possessing clinical value but also serving as a technological "name card" for Insilico Medicine.

Unlike AI-Biotech companies that directly engage in drug development, AI-CRO focuses more on industrial empowerment, with a business logic closer to preclinical CRO companies. For example, XtalPi, which recently submitted its IPO prospectus, is an AI-CRO company specializing in compound research and development, dedicated to playing the role of a service provider. Clients provide a target, and XtalPi designs a compound, further validating its effectiveness until final delivery.

AI-SaaS is more aligned with the attributes of large AI models, primarily selling AI-based digital solutions to pharmaceutical companies. Currently, there are few such companies in China, with most being based in Europe and the U.S., such as Schrödinger, listed on the U.S. stock market, and NVIDIA's Clara.

This demonstrates that although expectations for AI drug discovery are inflated, there remain substantial differences between companies in this field - they should not be lumped together. As AI drug discovery develops, this label will likely be dismantled and reconstructed. Currently, "AI drug discovery" remains an extremely unprofessional, imprecise pseudo-term lacking standardized metrics.

Removing the AI label, XtalPi is essentially a CRO (Contract Research Organization) providing services to pharmaceutical companies.

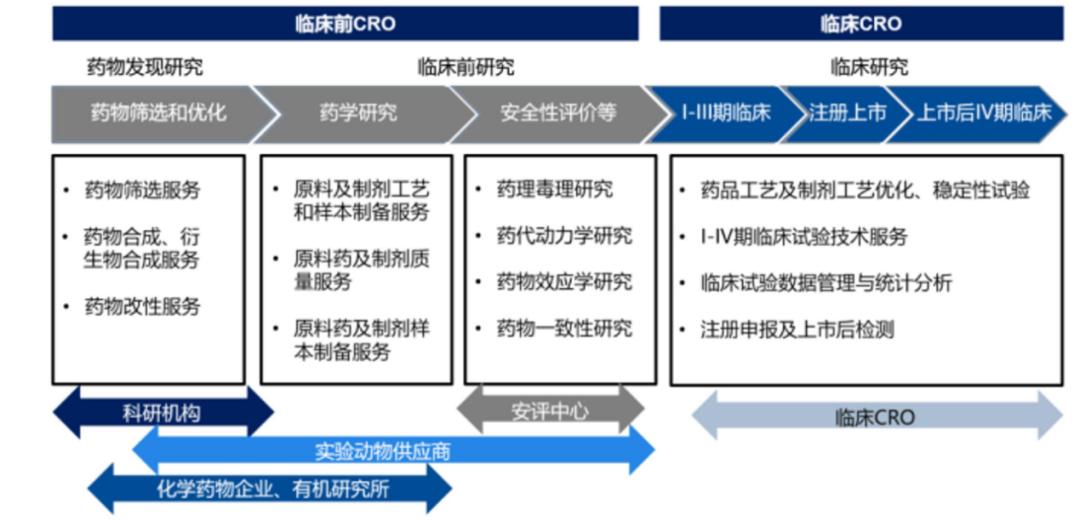

Drug R&D outsourcing involves multiple stages, which can be broadly divided into four phases: drug discovery, preclinical research, clinical research, and generic drug research. A mature large-scale CRO typically possesses comprehensive drug development capabilities to handle the entire pipeline.

Image: Drug development pathway, Source: Guosen Securities

Unlike large CRO companies with long-term accumulation, XtalPi is a relatively young company founded in 2015 by three MIT physicists without deep medical backgrounds. From its inception, XtalPi's core competitiveness has been quantum physics rather than clinical drug conversion.

In the drug development process, drug discovery is the first step, involving compound crystal synthesis and the most physics-intensive phase. XtalPi does not discover drug targets itself but receives them from clients. Its role is to validate these targets and design effective compounds for delivery. In other words, XtalPi's value primarily remains at the laboratory level.

