AI Technology is Reshaping the Venture Capital and Private Equity Investment Industry

-

Facing a downward cycle, increasingly negative headlines dominate authoritative investment media. Yet even in this challenging market environment, some astute VCs/PEs have already moved beyond anxiety, beginning to strategize for the new cycle and refine their approaches.

According to data from the Asset Management Association of China, as of the end of September 2023, there were 12,972 private equity and venture capital fund managers, with assets under management totaling 14.34 trillion yuan. By comparison, as of the fourth quarter of 2022, the U.S. private equity management scale was $7.085 trillion, managed by just 2,020 firms.

Compared to the U.S. market, China's private equity market suffers from an oversupply of GPs, limited capital and quality assets, and increasing pressure on GP survival. Institutions that recognized this trend early have quietly begun upgrading, shifting focus from external growth to strengthening internal organizational capabilities, making thorough preparations for the impending consolidation and reshuffling of the next decade.

When the VC/PE industry enters Hard mode, strategy becomes more critical. Good strategies require VC/PE leaders to possess strategic judgment, selection capabilities, and the determination to adhere to their chosen course. However, these decisions must be supported by complete historical data chains covering fundraising, investment, management, and exits. Regrettably, during the industry's decade of frenzied expansion, most leaders focused on territorial expansion rather than internal精细化运营管理.

Seasoned institutional leaders strive to master comprehensive process data, including long-term project tracking records. They build internal data platforms that consolidate lifecycle operational data, having recognized early that information inevitably degrades as it flows from enterprises to frontline investors and ultimately to decision-makers—whether pre- or post-investment. Rational investment decision-makers must establish mechanisms aligned with their team's focus and portfolio strategy. These mechanisms extend beyond investment alone, encompassing fund strategies including optimal exit timing. While individual project decisions may appear isolated, they form systemic patterns when analyzed across entire funds or multiple fund portfolios.

Therefore,精细化运营管理 integrates pre-/post-investment activities, fund operations, and human capital to holistically enhance institutional efficiency and predictability.

VC/PE is a people-centric business model. Traditionally, firms have attracted top investors with high salaries and ample resources, treating them as efficiency tools to boost project success rates through intense efforts. However, building a sustainable and high-performing team is exceptionally challenging. When core efficiency becomes overly reliant on individual performers, the fund's stability becomes fragile.

Increasingly, astute firm leaders are seeking digital transformation experts. Their goal is twofold: to abstract individualized efficiency tools into digital assets and to adopt digital tools that sustainably enhance the productivity of top investors.

Given the VC/PE industry's high barriers and operational complexity, there's a disconnect—technically skilled individuals often lack business acumen and collaborative capabilities, while business-savvy professionals frequently lack digital literacy. Hybrid talents proficient in both business and digital transformation are inherently scarce. Moreover, the VC/PE sector's flat structure and lack of dedicated R&D teams offer limited growth opportunities, prompting such talents to join the fintech sector instead. This results in a severe asymmetry between firms' digital talent needs and availability. AI, as an intelligent partner, may lower tool barriers, amplify their value, and bridge this talent-demand gap.

If we're talking about AI truly taking off and bringing more positive impacts to industry practitioners, the legal sector is undoubtedly one of the key areas.

This industry shares many similarities with the legal profession, such as heavy reliance on human expertise, high specialization, and vast amounts of complex paperwork. Successful vertical examples in the legal field include star projects like EvenUP and Harvey. According to Sequoia's official blog, 15,000 law firms are currently queuing up to use Harvey's AI products. When leading firms adopt these tools, others will inevitably follow suit. A partner at Allen & Overy stated, "Over time, law firms that don't adopt AI will find themselves at a competitive disadvantage."

Today, Feishu officially launched its AI capabilities at a product launch event. Feishu's AI has developed numerous applications in content creation, Q&A, meetings, data analysis, surveys, and emails. Since its launch, numerous VC and PE firms have migrated to Feishu, replacing their internal IM tools. "Business on Feishu" has always been the platform's core strategic direction, and the newly released Feishu 7 further strengthens this all-in-one approach.

As Feishu's exclusive ISV partner in the investment industry, Yuewei Investment Cloud has been highly recommended by multiple venture capital media and institutional practitioners, earning substantial recognition in the sector. Its strong reputation is attributed to two key factors: first, its core team boasts over a decade of experience in primary market investment and financing services, accumulating best practices from more than 400 institutions. Second, the Investment Cloud product itself stands apart from traditional asset management systems, offering top-tier user interaction experiences and rapid iteration capabilities.

Scenario 1: More Efficient Project Sourcing and Faster Information Access

Investment Cloud aims to enhance productivity for VC/PE firms by developing SaaS products that improve employee efficiency, foster collaboration between teams, and streamline leadership management. The platform integrates Feishu's core functionalities, such as Feishu Meetings/Notes, Calendar, Feishu Docs, and Multi-dimensional Tables, deeply embedding them into investment workflows. As a result, Investment Cloud represents the pinnacle of synergy between collaboration tools and investment management value. Investment firms can manage their projects, funds, and investors seamlessly with just one platform.

