AI Boosts Performance: Baidu's Q3 Earnings Exceed Expectations with ERNIE Model Reshaping Long-Term Competitiveness

-

After the Hong Kong stock market closed on November 21, Baidu released its Q3 2023 financial report.

In detail, the company achieved revenue of 34.447 billion yuan in Q3 2023, a 6% year-on-year increase. During the same period, its non-GAAP net profit attributable to shareholders reached 7.3 billion yuan, up 23% year-on-year, with a net profit margin of 21.19%, an improvement of approximately 3 percentage points compared to the previous year. This financial performance far exceeded market expectations, as many analysts had previously projected Baidu's net profit growth rate to be in the single digits.

Behind the impressive financial data, the progress of the ERNIE large model ecosystem has also been a focal point for the market. As a leading AI company in China, Baidu's breakthroughs in foundational capabilities, application ecosystems, and commercialization of large models not only directly impact short-term performance but also serve as key indicators for evaluating its long-term competitiveness.

At the Baidu World Conference on October 17 this year, the company upgraded its ERNIE model to version 4.0. Although the underlying architecture remains the same as versions 3.0 and 3.5, the parameter scale is expected to reach trillions, with significant improvements in comprehension, generation, logic, and memory. Meanwhile, the maturing large model technology has begun to drive innovation across all business lines, offering broader growth potential for Baidu's future.

Boosted by impressive performance and growth expectations in large models, Baidu's stock price surged during Hong Kong trading hours before its earnings release, briefly rising over 5% intraday. It eventually closed at HK$107.4 per share, marking an overall increase of 2.78%.

So, how does Baidu's financial report for this quarter actually look? After going all-in on AI, where does the company's future focus lie? Is it worth long-term attention?

According to the company's financial report, Baidu achieved revenue of RMB 34.4 billion in Q3 2023, a 6% year-on-year increase. Among this, Baidu Core revenue was RMB 26.6 billion, up 5% year-on-year. Online marketing revenue reached RMB 19.7 billion (up 5% YoY), while non-online marketing revenue was RMB 6.9 billion (up 6% YoY).

In terms of profit performance, Baidu achieved operating profit of RMB 6.3 billion this quarter, an 18% year-on-year increase. Baidu Core operating profit was RMB 5.5 billion (up 10% YoY) with an operating margin of 21%. Under non-GAAP measures, Baidu Core operating profit reached RMB 6.7 billion with a 25% operating margin.

In terms of profit growth, Baidu's non-GAAP net profit attributable to the company reached 7.3 billion yuan this quarter, representing a 23% year-over-year increase. The core business profit was 7 billion yuan, up 21% YoY, with a net profit margin of 26%.

