Is Microsoft's AI Era Ushering in a New Age of Internet Dominance?

-

Microsoft (NASDAQ: MSFT) released its Q1 FY2024 earnings report after the U.S. market closed on October 24, demonstrating strong performance in both revenue and profits. Key takeaways are as follows:

1. Revenue Growth Recovery and Strong Profit Expansion:

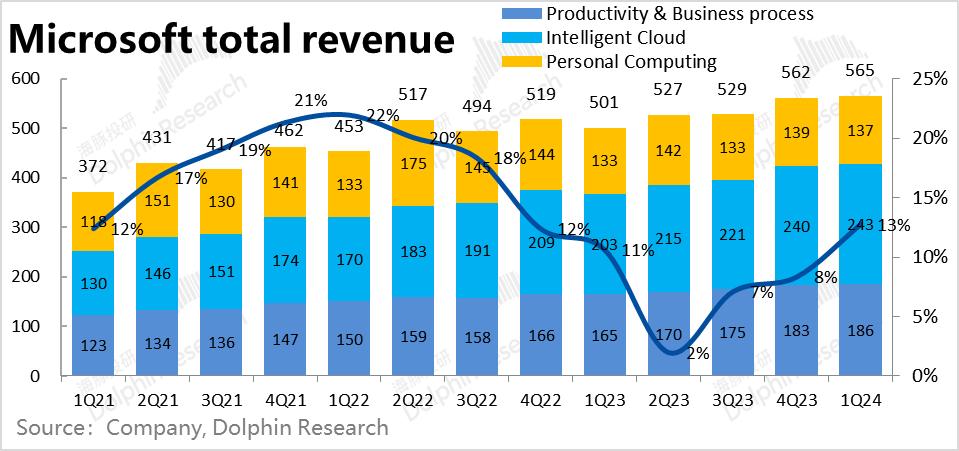

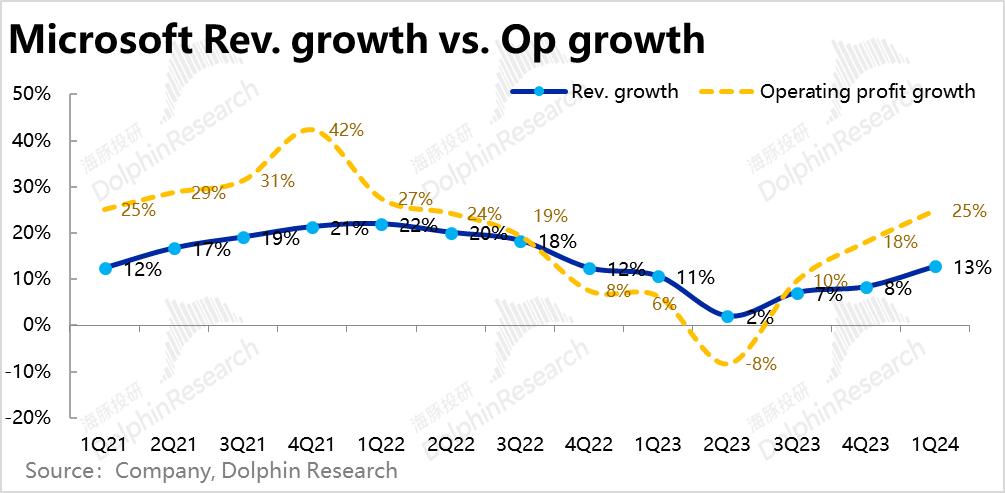

Microsoft reported revenue of $56.5 billion, significantly surpassing market expectations of $54.5 billion. The year-over-year growth rate rebounded sharply from 8.3% last quarter to 12.8%, confirming a recovery trend. Operating profit reached $26.9 billion, far exceeding the expected $24.1 billion, driven by AI-enhanced product margins and cost-cutting measures. The operating margin improved by 4.4 percentage points sequentially, signaling Microsoft's return to higher profit growth despite modest revenue increases.2. AI Begins to Deliver, Cloud Demand Rebounds:

