AIGC Startups Yet to Turn Profits While Microsoft and Adobe Reap Substantial Gains

-

The drama of Altman's 'coming and going' at OpenAI has temporarily concluded with his return.

The process was dramatic, the spectators were thrilled, and of course, Microsoft was the happiest of all.

Not only because Microsoft stood to win regardless of how the 'farce' unfolded, but also because there was a bigger revelation lurking behind—

The biggest beneficiaries of large models turned out to be these unexpected legacy players like Microsoft.

For instance, while Stable Diffusion and Midjourney raced to iterate and outdo each other, the one raking in massive profits from AI-generated images was actually Adobe.

Year to date, Adobe's market value has surged by over $100 billion in the U.S. stock market, quietly achieving a 90.58% increase. Meanwhile, Microsoft, OpenAI's largest shareholder and the company behind a series of AI Copilot products, has also seen a remarkable 55.93% rise.

These non-AI-native legacy players, seemingly still focused on traditional main products, have quietly dominated the AIGC space—for example, Microsoft recently launched Windows AI Studio, where developers can access various AI models and fine-tune them according to their needs.

The news was met with widespread lament from many startups in the same field.

Why are traditional companies the first to reap benefits in the era of large models?

To understand this, we must first recognize that the industry landscape has evolved significantly since the initial explosion of AIGC technology.

Traditional Companies Strike Back with AIGC

The development of AIGC can be broadly divided into two phases, from technological breakthroughs to market implementation.

Phase One: AIGC technology surged, with startups and new products emerging continuously.

During this phase, companies like Adobe and Microsoft seemed to play only a background role. Their traditional products, such as Photoshop and the Office suite, were even considered potential casualties of the AIGC revolution.

However, as the first wave of investment frenzy subsided and AIGC entered Phase Two—seeking practical applications—these traditional companies not only survived but became more active:

Adobe recently launched Firefly Image 2, a text-to-image generator with resolutions up to 2K, fully integrated into its suite of products like Photoshop, Illustrator, and Premiere Pro. Microsoft, leveraging its legacy Office software and Bing browser, introduced Copilot Studio.

Both Adobe and Microsoft have garnered significant attention by incorporating AIGC features into their offerings.

In contrast, startups are beginning to face commercialization challenges:

OpenAI has yet to turn a profit; Stability AI, the star startup behind Stable Diffusion, is reportedly mired in revenue troubles, with recent executive departures over copyright issues...

Why are seemingly traditional companies like Adobe and Microsoft achieving a "counterattack" in the AIGC 2.0 era, becoming the first to profit from new technologies?

On the surface, these companies appear to have simply updated their products by riding the AIGC wave.

But in reality, they hold the most critical link in taking products from technological implementation to market fit—scenarios.

Take Adobe as an example: its paid product Photoshop dominates nearly 70% of the design market, generating extremely stable cash flow. Moreover, many of its core users are commercial designers. To introduce AIGC for cost reduction and efficiency gains without altering workflows, purchasing an Adobe subscription is the most convenient approach.

This is because, from the user's (e.g., designers') perspective, tasks such as proposal evaluations, final product deliveries, and revisions all require communication and collaboration with other roles—this process involves an entire business workflow.

While other AI text-to-image tools like DALL·E 3 can generate numerous images at low cost, these images are neither editable vector graphics nor necessarily aligned with user needs. In short, they don't fit the business workflow and may even create additional workload.

As a product deeply embedded in business workflows, Adobe better understands designers' pain points in reducing workload. By launching tools like vector graphics generation (Firefly Vector Model) and AI photo editing (Generative Fill), it essentially uses AIGC to streamline workflows and save working hours.

The thriving Adobe and Microsoft represent only the approaches of traditional foreign companies in the AI 2.0 era.

In contrast, how are domestic traditional companies performing?

Recently, Whale, a domestic marketing digitalization service provider, held an autumn launch event themed "AGI for Growth - Unleashing the Power of AGI," focusing on AI and large model technologies.

As one of the representative companies in China's marketing field, what new AIGC products has Whale introduced? What lessons can be drawn from Whale's case for the marketing industry and the broader AIGC sector?

Let's break it down step by step.

How Top Players Utilize AI

Whale, a leading player in China's AI marketing and sales scenarios, became a unicorn within four years of its founding (2022).

Then came the birth of ChatGPT, marking a fresh start for Weever, the marketing field, and the entire industry. As a result, this AI-powered digital marketing and operations platform has seen its business thrive even more.

As large model implementation shifts from pure technological dividends to 'those who capture scenarios win the world,' companies with practical application scenarios can integrate AI and large models into their operations, forming new engines and business loops.

