Producer of Hit Short Drama Denies Earning Over 100 Million in 8 Days, Says Actual Profit Only a Few Million

-

"If I could really earn 100 million, I would have retired long ago."

When discussing the widely circulated myth of "achieving financial freedom with a short drama," Li Tao, founder of Xi'an Fengxing Culture and producer of the hit short drama Wushuang, candidly admitted in an interview.

Public data shows that Wushuang was launched on a WeChat mini-program on August 25 and generated over 100 million yuan in revenue within 8 days, making "earning over 100 million in 8 days" a legendary tale in the short drama industry.

However, Li Tao clarified that the so-called "over 100 million" refers to gross revenue, with traffic costs accounting for over 90%, leaving only a few million yuan in actual profit.

"These few million yuan still need to be distributed among the production team, screenwriters, post-production staff, and others," Li Tao revealed. As the producer of 14 hit short dramas, the company's total revenue from short dramas is less than 10 million yuan. As the founder and chief director, his cash reserves are even less than 1 million yuan.

Hit Short Dramas Are Essentially 'Traffic Containers'

Once considered "a bit lowbrow" by many, short dramas are now hailed as "the most profitable industry in 2023."

To the public, short dramas are characterized by their short episodes, numerous installments, and fast-paced plots, typically totaling 80-100 episodes. Viewers need to pay to unlock episodes beyond the first ten, with costs ranging from tens to a hundred yuan per drama.

"It's thrilling," a short drama enthusiast succinctly explained when asked about his obsession. "Watching short dramas is all about stress relief—every clip ends at a climax." He admitted that the reason he paid to binge dozens of short dramas was mainly due to curiosity about how the protagonists overcome adversity and rise to glory. "To put it bluntly, it's similar to wish-fulfillment web novels."

Behind-the-scenes footage of the hit short drama Unparalleled

"You don’t even need to pay special attention—almost all my friends in film companies are jumping into the short drama industry. It’s a fast-in, fast-out business," said Xu Tianyang, head of LeTV’s copyright department, describing the frenzy in the short drama market. In his view, the current short drama market can be divided into two main categories. The first is premium short dramas, mostly viewed in landscape mode and aired on long-video platforms like Tencent and iQiyi. These episodes typically last 10-20 minutes, with higher production costs and longer cycles, often reaching hundreds of thousands of yuan per episode.

The other category is the more widely known mini-program short dramas, viewed in portrait mode. The cost per episode usually does not exceed 10,000 yuan, sometimes even as low as a few hundred yuan. The core cost lies not in content production but in traffic promotion. The plots are often clichéd, featuring tropes like the "Smirking God of War" or "Domineering CEO." These are less like traditional dramas and more like traffic containers for viral distribution, with weak content attributes.

An industry insider revealed that the current profit models for short dramas mainly include revenue sharing, platform purchases, brand customization, advertising, and e-commerce livestreaming. Revenue sharing is the primary cooperation model adopted by platforms for micro-short dramas. However, the methods and calculations for revenue sharing vary across platforms.

Platforms often determine investment costs based on specific output ratios. For example, an initial investment of 50,000 yuan may require an ROI (return on investment) of 1:1.1 to 1:5. If the revenue meets this target, further investments are made, and overall income grows like a snowball.

The short drama industry’s explosive growth is inseparable from various lucrative myths. Rumors previously circulated that The Black Lotus’s Rise to Power, a short drama produced by Mi Meng, generated over 20 million yuan in revenue within 24 hours. However, multiple industry professionals stated that Mi Meng’s performance is merely "decent" in the short drama circle, far from being top-tier. Several platforms have since announced the removal of The Black Lotus’s Rise to Power, citing its promotion of extreme revenge and violent justice, which distorts moral values.

"Short dramas on mini-programs became popular last year, mainly because the pandemic created a gap in the film and television industry. With declining demand for traditional box office movies, many professionals turned to this field," said Li Jin, a Tencent producer and creator of the well-known short drama The World of Aunties. In her view, it's not uncommon for the industry to see total paid revenues exceeding 10 million or even reaching hundreds of millions. However, this is purely traffic revenue, and after deducting overall costs, the profit margin is only about 5%-7%. Still, for content creators, this less-than-10% profit is not a small amount.

Li Tao revealed that due to the extremely fast pace of short drama production—often completing a series within a month—most partners and directors in his company work over 12 hours a day and still can't afford to buy a house. "Most of the income goes to traffic-buying companies and platforms like Douyin and Kuaishou, essentially paying for access," he said.

Hot Investment? Industry Insiders Remain Cautious

"Currently, the short drama industry shows some explosive potential. But if you're not an insider in the film and television industry, you should think carefully before investing—there are huge risks behind it," Chang Huifang, a partner at Taoyun Capital who has long focused on film and television investments, told The Paper.

"The best candidates for short drama investments are online literature companies, such as Chinese Online and Yuewen. They have a wealth of literary IPs, and investing in short dramas can maximize the use of these resources," Chang Huifang admitted. In her view, the short drama industry is currently overhyped. Like the film and television industry, people only see the few top hits, but many practitioners don't realize the costs spent on traffic or the high probability of failure behind the scenes.

"If you want to invest, you can't just focus on the blockbusters; you need to look at the entire industry," she revealed. Among the short drama projects she examined, many producers admitted that profits were lower than expected. "With a budget of 200,000 yuan, a net profit of 10,000 to 20,000 yuan is already very good."

Leading platform company Jiuzhou Culture once stated that it releases 50 to 60 short dramas monthly, each costing 200,000 to 300,000 yuan. About 70% break even, 10% to 15% become hits, 30% flop, and 10% result in pure losses. This means the short drama industry still follows the "80/20 rule" of the content industry, where most are just participants, and only a few truly stand out.

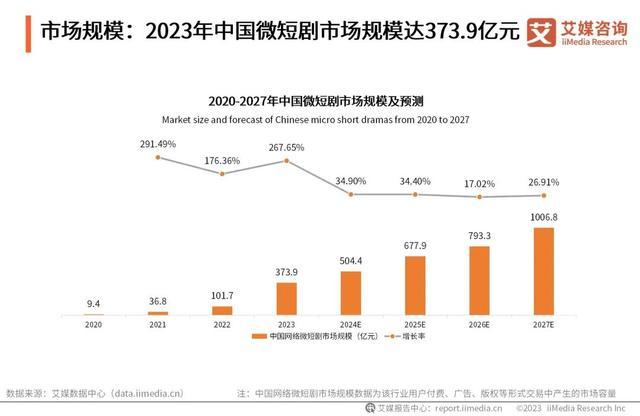

Despite this, more people are trying to ride the short drama wave. According to iiMedia Research's "2023-2024 China Micro Short Drama Market Research Report," China's online micro short drama market reached 37.39 billion yuan in 2023, a year-on-year increase of 267.65%. By 2027, the market size is expected to exceed 100 billion yuan.

"Many circulating articles are not telling the truth," said Li Tao. "At first, I was indignant and asked them why they wrote like that. They said if they didn’t portray the short drama industry as highly profitable, no one would read it." He admitted that much of the hype about the industry's "huge profits" is nonsense, attracting those only looking for quick money.

"The野蛮生长期 (wild growth period) of the short drama industry is coming to an end," Xu Tianyang told reporters. Previously, platforms like WeChat, Douyin, and Kuaishou issued治理公告 (governance announcements), cracking down on违规内容 (non-compliant content) involving pornography, violence, and不良价值观 (bad values). Violators may face penalties like removal or account bans.