2023 Heavyweight Report on Large Models in the Financial Industry Released

-

On November 9th, at the sub-forum 'Building New Models for Digital-Real Integration, Boosting New Development of Industrial Digital Finance' during the 2023 Financial Street Forum, China Banking and Insurance Media and Tencent Research Institute jointly released '2023 Report on Large Model Applications in the Financial Industry', providing an in-depth analysis of the development trends of large models, establishing a systematic blueprint for their application in the financial sector, and guiding the evolution of digital and intelligent finance.

This report combines the insights and expertise of Tencent Research Institute, China Banking and Insurance Media, and KPMG in foundational large models, as well as their deep experience in digital transformation and implementation in banking, securities, and asset management. It aims to dispel myths and objectively and accurately reflect relevant trends, exploring practical application scenarios for large models in the financial industry with a focus on effectiveness.

Expert Commentary:

Over the past year, the financial industry has increasingly explored and utilized large models, reflecting a strong demand for learning and applying new technologies. We hope that the release of this report will catalyze the organic integration of 'technology + finance + industry,' foster a rational atmosphere for technological innovation and application, and help elevate the value of the industrial chain.

- Du Zengliang, Party Committee Member and General Manager of China Banking and Insurance Media

Large model capabilities are gradually penetrating various industries, sparking a new wave of innovation and industry transformation. In the financial sector, industry-specific large models have brought unprecedented opportunities to financial markets, enabling institutions to achieve an 'efficiency revolution' in services and management across scenarios such as precision marketing, customer service, and code generation. Looking ahead, we anticipate the financial industry will accelerate into a new phase of AI-driven quality and efficiency improvements.

- Si Xiao, Dean of Tencent Research Institute

The new generation of AI technologies, represented by large models, is rapidly changing lifestyles and empowering all sectors. In finance, leveraging advanced digital infrastructure and the deep integration of cloud architecture with AI, large model applications will advance faster and more profoundly than in other industries, reshaping financial service experiences, enhancing efficiency, and providing insights into markets and risks. With continued exploration and innovation across the industry, we expect to see a continuous emergence of high-quality, high-value applications of financial large models.

- Hu Liming, Vice President of Tencent Cloud

The flourishing digital economy has created a vast stage for financial innovation, while the emergence of large language models is driving paradigm shifts in the fintech industry. Under the premise of risk prevention, we must adhere to using fintech to support the essence of finance, and explore with a prudent yet inclusive mindset the new capabilities, scenarios, and models that large language models can bring to fintech. Fintech will undoubtedly develop towards more open, innovative, and sustainable directions.

- Huang Aizhou, Head of Fintech at KPMG Enterprise Consulting

With the evolution of digital systems in financial institutions, the intelligent digital construction of the financial industry is progressing from 'laying foundations' to 'building momentum'. Facing the disruptive impact of emerging technologies like large language models, we should rationally analyze the technological trends, focus on application scenarios, strengthen support systems, identify development pathways, and build a new financial operation ecosystem that is secure, efficient, and value-transforming.

- Liu Xiaoguang KPMG Enterprise Consulting Managing Partner for Financial Digital Transformation Consulting

Main Content:

Placing large models within the historical context of artificial intelligence development: Starting from the 1950s when Alan Turing first posed the profound question, "Can machines think?" AI has undergone a long and evolving journey. Over the subsequent 70-plus years, the field has experienced ups and downs, culminating in the current fourth wave. The catalyst for this AI resurgence lies in the technological breakthroughs underpinning large models, most notably the Transformer architecture. Unlike traditional programming-based approaches, its foundation is a semantic function closer to natural language. By training this model on massive corpora, pre-trained language models emerged. Coupled with exponential growth in computational power and data scale, the emergent capabilities of large models have positioned them at the forefront of this technological revolution.

Beyond foundational technological progress, the past year has seen an explosion of large model-centric solutions and products in the enterprise services market, driving industries to embrace the disruptive innovations brought by this fourth wave of AI.