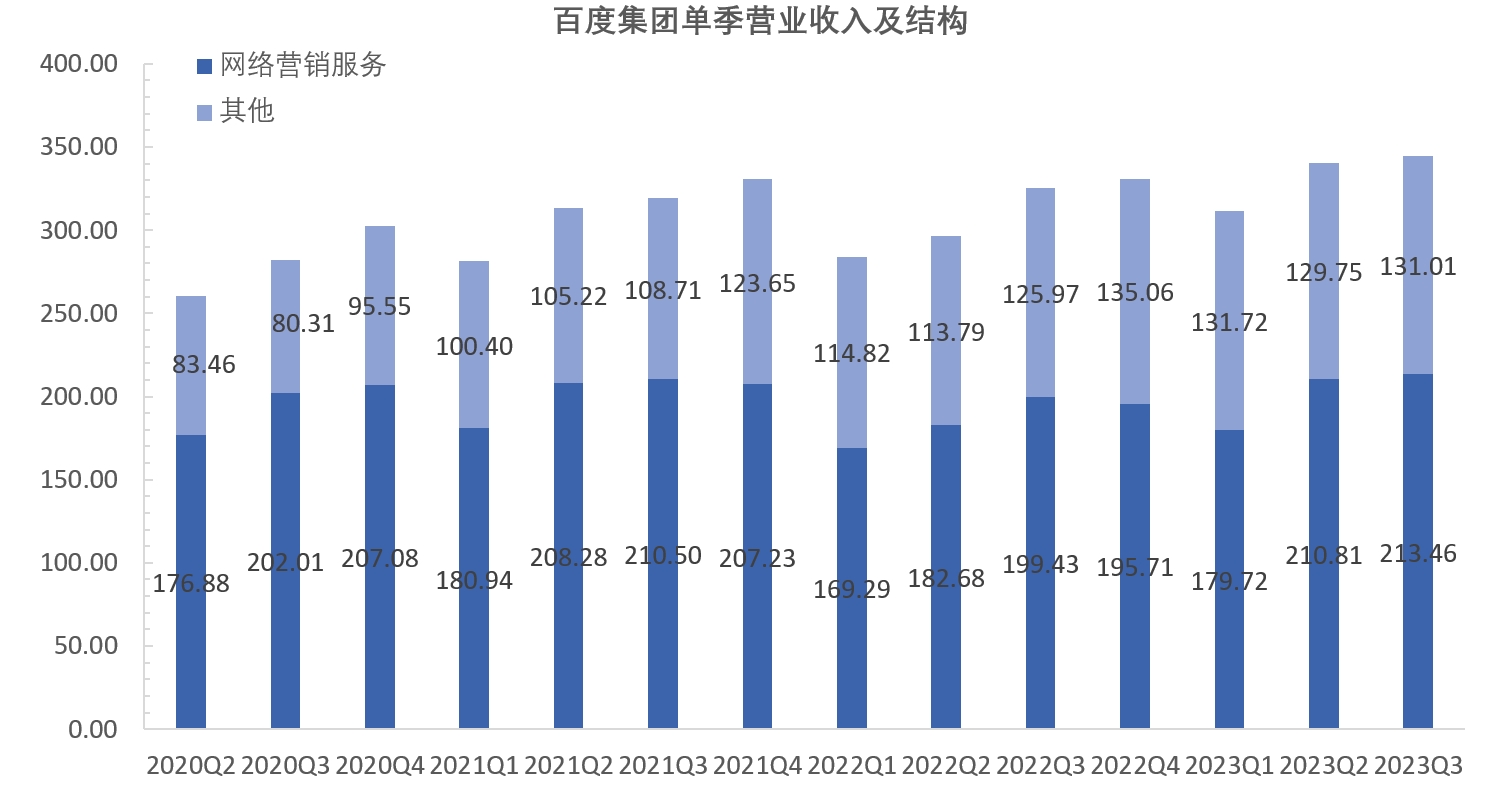

Figure: Baidu's Quarterly Revenue Structure. Source: Wind, compiled by 36KrMeanwhile, Baidu announced new data for its AI-native applications: Ernie Bot has reached 70 million users, covering 4,300 scenarios; the calls to Ernie large model have grown exponentially, with over 10,000 enterprises using large model capabilities on Baidu's Qianfan platform monthly; after reconstruction, Baidu Wenku's new AI features have been used over 200 million times by more than 30 million users; Baidu Netdisk's AI assistant Yun Yiduo has gained 20 million users since its launch.

These numbers also reflect a clearer long-term trend: as the company places more strategic emphasis on integrating its core business with AI, this signifies the continuous optimization of large model performance and the restructuring and development of more AI-native applications, which are crucial for Baidu to solidify its position in the digital economy era. This is precisely the original intent behind Baidu's Q2 announcement to reconstruct its products and services with an AI-native mindset. After all, deep integration with AI translates to better product experiences, higher user retention, and lower operational costs—foundational capabilities that ensure the company's long-term sustainable growth.

In this quarter's financial report, the Ernie Bot model remains a top priority, fully demonstrating Baidu's tactical and strategic commitment to AI. In October of this year, Baidu released Ernie Bot 4.0, which has shown significant improvements in understanding, generation, logic, and memory capabilities, with overall performance now comparable to GPT-4. At the same time, as large model technology matures, these models and AI-native applications have become new drivers of the company's growth, injecting fresh vitality into Baidu's future development. Currently, the Ernie Bot model provides Baidu with potential growth opportunities in several key areas:

1. The Ernie Bot model has comprehensively restructured Baidu's existing products, enhancing the competitive barriers of its core business.