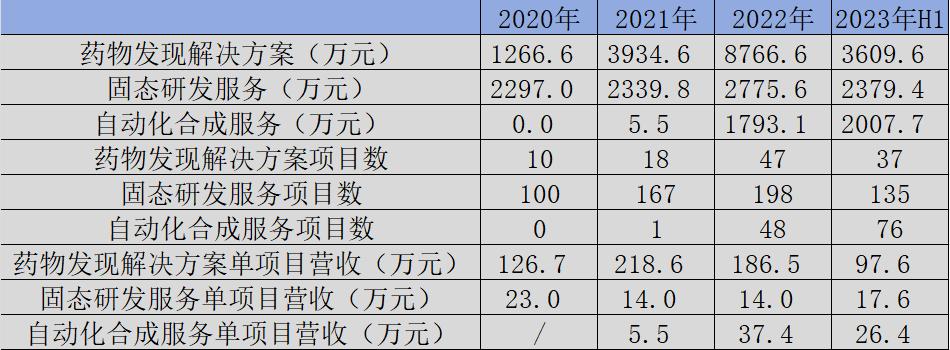

More specifically, XtalPi's business can be divided into three parts: drug discovery solutions, solid-state R&D services, and automated synthesis services. The automated synthesis service, launched in 2021, is gradually becoming a new driver of the company's revenue.

Figure: XtalPi's Business Breakdown, Source: Jinduan Research Institute

Drug discovery solutions are XtalPi's core business. The process begins with validating the target required by the client, followed by optimizing and identifying promising compounds, and then designing deliverable compound products based on the confirmed compounds. This business segment of XtalPi has shown remarkable growth, with revenue increasing from RMB 12.666 million in 2020 to RMB 87.666 million in 2022.

Despite this encouraging growth, the business is highly correlated with the overall pharmaceutical financing environment. If pharmaceutical companies face greater difficulties in securing financing, their willingness to develop new drugs will significantly decrease. Currently, XtalPi's revenue per project is approximately RMB 2 million, and expanding the customer base is challenging, sometimes requiring competition with large CRO companies.

Solid-state R&D services represent another pillar business for XtalPi, which investors can simply understand as third-party compound testing services. In 2016, when 'universal pharma giant' Pfizer hosted a 'Global Crystal Structure Prediction' competition, XtalPi provided accurate predictions and thereby gained Pfizer's recognition. XtalPi's solid-state R&D services were subsequently procured for Pfizer's COVID-19 therapeutic Paxlovid in 2021, becoming the company's most notable achievement.

Despite receiving recognition from numerous clients including international giants like Pfizer, Johnson & Johnson, and Merck, this business has limited growth potential. From 2020 to 2022, the revenue per project for XtalPi's solid-state R&D services was only RMB 230,000, 140,000, and 140,000 respectively. The low average customer spending significantly restricts the business's growth prospects.

Automated chemical synthesis services represent a new business launched by XtalPi in 2021, which can be seen as an optimization of clients' compound synthesis processes. It primarily utilizes automated robotic workstations to achieve higher-throughput reaction condition screening and optimization, thereby improving compound synthesis efficiency.

This emerging business has shown rapid growth, generating RMB 20 million in revenue in just the first half of this year. Although the average customer spending remains low, it demonstrates strong growth potential and could become the most competitive product in XtalPi's business lineup.

Looking at XtalPi's three business lines, the primary focus remains on empowering clients' drug discovery processes. The rapid acquisition of numerous clients in such a short time sufficiently demonstrates that XtalPi has deeply engaged with frontline operations, addressing certain gaps in the industry.

However, these market gaps don't command high average order values. If future commercialization stops at this level, the value this business model can create warrants more rational consideration.

Compared to traditional CRO companies, XtalPi's greatest highlight lies in its AI technology empowerment. But AI isn't a panacea - clients won't pay more simply because you use AI, unless AI can deliver additional technological premium.