Large models offer dual advantages: superior generalization capabilities enabling human-like chain-of-thought reasoning without additional training or gradient updates, and a paradigm shift in development approaches. Traditional project-based product development is giving way to product and platform-centric models, reducing costs and delivery cycles while improving scenario precision. Empowered by large models, every industry is embracing this technological wave, heralding transformative paradigm shifts and scenario revolutions.

The extraordinary capabilities of large models are highly desirable. How can we advance their implementation in the financial industry? This report attempts to explore three core issues regarding the application of large models in finance: how to select the appropriate large model, how to adapt the model to specific scenarios, and the main directions for empowering the financial sector.

Understanding the applicable scenarios of large models across various industries can help us better utilize these models to solve practical problems. By clarifying scenario boundaries, enterprises and researchers can allocate resources more effectively. Once the specific application scenarios of models in a particular industry are identified, companies can invest corresponding resources based on actual needs to maximize return on investment.

First Major Question: How to Determine Which Type of Large Model Should Be Used for a Given Scenario?

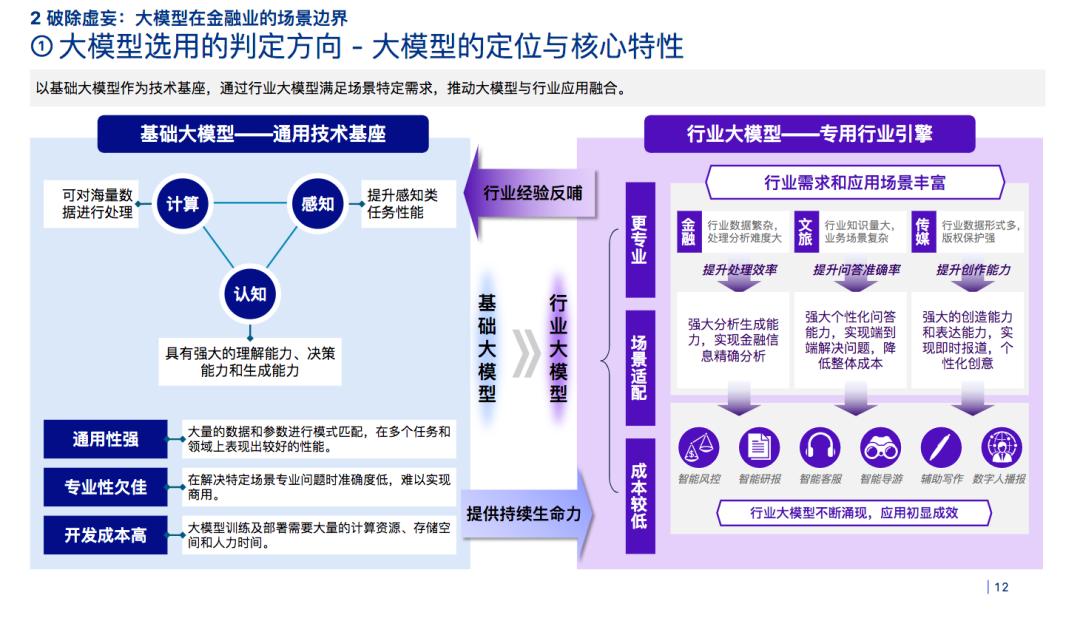

The continuous advancement in the field of large models has led to the emergence of two concepts: general foundation models and vertical industry models. Foundation models are positioned as universal technical bases, while industry models serve as engines for driving digital transformation and intelligent upgrades across various professional fields.

When using foundation models as a technical base, the focus is primarily on their universality, though they may lack specialization. In contrast, industry models are more specialized, focused, and cost-effective.

The key characteristics of foundation models are creativity and experientiality, emphasizing user experience. They cater to general knowledge and broad-domain scenarios, aiming for interactive experiences and human-like communication. Currently, they are primarily used for To C content consumption, with core tools being highly experiential, easy to use, and capable of directly producing value-driven content.

The keywords for industry-specific large models are controllability and high return on investment. These models are primarily designed for specialized vertical scenarios with low error tolerance, pursuing reasonable returns, and are mainly used in B2B enterprise services. Core tools currently enable enterprises to train specific models for niche scenarios at a reasonable cost. General models are horizontal, while industry-specific models are vertical, with both types being interconnected and indispensable.