This quarter, Baidu's online marketing revenue reached 19.7 billion yuan. With the continuous empowerment of large models, Baidu's existing products such as search, marketing, Wenku, Netdisk, and maps have seen optimizations in content, branding, and operational efficiency. These improvements have further enhanced the growth potential and competitive advantages of the company's core businesses, laying a solid foundation for their steady recovery in the future.

For example, in the search engine domain: At this year's Baidu World Conference, Baidu further upgraded its search engine. Empowered by AI, the new Baidu Search now features three key characteristics: ultimate satisfaction, recommendation stimulation, and multi-round interaction. These features redefine the logic of "search" by better understanding users, more accurately matching information flows, better aligning with interests, and providing more opportunities for expression. As a result, users' precise query needs are further met. Under the "New Search" function, over 300 million search queries are now satisfied by generative search daily, with the proportion of first-position satisfactory answers nearly doubling.

In advertising, Baidu has reconstructed its commercial and advertising systems with an AI-native mindset, revolutionizing the business ecosystem. The company launched the world's first AI Native marketing platform, "Qingke." Currently, more than 1,000 enterprises are using the Qingke platform, reducing average ad creation time from 2 hours to 5 minutes and increasing average conversion rates by 10%. Overall, AI-driven marketing innovation has continuously improved enterprises' content production and ad delivery efficiency. At the same time, higher customer retention and conversion rates have further benefited Baidu's core advertising business, driving revenue expansion.

2. AI native applications based on large models are experiencing explosive growth, offering more possibilities for future commercialization.

Currently, Baidu has developed numerous native applications, including the AI conversational app Wenxin Yiyan, the generative business intelligence product Baidu GBI, and the intelligent work platform Ruliu, leveraging the underlying technology of the Wenxin large model and the PaddlePaddle deep learning platform framework. These applications continuously enrich the large model ecosystem, meeting the strong demand for AI to enhance work and learning efficiency.

With its first-mover advantage, Baidu's AI native applications have seen significant growth in user numbers, usage rates, and payment rates, laying the foundation for commercialization. Taking Wenxin Yiyan as an example, its user base has now reached 70 million, covering 4,300 scenarios and 2,492 applications. Moreover, in addition to the free version, Baidu officially launched the professional version of Wenxin Yiyan in November this year, priced at 59.9 yuan per month, and introduced a joint membership for Wenxin Yiyan and Wenxin Yige, priced at 99 yuan per month, making it the first large model application in China to adopt a membership model for C-end users.

3. The AI Ecosystem Based on Intelligent Cloud is Gradually Improving and Enriching

This quarter, the logical innovation of Baidu's Intelligent Cloud business is more noteworthy for investors.

During the quarter, Baidu's Intelligent Cloud's Qianfan large model platform welcomed over 20,000 enterprises. In this quarter, driven by the rapidly increasing demand for AI-native applications, Baidu Intelligent Cloud provided customers with a full-stack service solution covering five major needs, including AI computing power, large model API calls, secondary development of large models, AI-native application development tools, and an AI-native application store.

In today's booming AI era, enterprises' willingness to undergo digital and intelligent transformation and adopt large models has significantly increased. However, given the high threshold for understanding and mastering AI technology and the shortage of professionals, enterprises directly participating in the R&D of large AI models require substantial investments in time, manpower, and material costs. Against this backdrop, Baidu Intelligent Cloud focuses on AI, PaaS, and comprehensive solutions, continuously deepening enterprise digital transformation, striving to build a "large model super factory," and promoting the democratization of AI.