Weever's advantage lies in its years of accumulated marketing scenarios, which encompass not only extensive commercial experience and vertical data but also a profound understanding of industry needs.

For the marketing industry, the most useful capabilities brought by large models are twofold: data summarization and content generation.

Among these, content generation is even more critical because large models can enhance marketing by conveying the breadth and depth of content.

Returning to our example of Weever, how does it leverage general-purpose AI large models to demonstrate the breadth and depth of content generation in the specialized field of marketing?

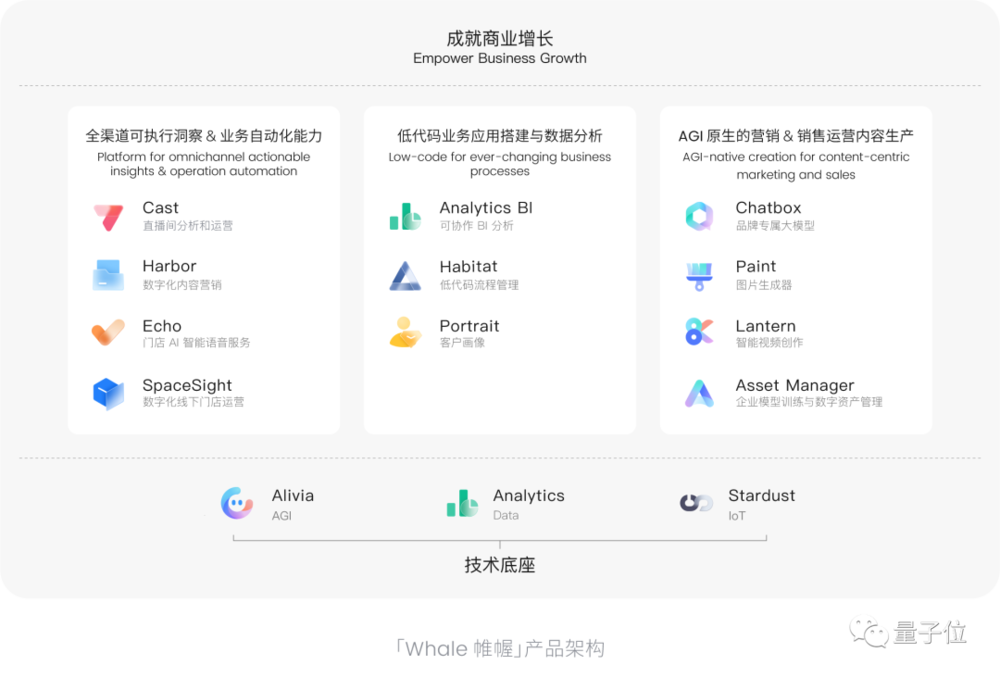

To briefly introduce, at this product launch, Weever unveiled a comprehensive suite of products, including iterative updates and entirely new releases. Specifically, these include:

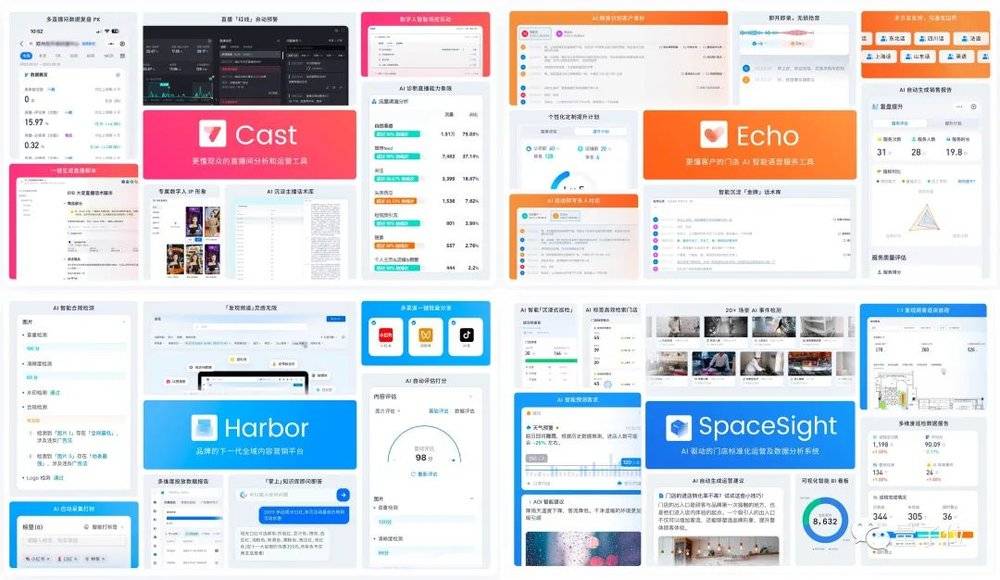

"AGI Cloud Alivia", "Whale SpaceSight", "Whale Harbor", "Whale Echo", "Whale Cast".

