Lenovo's Core PC Business Revenue Declines Again, Embracing AI Proves Challenging

-

On the afternoon of November 16, Lenovo Group released its interim performance report for the 2024 fiscal year (as of September 30, 2023): half-year revenue was $27.31 billion, a year-on-year decline of 20%; net profit attributable to the parent company was $425 million, a year-on-year drop of 60%.

The past six months have been a period of Lenovo striving for 'transformation.' Faced with the reality of sluggish growth in the global PC market, this 39-year-old PC giant is making every effort to build a second growth curve. Actively embracing the new wave of AI applications driven by generative AI and large models has become its best choice.

In an internal letter released alongside the financial report, Yang Yuanqing, Chairman and CEO of Lenovo Group, summarized the company's changes as follows: '(Lenovo Group) now has a comprehensive AI product roadmap, including a variety of smart terminals such as AI-powered computers, phones, and tablets, as well as AI-oriented and optimized infrastructure, solutions, and services.'

Despite its full-throttle efforts to integrate AI into all aspects of its business, the current performance shows that AI's contribution to Lenovo remains quite limited at this stage.

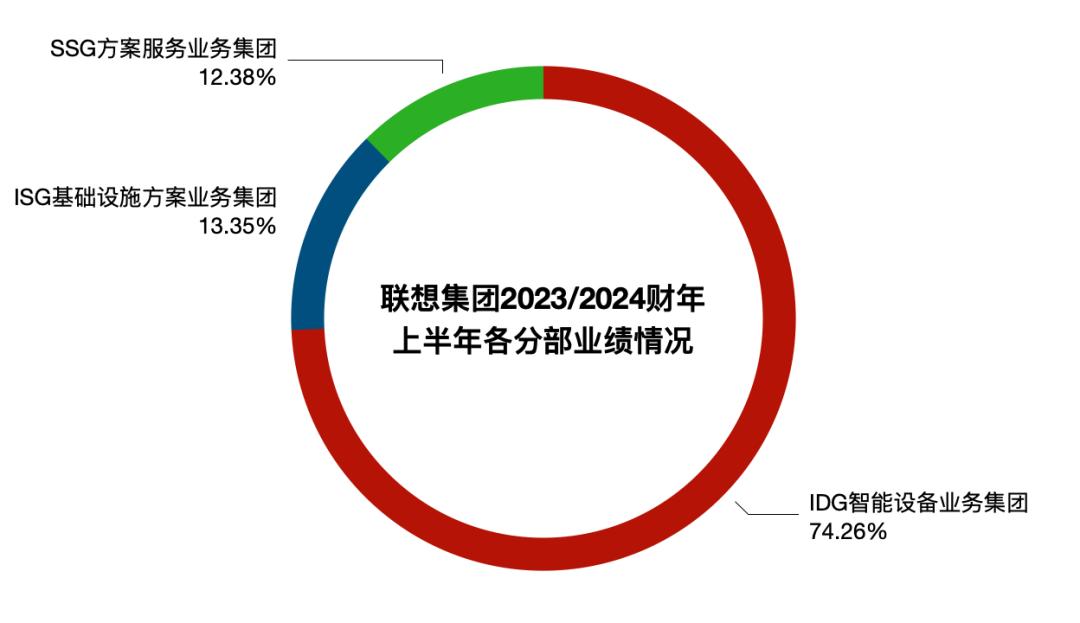

Currently, Lenovo Group's business layout is divided into three major segments:

- Intelligent Devices Group (IDG): Includes PC, mobile phones, tablets, and other hardware businesses, which are Lenovo's traditional core operations.

- Infrastructure Solutions Group (ISG): Includes servers, storage, edge computing products like ThinkEdge, and other hardware products essential for AI training.

- Solutions and Services Group (SSG): Includes operation and maintenance services, projects and solutions, additional services, and support services.

According to the 2023 interim performance report, IDG remains Lenovo's largest revenue source, generating $21.775 billion in the first half of the year. Despite a 22% year-on-year decline, it still accounts for 74% of total revenue.