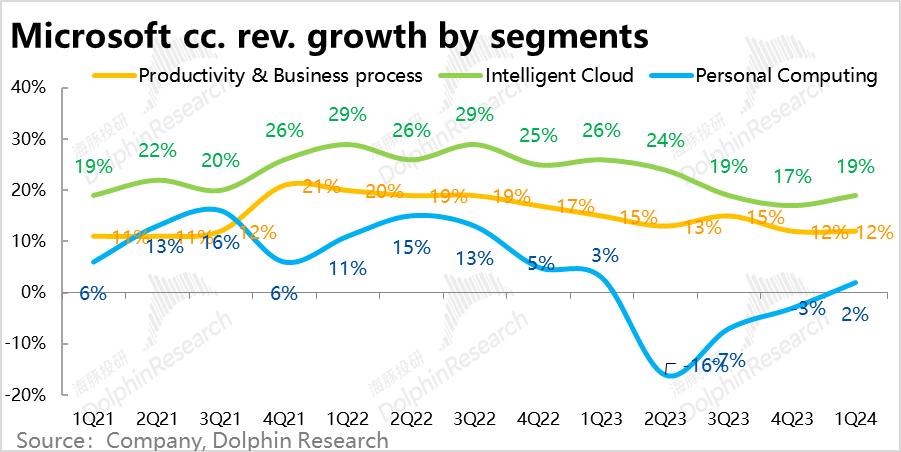

Azure, Microsoft's core cloud service, posted revenue of $16.8 billion, with growth accelerating to 29% after seven consecutive quarters of slowdown. This reversal suggests: (1) The AI wave is generating tangible demand for cloud services, boosting provider revenues; (2) The cost-cutting cycle among欧美 companies, which reduced cloud usage, has ended. The Intelligent Cloud segment overall grew 19% YoY to $24.3 billion, exceeding guidance and expectations.3. Office Copilot Drives Stable Volume but Higher Pricing:

Office 365 commercial revenue rose 18% YoY to $10.9 billion, with subscriber growth plateauing at 10%. However, average revenue per user increased 7%, driven by premium AI features like Copilot. The Productivity and Business Processes segment grew 2% YoY to $18.6 billion, also exceeding expectations.4. Personal Computing Rebound Strongest:

The previously struggling Personal Computing segment returned to growth (3% YoY) with revenue of $13.7 billion, $800 million above expectations. Windows and Xbox led the recovery, while hardware and Bing ads lagged.5. Pricing Power and Cost Efficiency Boost Margins:

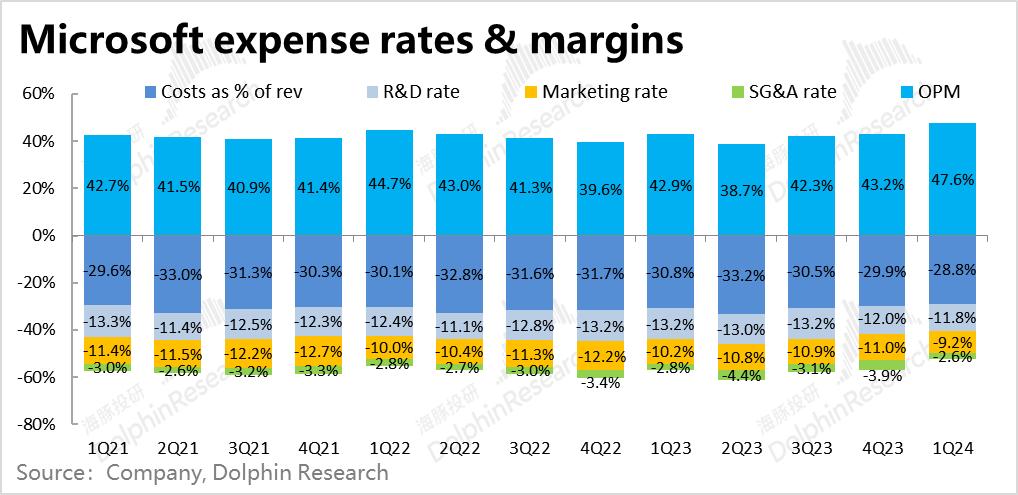

Gross margin expanded to 71.2% (+1-2 ppts YoY/QoQ) due to higher-margin AI products and cloud pricing. Sales and marketing expenses fell to 9.2% of revenue—the first sub-10% reading since 2021—while R&D and administrative costs also declined.6. Next Quarter Outlook:

Guidance for Intelligent Cloud and Productivity segments aligns with expectations, though growth may slow slightly. Personal Computing is projected to surge to $16.7 billion (vs. $14.7 billion expected). Operating profit is forecast at $25.9 billion, well above the $24.2 billion consensus.Conclusion:

Microsoft’s growth recovery is now firmly established, with profits outpacing revenue due to cost discipline. AI contributions—via Copilot and Azure—are materializing, validating market optimism. However, the muted 4% after-hours stock reaction reflects already-high AI expectations and tempered guidance for core segments. Future performance hinges on macroeconomic conditions and AI’s tangible impact.1.1 Azure Growth Revival in the AI Wave

Azure’s 29% YoY growth (or +1ppt in constant currency) marks a turnaround after seven quarters of deceleration, indicating either (1) AI-driven cloud demand or (2) the end of corporate cloud austerity. Non-Azure cloud services also rebounded (+2%), reinforcing the trend.1.2 Office Revival Fueled by Copilot

Office 365 commercial revenue grew 18% YoY (17% ex-FX), aided by Copilot’s premium pricing despite flat subscriber growth.From a volume-price perspective:

-

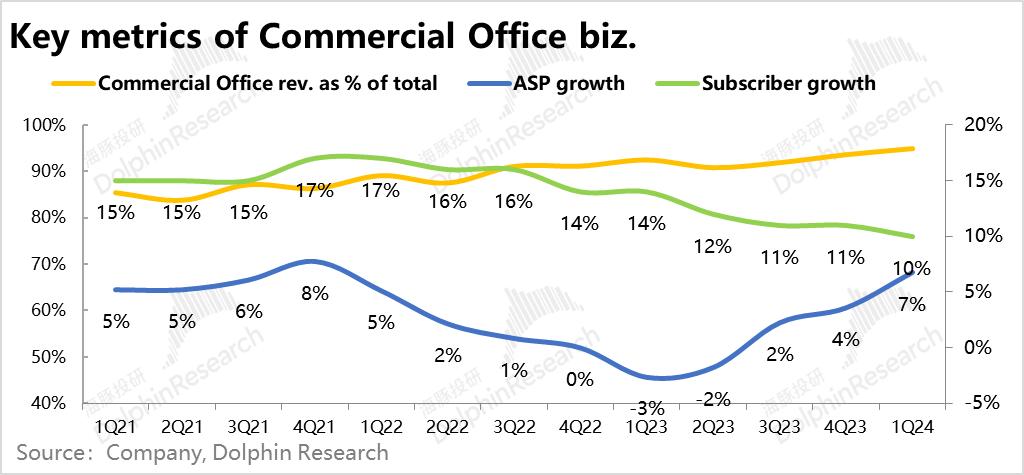

This quarter, the number of enterprise Office 365 subscribers grew by 10% YoY, slowing from the previous quarter, indicating that user growth has peaked and the Office business can no longer rely on volume-driven growth.

-

On pricing, the average revenue per user (ARPU) for Office 365 rose 7% YoY. While the low base from last year played a role, our calculations show ARPU increased by over $2. Dolphin Research believes the launch of Office Copilot, with its pricing far exceeding market expectations, has driven a significant rise in Office ARPU, with AI now making a clear contribution to the Office business.

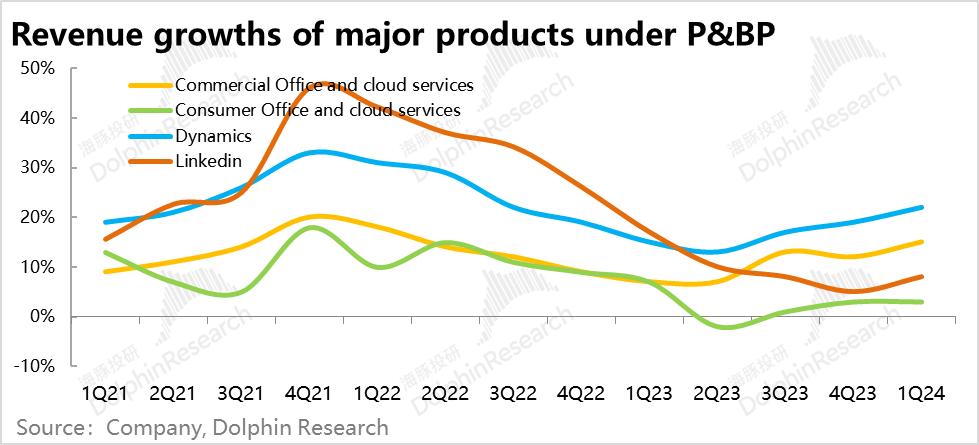

As for other businesses in the Productivity segment:

① Similar to enterprise Office, Dynamics also showed a recovery in revenue growth, reaching 22% this quarter.