The foundational capabilities of these products are provided by Alivia, an enterprise-level AGI toolkit specifically designed for marketing and sales.

It's called a toolkit because Alivia not only comprehensively covers the marketing field but also offers features ranging from AI voice, AI posters, AI video editing to AI digital human livestreaming. It even provides enterprise-level model training and management, making it truly comprehensive.

Using Alivia's large model capabilities can save time and effort in reaching more users.

Take the now indispensable AIGC capabilities for creating promotional materials in e-commerce as an example. Text-to-image, image-to-image, and video editing have become essential features. If unsatisfied, you can even train your own enterprise-level model specifically.

Text-to-image capability can generate content with precision down to letters, and won't confuse the subjects described in black and white colors:

When the generation prompt emphasizes scenarios like "back view," the AI can accurately adjust the model's pose:

As for image-to-image capabilities, it goes even further - whether replacing product backgrounds in posters:

Or substituting models in posters:

For Alivia, these are effortless tasks completed in seconds.

Advertisers can customize poster styles and designs according to brand identity. With this foundation, AIGC can generate required posters with ease.

For marketing scenarios beyond posters' capabilities, the video editor feature can quickly produce flash videos - including those with digital human avatars.

Based on the foundation of Alivia's large model capabilities, Weiwo has launched a series of AI products. The most core ones are the following:

SpaceSight/Digital Intelligence Space, applied to digital offline store operations;

Harbor/Content Marketing Hub, applied to digital content marketing;

Echo/Voice Painting, applied to digital voice services;

Cast/Live Broadcast, applied to digital live streaming room operations.

These four products are further manifestations of Weiwo's Alivia large model capabilities, enabling Weiwo to deeply deliver marketing content.

The so-called depth can be understood as a comprehensive and in-depth understanding of every industry and every user, ensuring that the generated content appears before users as accurately as possible at the conversion points of the customer journey.

To put it simply, everyone receives content that they can understand and are interested in, thereby increasing marketing conversion rates.

To achieve this, in addition to accumulating user preference data from both online (live streaming rooms) and offline (stores) channels over time, it also relies on Harbor, the content marketing platform.

Harbor collects and organizes various types of data, including the scripts used during live streams and their effectiveness, as well as foot traffic and customer retention rates in different store areas.

When Whale (Weimo) uses the data summarization capabilities of large models combined with content generation to analyze and present the relationships between data, and then feeds this to the large model, what happens?

The result is that every operator or salesperson using Whale becomes incredibly efficient (doge). Comparisons of product data requested by the boss can be obtained in no time.

A platform that effectively utilizes the data summarization and content generation capabilities of large models and provides them to every customer in need is now making a direct and tangible impact.

It's not just about being 'usable.' More importantly, AIGC has created an 'amplifier effect':

Traditional marketing uses technology to help clients expand traffic and conversion rates. With AIGC, this process becomes faster, cheaper, and more efficient.

However, in an era where everyone can use AI and large models, established companies and startups seem to be on the same starting line. Why are companies like Adobe and Whale benefiting more? Are there any lessons to be learned?

Driven by curiosity, we spoke with Yesheng Xuan, founder and CEO of Whale, about Whale's positioning in the AIGC landscape, his views on the AIGC industry, and how AIGC impacts players across various sectors.

Who is Reaping the Benefits of AIGC Technology?

Yesheng Xuan holds a master's degree in Computation and Neural Systems from Caltech, worked in data science at Facebook, and later entered the digital marketing industry in China, founding Whale.

When discussing AIGC, Yesheng Xuan believes current players can be divided into four tiers.

The bottom layer consists of startups like OpenAI and Stability AI, or companies that possess AGI technology itself. These players own general large model technologies and provide foundational technical support for upper-tier players.

The third layer includes infrastructure-focused players like LangChain and AgentChain. They develop technical foundations supporting general large models, many being open-source tools that further facilitate AIGC and large model development.

The second layer comprises AI tool products emerging from the previous two layers, such as companies developing through technologies like LoRA. These companies focus on providing tools themselves, thereby creating niche innovative approaches.

The top layer consists of application companies, including international players like Adobe and Microsoft, as well as domestic companies like Weihuo. These companies have established scenarios and built applications with stable traffic, while also expanding their business into the previous layers based on demand.

Which of these four types of players can ultimately reap the technological dividends?

Ye Shengxuan's view is: startups cannot ultimately reap the technological dividends.