Notably, the report states that "non-PC products accounted for 20% of IDG's revenue." In other words, traditional PCs remain the largest revenue category among Lenovo's products. The decline in IDG's revenue is attributed to inventory adjustments in the PC channel.

In comparison, the ISG segment, which includes AI servers, generated revenue of $3.916 billion, accounting for approximately 13% of the total. The SSG segment, encompassing various industry SaaS solutions, reported revenue of $3.631 billion, making up about 12%.

▲(Data Source/Company Financial Report)

The decline in Lenovo Group's PC business is not surprising, as the global PC market is facing growth stagnation challenges.

According to data released by renowned research firm IDC, global PC shipments in Q3 2023 reached 68.2 million units, marking a 7.6% year-over-year decline. Lenovo led the market with a 23.5% share, followed by HP at 19.8% and Dell at 17.3%.

Regarding the 2024 PC market, Yang Yuanqing showed cautious optimism, predicting single-digit growth recovery with a likely increase below 5%. Additionally, Lenovo's previously showcased AI PCs are expected to enter mass production globally by mid-2024.

In recent months, facing declining demand in its core PC business, Lenovo has proactively sought growth opportunities through generative AI's structural industry transformation. The company first targeted its hardware expertise, positioning itself as a "shovel seller" providing computing infrastructure for large AI model development and applications.

In February, Lenovo Group launched its AI server brand "WenTian," claiming it was entirely developed by a local Chinese R&D team. In April, the company announced a collaboration with NVIDIA in automotive computing to create an in-vehicle domain controller platform. By June, Lenovo's IDG (Intelligent Devices Group) pledged an additional $1 billion to accelerate global AI deployment over the next three years.

Additionally, Lenovo is making strides into the intelligent solutions market. In June, the company showcased seven core industry solutions powered by AI foundational technologies, covering government, telecommunications, finance, education, internet services, manufacturing, and key industries.

On October 24, at its flagship Lenovo Tech World event, the company introduced the "AI for All" vision, aiming to integrate AI across all business lines and deploy computing capabilities "from pocket to cloud."

Following this strategy, Lenovo unveiled a range of AI-powered hardware and software products, including AI PCs, large model compression technology, the ThinkEdge SE455 V3 (touted as the "most powerful edge server"), and Motorola's adaptive flexible screen concept device. The company also announced a strategic partnership with NVIDIA, the global leader in AI chips.

Despite frequent moves, it is not easy for Lenovo Group to drive its business transformation from PCs to markets such as AI servers and smart solutions.

On one hand, competition in related markets is fierce. According to a KPMG report, computing power service providers in the market can be divided into three categories: new IT service providers, cloud computing service providers, and computing power network service providers. Lenovo falls into the first category.

Due to the nature of its past business, Lenovo, as a representative of new IT service providers, has not made significant strides in AI computing power. In contrast, major cloud computing players have deployed extensive intelligent computing power due to their previous business needs. In the era of large models, these manufacturers are generally ramping up AI computing power and its upper-layer applications, striving to create synergistic business advantages.

Players in the same field of new IT service providers are also eyeing this market opportunity. This year, server manufacturers such as Inspur Information, H3C, and Ningchang have all launched new AI server products.

On the other hand, the AI computing power industry is known for its long return-on-investment cycle, making it difficult to achieve quick success. This is reflected in Lenovo Group's financial performance. The earnings report stated that due to factors such as the "high development costs" of AI-related infrastructure projects, the profitability of Lenovo's ISG division has been under pressure.

As a result, Lenovo's ISG division recorded a loss of $114 million in the first half of fiscal year 2024.

At the end of the internal letter, Yang Yuanqing quoted the ancient Roman philosopher Seneca: "Luck is what happens when preparation meets opportunity." He stated: "Lenovo has secured an advantageous position in the AI era."

However, objectively speaking, in the era of large AI models, Lenovo still faces significant challenges ahead.