② LinkedIn revenue growth rebounded to 8%, even after accounting for favorable currency effects.

③ Only the consumer Office business remained weak.

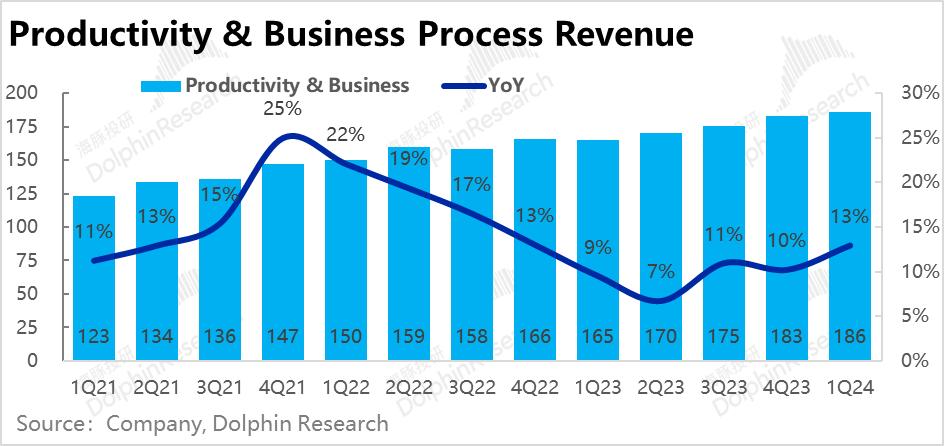

Driven by the recovery in enterprise Office and Dynamics, the Productivity and Business Processes (P&BP) segment revenue reached $18.6 billion, with YoY growth up 2 percentage points, slightly exceeding guidance and market expectations of $18.3 billion.

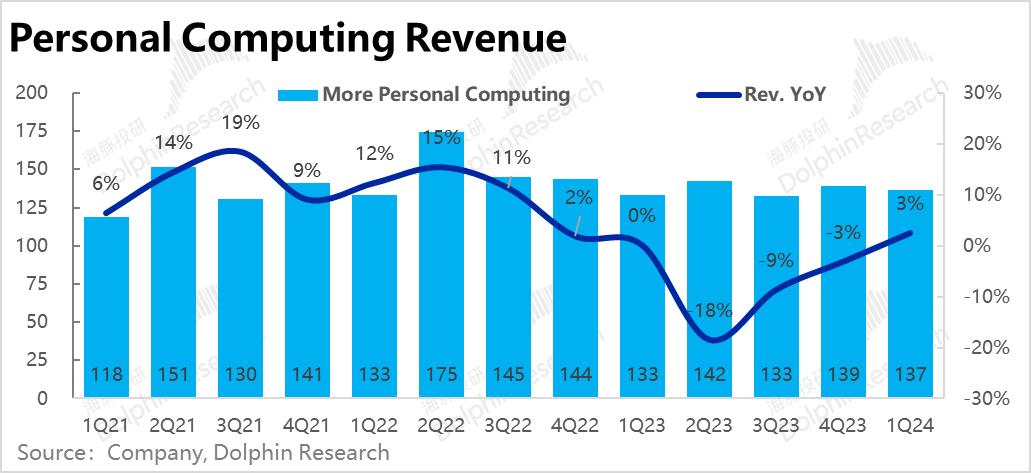

Beyond core business recovery, the previously weakest-performing PC segment also rebounded unexpectedly. The More Personal Computing segment revenue hit $13.7 billion, with growth turning positive at 3%. The actual revenue exceeded market expectations by $800 million, making it the segment with the largest positive surprise among Microsoft's three main divisions.

Breaking it down:

- Windows OEM revenue grew 4% YoY, reversing its decline.

- Hardware sales, mainly Surface products, still fell sharply by 22%.

- Xbox software and content revenue growth rebounded to 13%.

- Advertising revenue, more tied to macroeconomic conditions, recovered more slowly, rising from 8% last quarter to 10%, but growth was flat excluding currency effects.