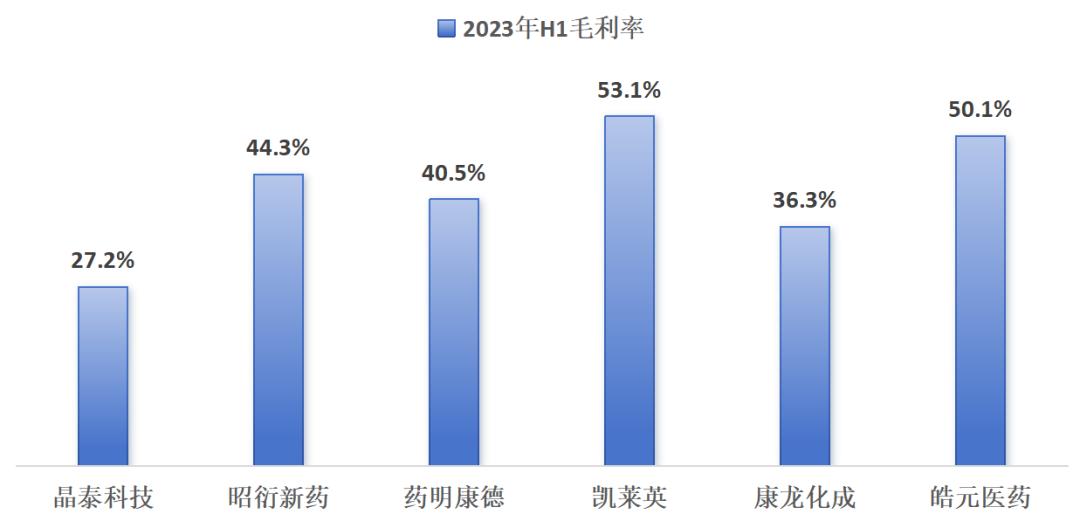

So how should we measure a company's premium capability? I believe product gross margin serves as an excellent operational metric, representing the combined result of a company's technological strength, brand power, and operational capabilities. For instance, BeiGene exemplifies technological strength, Kweichow Moutai represents brand power, while Haidilao demonstrates operational excellence.

Looking back at XtalPi's gross margin performance in recent years, its gross margin has steadily declined from 62.4% in 2020 to less than 50% by the end of 2022. In the first half of this year, this figure dropped further to 27.2%. This trend is highly likely related to the increasing proportion of its emerging automated chemical synthesis services, suggesting that this business segment may have relatively low gross margins.

Figure: XtalPi's Gross Margin and Emerging Business Proportion. Source: Jinduan Research InstituteWhen compared horizontally with other CRO companies, investors may be surprised to find that XtalPi's gross margin in the first half of this year was significantly lower than the industry average. It appears that AI technology has not brought any premium to the company's valuation.

Figure: Horizontal comparison of gross margins among CRO companies. Source: Jinduan Research Institute

In terms of scale, it's understandable that latecomer XtalPi cannot match traditional CROs. However, having such a small scale while maintaining gross margins far below other CRO companies is clearly unacceptable. This inevitably leads us to ask: What tangible changes has AI technology actually brought to this industry?

The future belongs to AI, but this doesn't mean all AI applications represent the future.

Both Insilico Medicine and XtalPi are pioneers in AI-driven drug discovery, but this label remains overly vague. What role should AI truly play in the pharmaceutical field? What should be the commercialization path for AI-driven drug development? All these questions remain unanswered.

From an industrial development perspective, XtalPi has indeed taken root in the sector with a down-to-earth approach, using AI technology to fill industry gaps. However, these explorations currently cannot translate into commercial benefits and will not create value for shareholders in the short term.

As industry observers, we clearly understand that AI desperately needs a boom. But this must be built on a solid foundation—forcing growth prematurely would not only harm companies but also damage investor confidence, especially in a socially impactful industry like pharmaceuticals.

For emerging technologies, investors should be tolerant but avoid blindly following trends. Throughout investment history, every bubble has inevitably been followed by significant fallout.

This article is based on publicly available information and is intended for informational purposes only, not as investment advice.