Second major issue: How to select application scenarios for large models empowering the financial industry?

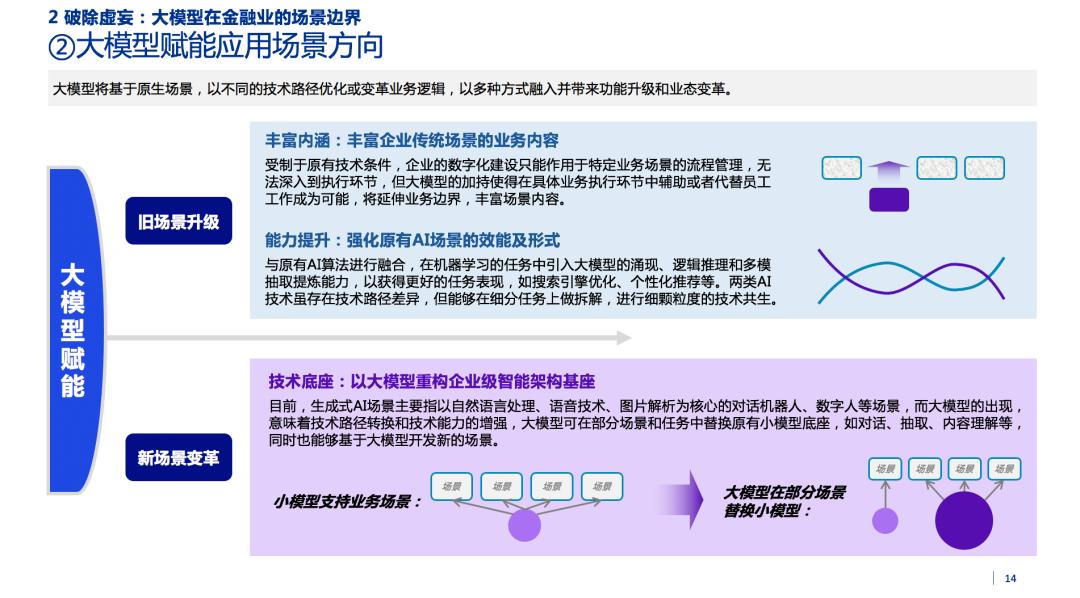

For the financial industry, the rich existing business scenarios and content can be further strengthened with large models, providing more intelligent and humanized service methods. Constrained by previous technical conditions, enterprises' digital construction was only used for specific business process management, making it difficult to integrate technology into every specific business module. Going further, continuous deep integration into execution stages was challenging. However, the support of large models enables us to gain assistance in more specific business scenarios, even replacing repetitive parts of the original work, including rule-based and logical scenarios. On this foundation, new scenario transformations will emerge. When we introduce large models' emergent capabilities, logical reasoning, and multi-modal extraction and refinement into machine learning tasks, we can achieve better task performance. These different AI technologies, though following varied technical paths, can be decomposed for specific tasks, enabling fine-grained technical symbiosis. In the future, we will see many concrete applications of large model technologies, not in a mutually conflicting relationship but in coexistence, including underlying ideas and technical paths.

The Third Major Question: What Directions Will Large Models Empower in the Financial Industry?

New scenarios will leverage large models to reconstruct enterprise-level intelligent architecture foundations. The advent of large models represents a transformation in technological approaches and an enhancement of capabilities, allowing them to replace smaller models in numerous scenarios such as dialogue, extraction, and content comprehension. Additionally, they enable the development of many new applications based on these models. To be more specific, we can observe applications like text-based interactive systems powered by large models being utilized in customer service. These technologies do not exist in isolation; they can be integrated with current digital human technologies to introduce digital customer service solutions. The advantage is that they provide stable responses and operate 24/7 without requiring additional support conditions.

