AI Interview: I Only Talked with AI for a Few Minutes at an Asset Management Firm

-

The impact of artificial intelligence (AI) on the financial industry has already begun.

Currently, it's the peak season for campus recruitment, and HR departments at asset management firms are overwhelmed with work.

However, some financial institutions have unveiled a 'time-saving' solution—AI interview robots.

During interviews at these institutions, candidates will face a futuristic scenario: conversing with an AI interviewer (robot).

After carefully answering each 'interview question' with emotion in front of the camera, the AI interviewer will provide a comprehensive score based on multiple factors (speech, facial expressions, subtle movements, etc.).

The resulting 'interview score' will determine whether the candidate advances to the next round.

This 'solitary' interview trend is gaining momentum in the asset management industry...

Information from social platforms shows that more and more companies are adopting 'AI interviews.'

This has directly led to the appearance of 'trick summaries' on job application websites aimed at 'handling AI interviews.'

Among these institutions, mainland financial firms are particularly active, likely due to the high volume of applications they receive.

It is reported that 'AI interviewers' primarily serve as 'screening roles' in the recruitment process, conducting initial reviews and first-round interviews.

These systems follow a set procedure, requiring candidates to record answers to on-screen questions within a specified time. The AI then evaluates candidates based on language use, eye contact, voice, speech speed, tone, body language, and other factors, aligning with the preferences of the hiring organization. The fastest scoring can be completed in just a few minutes.

Moreover, AI interviews do not require candidates to visit a physical location. As long as they have internet access and a device with a camera (such as a computer, tablet, or smartphone), they can participate in such interviews.

This represents one of the most advanced forms of 'human-machine interaction' today.

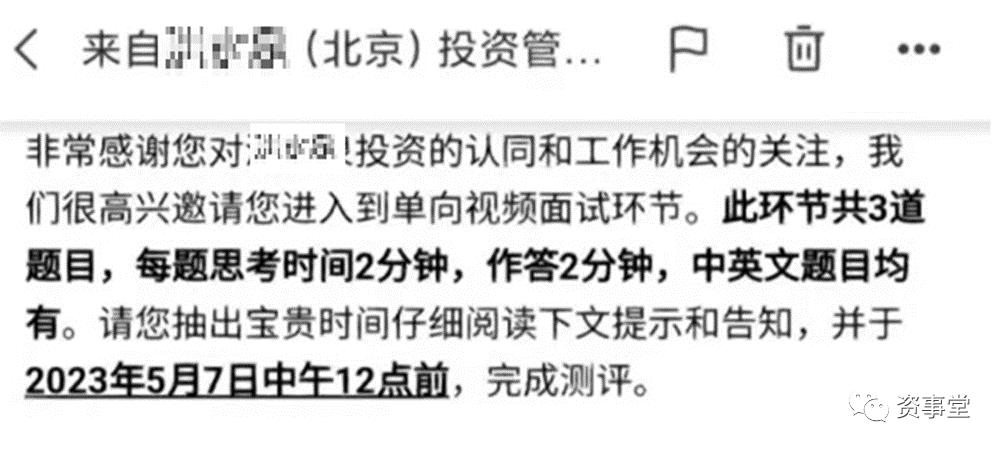

Notably, a long-established private equity firm in Beijing began using AI interviews earlier this year, and some candidates have shared their experiences on social media platforms.

It is reported that in the first half of 2023, the organization sent interview invitations to candidates, labeling this stage as the 'One-way Video Interview Session' in the email.

Moreover, this organization's AI interview had very few questions—only three in total. 'Each question allows 2 minutes for thinking and 2 minutes for answering, with both Chinese and English questions included.'

Candidates were required to face the robot and answer questions such as:

- Answer in English: What are the three most important factors influencing your career choice and why?

- Who do you admire the most? What inspirations have they given you?

- Based on the provided materials, share your perspective on confidence.

It can be seen that the aforementioned interview questions are quite open-ended, aimed at understanding a person's values, thinking patterns, breadth of knowledge, and more.