With the latest Feishu AI release, collaborative office work has been further enhanced. For instance, for project-related meetings, AI can directly generate meeting minutes, to-do lists, and section summaries, demonstrating excellent structured summarization capabilities. Industry research analysis reports are one of the most suitable scenarios for writing reports in Feishu Docs. AI can assist you in summarizing, expanding/condensing, translating, continuing, and polishing documents within Feishu Docs.

Scenario 2: Improving Daily Work: Handling Complex Text Processing Tasks

Investment Cloud's widely recognized features by institutions also include automated batch collection of financial reports from invested enterprises, freeing up tedious and repetitive post-investment work. Real-time indicator updates, automatic calculation of metrics, and immediate access to fund performance are available. In this process, AI has demonstrated PDF reading capabilities, such as: business plan summarization, financial report analysis, and Q&A on report viewpoints, all performed remarkably well. The next step for Investment Cloud is expected to embed AI directly into the system, where uploaded files are automatically parsed by AI and entered into the system, completely eliminating the manual data entry process.

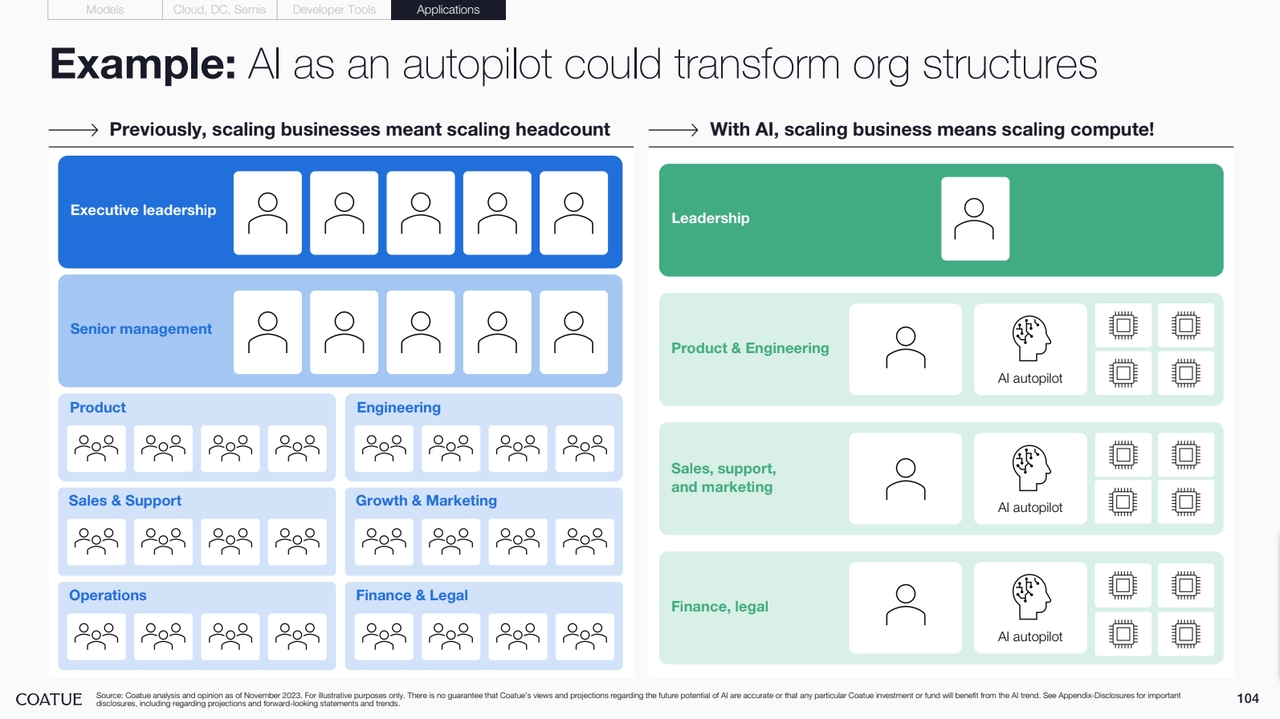

Last week, investment firm Coatue released its AI research report, which included insights such as: AI will create new platform opportunities - the era of "Intelligence as a Service" (IQaaS), and may fundamentally transform the organizational structures of future companies.

For VC/PE business operations, it may appear to consist solely of investment and fundraising activities, but in reality, it's a "process-driven" industry with an extensive workflow chain. This spans from resource construction and information sourcing, to information processing, feedback mechanisms, and ultimately decision-making processes. Ultimately, a VC/PE's core capability essentially lies in achieving optimal global cost efficiency.

Next, Feishu will open more AI capabilities embedded in the Investment Cloud system. As a container, Investment Cloud combined with user data will enable My AI to deliver greater value. The VC/PE industry's organizational structures may consequently accelerate toward new opportunities.