Currently, Baidu's Intelligent Cloud Qianfan platform not only exclusively hosts the Wenxin large model 4.0, but also supports 45 mainstream large models from both domestic and international sources. The platform serves tens of thousands of enterprise users monthly, covering nearly 500 application scenarios. During this year's World Conference, Baidu announced a comprehensive upgrade to its "Cloud Intelligence Integration" strategy, providing full-stack service solutions for five categories of enterprise needs in large model implementation, empowering partners' business growth, helping enterprises improve ROI, and jointly building a prosperous large model industry ecosystem.

In September this year, Baidu officially launched the ERNIE Bot plugin ecosystem platform - Lingjing Matrix. Plugins represent a special type of AI-native application and are the most accessible entry point for AI-native development. Within one month of launch, Lingjing Matrix has received 27,000 developer registration applications, covering over 20 vertical industries, with individual developers accounting for more than 30% of the total.

Looking ahead, we believe that as enterprises continue to demonstrate strong demand in the field of AI large model applications, Baidu, as a pioneer benefiting from its sustained technological and industrial investments, is expected to further diversify its cloud service customer base. While enhancing the risk resilience of its intelligent cloud business, this will drive continuous revenue expansion and strengthen the company's second growth curve.

4. Expanded Coverage of Autonomous Driving Services

This quarter, Baidu's autonomous driving service, Apollo Go, supplied approximately 821,000 autonomous ride-hailing orders. By the end of September, Apollo Go had cumulatively provided 4.1 million autonomous ride-hailing orders to the public, firmly establishing itself as the world's largest autonomous ride-hailing service provider.

In terms of city coverage, Baidu's fully unmanned autonomous driving fleet has entered five cities: Beijing, Shenzhen, Wuhan, Chongqing, and Shanghai, making it the first company to conduct fully unmanned autonomous driving operations and testing in multiple cities across China.

Focusing on Wuhan's operations, since launching fully unmanned autonomous ride-hailing services in August 2022, Baidu Apollo has increased its fleet of fully unmanned autonomous vehicles in Wuhan to 300, a 60-fold increase. The operational area has expanded from 100 square kilometers to 1,100 square kilometers, an 11-fold increase. To date, Wuhan has recorded over 340,000 cumulative orders, making it the world's largest unmanned driving service area.

Overall, Baidu's Q3 financial report highlights three key surprises:

First, the foundational performance of Wenxin Large Model 4.0, such as comprehension, generation, logic, and memory, has seen significant enhancements. Since the launch of Wenxin Yiyan in March, the training algorithm efficiency of Wenxin Large Model 4.0 has improved by 3.6 times, and inference performance has increased by 50 times.

Second, the integration of AI with Baidu's search, marketing, Wenku, and Netdisk businesses has made notable progress, with significant operational data results. For example, the proportion of satisfactory answers provided by Baidu Search in the first position has nearly doubled; Qingke has served over 400 enterprises, reducing average ad creation time from 2 hours to 5 minutes and increasing average conversions by 10%.

Third, Baidu's large model ecosystem is becoming increasingly robust, forming complementary advantages with industrial clients. For instance, Baidu Intelligent Cloud Qianfan has served over 20,000 clients, with nearly 10,000 monthly active enterprises on the platform, covering nearly 500 scenarios. The PaddlePaddle platform has attracted 8 million developers, created 800,000 AI models, and served 220,000 enterprises and institutions, ranking first in China's deep learning platform market by comprehensive share.

In summary, we believe that with the continuous iteration and maturation of the Wenxin large model, Baidu's future potential is further amplified, and the deep integration with AI will gradually reflect in subsequent financial data.

On one hand, the large model and AI-native applications have optimized and reshaped the company's traditional businesses, infusing them with new vitality and effectively enhancing the core competitive barriers of these traditional operations. On the other hand, the implementation of diverse application scenarios across various business lines provides more high-quality data for training the large model, accelerating its iteration and upgrading, and promoting the optimization of model performance. Ultimately, a clear flywheel effect will form between the large model and specific businesses. This can increase user stickiness, drive expansion on the revenue side, and also bring significant cost reductions and efficiency improvements to the company, promoting the release of profits.

In light of this, we believe that Baidu's long-term competitiveness may be gradually reshaped through deep integration and synergistic optimization with AI.