The latter also reflects this established private equity firm's focus on the intrinsic character and values of candidates.

Social media has also exposed that some public fund institutions are introducing 'AI' into their interview processes.

One candidate revealed: In the recruitment for non-quantitative positions (equity and fixed income investment) at a large public fund in Shanghai, there was an AI interview consisting of four questions, while quantitative positions did not include an AI interview.

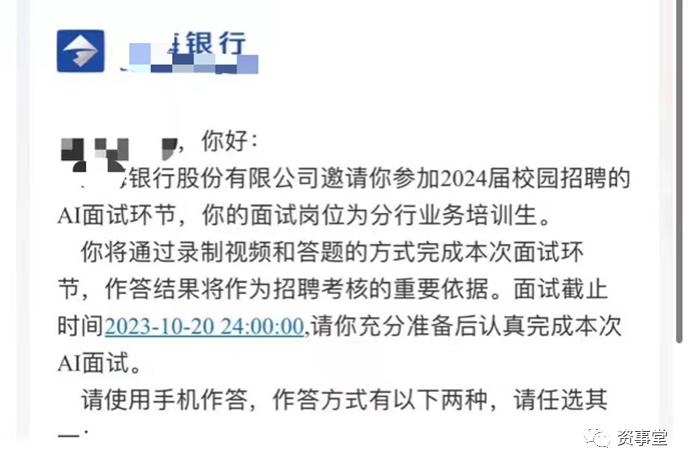

Similarly, in this year's campus recruitment, a bank-affiliated institution also issued an AI interview notice, requiring candidates to answer questions via mobile phone.

This listed company stated: 'You (the recipient of the interview notice) will complete this interview session by recording videos and answering questions, and the results will serve as an important basis for the recruitment assessment.'

Another listed bank has adopted this model, with interview questions including: self-introduction, career goals, life aspirations, and roles played in previous projects.

Investigation by Zishitang found that some large listed companies in China are also using AI interview platforms, with some technical overlap in the HR tools used by financial institutions.

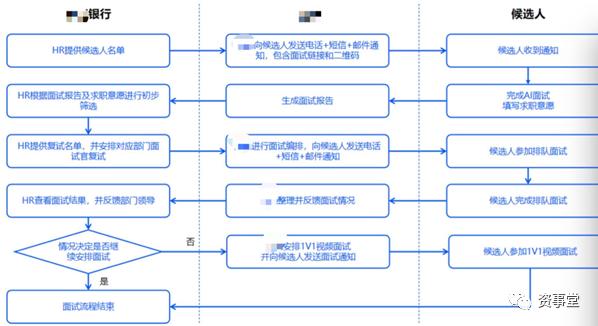

An AI development platform specializing in technical support for financial institutions' AI interviews reveals the interaction model between financial institutions and AI interviewers.

(As shown above) The bank's HR provides a candidate list to the AI platform, which then notifies candidates to complete AI interviews, fill in job preferences, and generates intelligent interview reports based on algorithms before feeding back to the bank.

Afterwards, the HR department of banking institutions compiles a shortlist for further interviews and notifies the candidates for either online or offline face-to-face interviews. The intelligent platform can then organize and provide feedback on the interview process.

Some industry sources have noted that factors such as the pandemic have increased the frequency of AI interviews in financial institutions.

It can be seen that the primary function of AI interviewers lies in the 'screening' of large volumes of resumes and the initial interview rounds, acting as an 'HR assistant.'

Financial institutions may adopt AI interviews due to constraints on manpower and costs, but considerations such as 'objectivity' and reducing 'rent-seeking' behaviors also play a role.

When AI can better address aspects like efficiency and fairness, its widespread application becomes inevitable.

However, is this method entirely without issues?

Could AI interviews create a new form of unfairness?

What if the AI interviewer encounters software errors?

How to solve these problems may be the key issue worth noticing after the mass replication of AI interviewers........