After Reviewing the Top 10 Most Profitable AI Agent Companies in 2025, I Summarized 3 Underlying Logics

-

An in-depth analysis of the growth data and business models of the Top 10 companies reveals three core underlying logics: vertical specialization, experience-first, and efficiency-driven. These principles not only serve as the key to their high profitability but also provide critical directions for entrepreneurship and development in the AI Agent field.

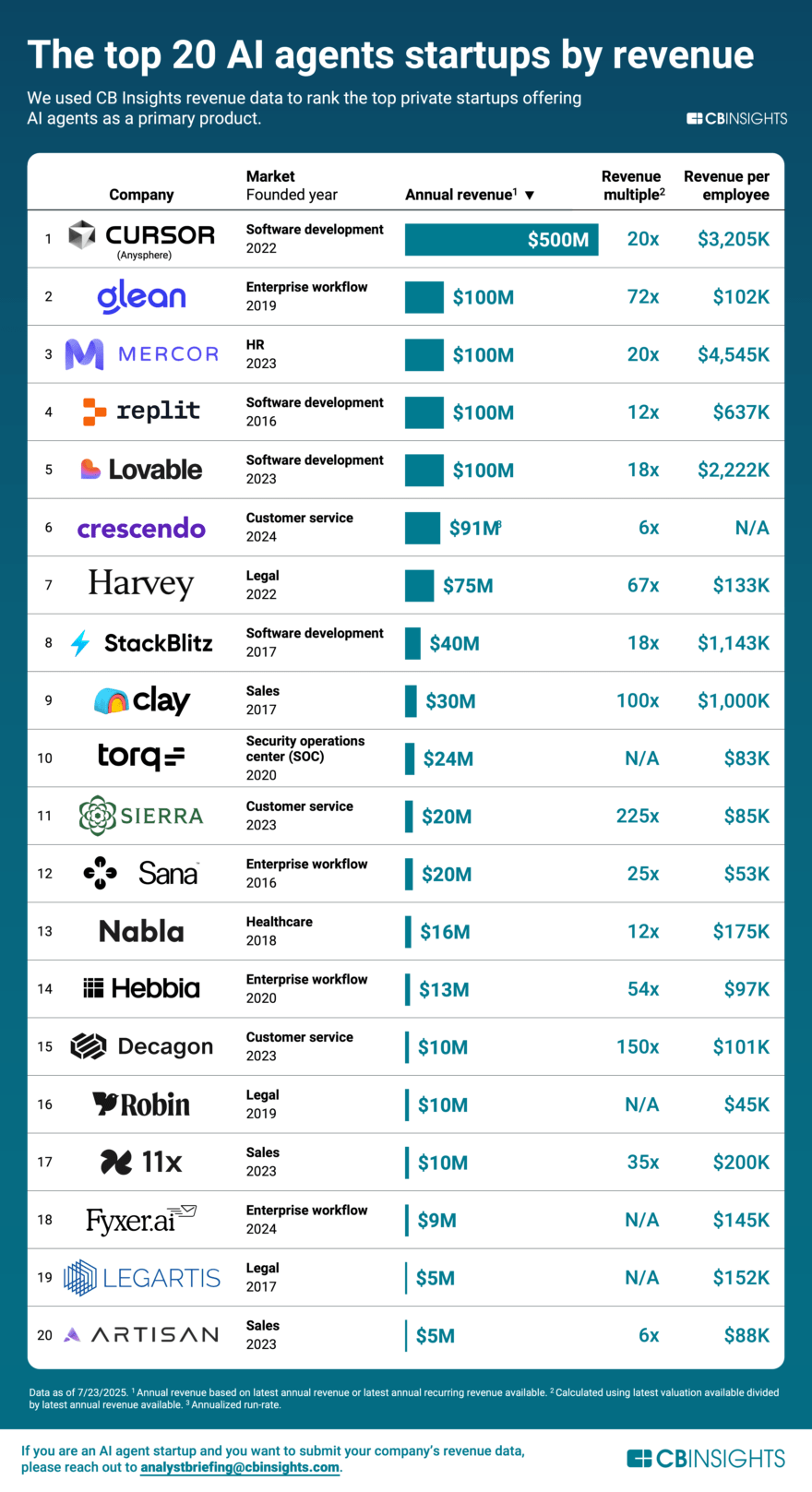

In July 2025, CB Insights released its first-ever ranking of the top 20 highest-revenue AI Agent startups globally.