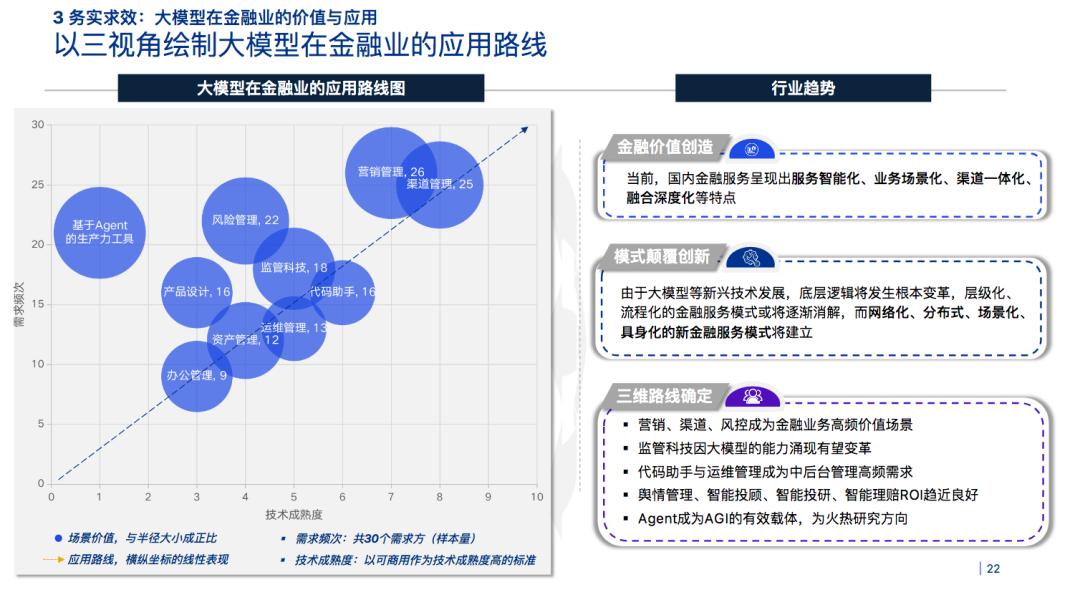

Large models are driving an efficiency revolution, bringing four value trends to the financial industry—greater capability, higher efficiency, broader scenarios, and deeper applications. Before applying large models to the industry, it is essential to consider three aspects: technical maturity, demand frequency, and scenario value.

Through research on financial institutions, large model service providers, and Tencent's internal technical teams, this report has formed an application framework for large models in the financial industry. First, for the complex financial sector, considering its unique characteristics, the report maps out a comprehensive view of large model applications in finance. This is categorized into front/middle-office general applications, regulatory technology, sector-specific applications, and back-office applications. Core application modules include channel operations, marketing management, product design, asset management, risk management, development and operations, regulatory technology, office management, and general tools. These modules are interconnected through inherent technical logic.

To assist financial enterprises in identifying specific implementation pathways, this report evaluates the industry's value structure and development trends. It then outlines an application roadmap for large models in finance based on three dimensions: technical maturity, demand frequency, and scenario value.

Marketing, channels, and risk control represent high-frequency value scenarios in financial services where large models are expected to achieve the earliest practical applications. In backend system development, code assistants and operations management are high-demand areas where technological applications can enhance efficiency. Public opinion management, robo-advisors, intelligent investment research, automated claims settlement, and smart customer service demonstrate high ROI (Return on Investment) and may soon transition from pilot projects to real-world implementations.

Long-term, AI Agents are likely to become the primary carriers of this new wave of large model-supported artificial intelligence technology. Agent-based productivity tools are continuously redefining scenario frameworks through technological research, emerging as indispensable atomic modules in next-generation large model application systems.

The era of large models is witnessing leapfrog development in cognitive intelligence: progressing from fragmented to holistic approaches, from structured to multimodal systems. Single models are increasingly approximating all dimensions of the real world, enabling cross-scenario and cross-domain applications to flourish comprehensively. The evolution from decision-based AI to generative AI, and from simple task-specific models to complex general-purpose models capable of handling diverse tasks, has ushered in a fundamentally usable era for language understanding, multi-turn dialogue, and problem-solving.

Looking ahead, the report anticipates financial institutions establishing comprehensive, systematic intelligent empowerment blueprints to achieve technology-driven high-quality development in finance. This will solidify technical foundations, clarify potential directions, and accelerate the industry's transition into an AI-powered efficiency enhancement phase, collectively ushering in a new era of digital-intelligent finance.