Taking OpenAI as an example, although such companies can leverage technological innovation to establish their value, achieve rapid breakthrough, and even single-handedly drive the growth of the entire AIGC technology ecosystem;

Ultimately, foundational technologies like large models still rely on computing power, data, and application scenarios, which means the benefits will ultimately be reaped by cloud providers like Microsoft.

However, looking deeper, the players who can truly harvest the dividends of this technology are not merely those with validated scenarios or market-proven products.

Ye Shengxuan believes there are two key criteria.

First, these companies must possess the ability to unlock the value of AIGC technology, understanding how different users in various scenarios require tailored algorithmic solutions.

Take image generation as an example. While the types of classic algorithms are limited, the specific algorithmic needs vary significantly across different industries and use cases.

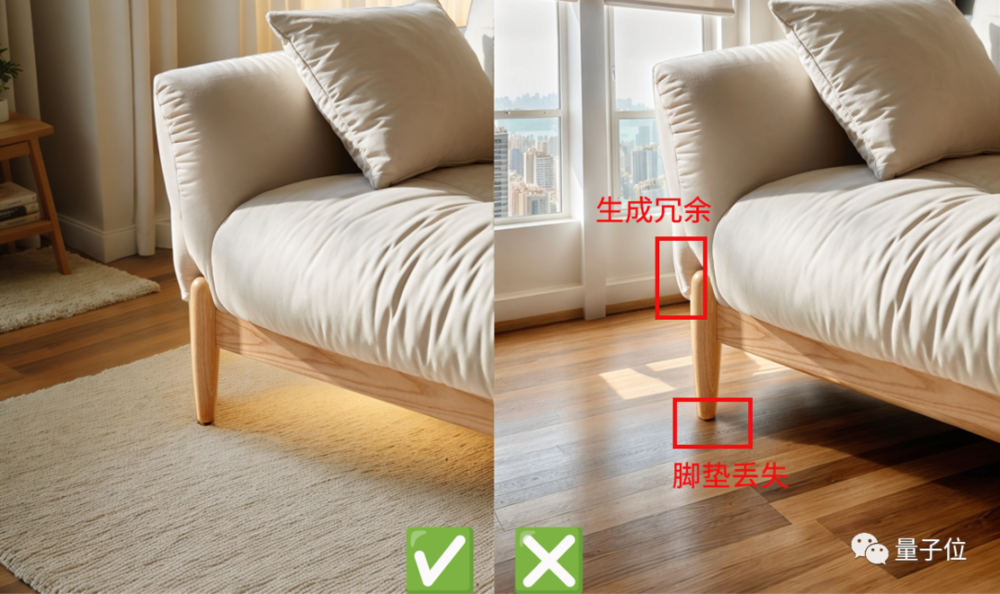

For instance, in the home furnishing industry, generating furniture designs with perfect and logical details requires continuous refinement of algorithms within the vertical domain to make the AI a "professional designer":

Another example is scenario understanding. Different industries have distinct "rules" for operating physical stores—food stores must comply with safety regulations, while clothing stores have specific merchandise arrangement requirements.

How to develop enterprise-specific scene understanding algorithms based on these detailed differences also requires expertise:

Therefore, regardless of the field, the pathways for AIGC technology application will vary. How to leverage appropriate technology to maximize technical enhancement for one's own scenarios is a question that scenario players need to consider.

On the other hand, companies themselves must possess technical capabilities to quickly keep up with the new wave of AIGC, maximizing the value brought by technology and implementing it effectively in scenarios.

Ye Shengxuan stated that as a technology company, Whale (Weiwo) will inherit Facebook's open-source culture, actively embrace open-source, contribute to open-source, and engage in AIGC technology research.

For example, Whale has also contributed to many AI open-source communities such as Stable Diffusion, participating in various project follow-ups. This not only does not conflict with product development but is complementary.

Of course, regardless of the type of player, it is ultimately necessary to timely judge the direction of AIGC from the present and future and choose the appropriate implementation approach.

After all, regarding AIGC technology itself, some still hold a cautious attitude, believing it may be overhyped. The current AI generation capabilities are not perfect and still have some distance from being directly usable.

Regarding the current technological development progress of AIGC and whether it is worth investing in the future, Ye Shengxuan offered this summary:

The advancement of technology itself cannot be stopped. Just as AGI should not be a goal or a technical evaluation standard, but rather a path to achieving end-customer needs.

As for judging whether a technology is worth investing in, it ultimately comes down to three key indicators: whether the technology's implementation is truly useful, whether the market size is large enough (for example, lip-sync translation is not considered a large market), and whether customers are willing to pay for it.

Therefore, instead of waiting for a certain milestone to arrive, one should identify their own application scenarios and grasp the technological path to reap the ultimate technological dividends in the competitive landscape.