Here’s an introduction to the top 10 companies:

1. Cursor

Positioned as an AI programming agent, Cursor is an industry leader with an annual recurring revenue (ARR) of $500 million. It currently boasts over 360,000 paying users, generating hundreds of millions of lines of code daily, with clients including Stripe, OpenAI, and Spotify.

In May 2025, Anysphere (Cursor’s parent company) secured $900 million in funding, valuing the company at approximately $9 billion, with revenue per employee reaching $3.205 million.

2. Glean

Headquartered in Palo Alto, California, Glean is positioned as a "Work AI platform," specializing in enterprise-grade search + AI agent functionalities. Employees can interact with the system using natural language to retrieve information from multiple SaaS applications and automate workflows.

Its ARR stands at $100 million, and in June 2025, it raised $150 million in funding, valuing the company at $7.2 billion, with revenue per employee at $102,000.

3. Mercor

An AI-driven recruitment platform that simplifies hiring processes by leveraging AI to efficiently match candidates with job openings. The platform uses advanced AI models to screen resumes, conduct interviews, and align candidates with employer needs.

The company’s ARR is $100 million, with revenue per employee at $4.545 million.

4. Replit

An AI programming agent that enables app development using natural language, with an ARR of $100 million. Replit grew its ARR from $10 million to $100 million in just six months and is currently negotiating a new funding round that could nearly triple its valuation to $3 billion, with revenue per employee at $637,000.

5. Lovable

A Stockholm-based AI startup that allows users to build full-fledged web applications without coding, using natural language prompts.

Lovable achieved an ARR of $100 million in just eight months, with revenue per employee reaching $2.222 million and a latest valuation of $1.8 billion.

6. Crescendo

In the AI customer service sector, Crescendo stands out with its human-AI collaboration model, seamlessly integrating AI and human support workflows into a unified solution.

Its ARR is $91 million, with a latest valuation of $500 million.

7. Harvey

Its legal AI assistant, Harvey Assistant, automates tasks like legal research, document drafting, contract analysis, and due diligence. In June 2025, Harvey AI raised $300 million in Series E funding, valuing the company at $5 billion, with an ARR of $75 million and revenue per employee at $133,000.

8. StackBlitz

A browser-based integrated development environment (IDE) that allows developers to build, run, and deploy full-stack web applications directly from their browsers.

In January 2025, StackBlitz secured over $100 million in new funding, surpassing 2 million registered users. Its ARR is $40 million, with revenue per employee at $1.143 million.

9. Clay

A pre-sales lead management platform that leverages AI and integrates data from over 100 external sources to optimize marketing workflows, providing sales and marketing teams with accurate insights. Clay operates as a SaaS platform, offering API integrations and automated spreadsheet generation.

In its latest funding round, Clay was valued at $3 billion, with an ARR of $30 million and revenue per employee at $1 million.

10. Torq

An AI-driven security automation platform for security operations teams, focusing on no-code/low-code automation for SOC processes. Its ARR is $20 million, with revenue per employee at $83,000.

Other notable companies on the list include Sierra, Sana, Nabla, Hebbia, Fyxer, and Tome, which play significant roles in customer service, enterprise AI assistants, healthcare, and information management, with ARRs ranging from $12 million to $20 million.

After reviewing the financial reports and growth data of these 10 companies, I identified three underlying logics that truly drive their profitability.

1. Vertical Specialization

Be a "small but mighty" disruptor in niche markets.

Leading companies almost exclusively focus on a single domain, such as legal AI Harvey or programming agent Cursor.

Rather than competing with giants in broad markets, digging deep into vertical scenarios with tailored solutions creates irreplaceable value.

While large-scale battles are crowded with giants, blue oceans lie in specialized niches.

2. Experience-First

Make AI tools "indispensable" through superior user experience.

Users pay for Cursor and Lovable because their natural language interfaces and no-code designs turn complex functionalities into "foolproof experiences."

No matter how advanced the technology, users only pay for what’s intuitive and delightful.

Technology is the core, but experience is the bridge—users pay for what works seamlessly.

3. Efficiency-Driven

Win the cost battle with high revenue per employee.

Mercor’s $4.54 million and Clay’s $1 million revenue per employee prove that AI entrepreneurship hinges on "leveraging technology to amplify efficiency."

Avoiding blind team expansion and relying on product automation to reduce costs and boost efficiency is the sustainable growth formula.

The ultimate goal of AI entrepreneurship is turning every employee into a revenue engine worth millions.