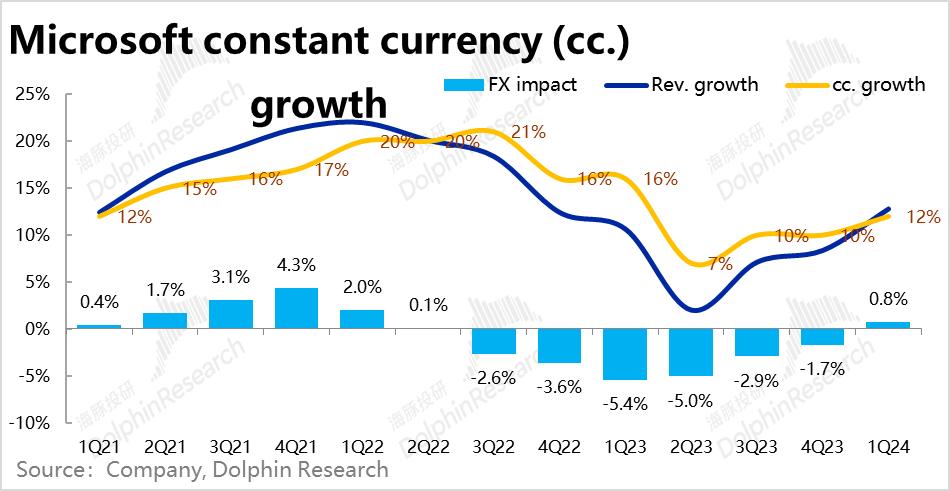

Overall, Microsoft's revenue for the quarter was $56.5 billion, well above the expected $54.5 billion, with all three segments slightly exceeding expectations. The More Personal Computing segment contributed the most, and YoY growth accelerated from 8% last quarter to 13%.

Excluding currency effects, growth was 12%, indicating a ~1 percentage point boost from FX. Even on a constant-currency basis, revenue growth accelerated by 2 percentage points, confirming a clear recovery.

Excluding FX, Intelligent Cloud and More Personal Computing segments showed growth acceleration, while Productivity and Business Processes growth was flat.

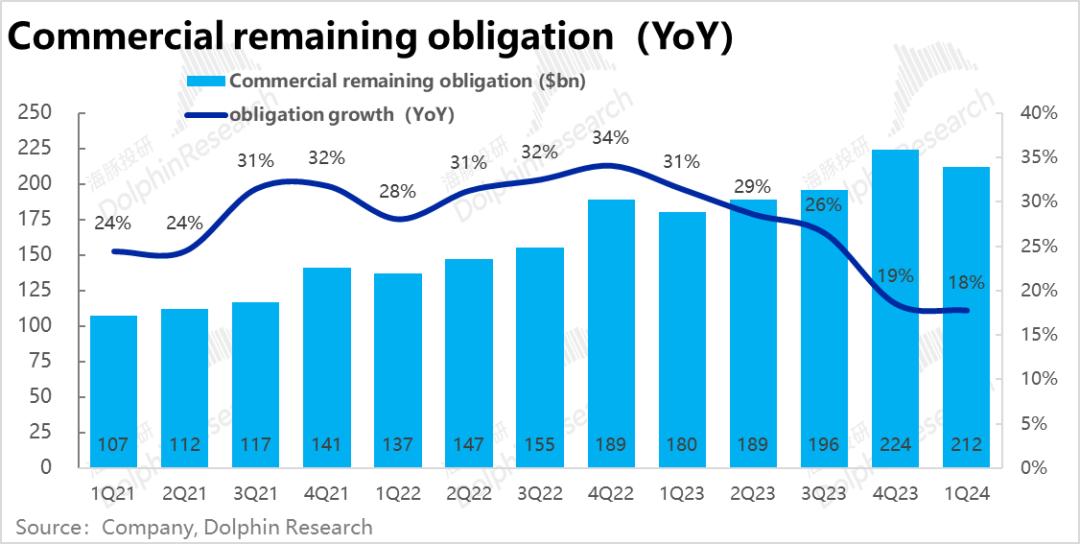

With most businesses showing signs of recovery, how did the "pipeline" metrics reflecting future growth perform?

Starting with long-term "pipeline"—the commercial contract backlog—the remaining performance obligation (RPO) at quarter-end was $212 billion. Due to seasonality, it declined QoQ, with growth slowing to 18%, still at historically low levels. The long-term pipeline shows no clear improvement.

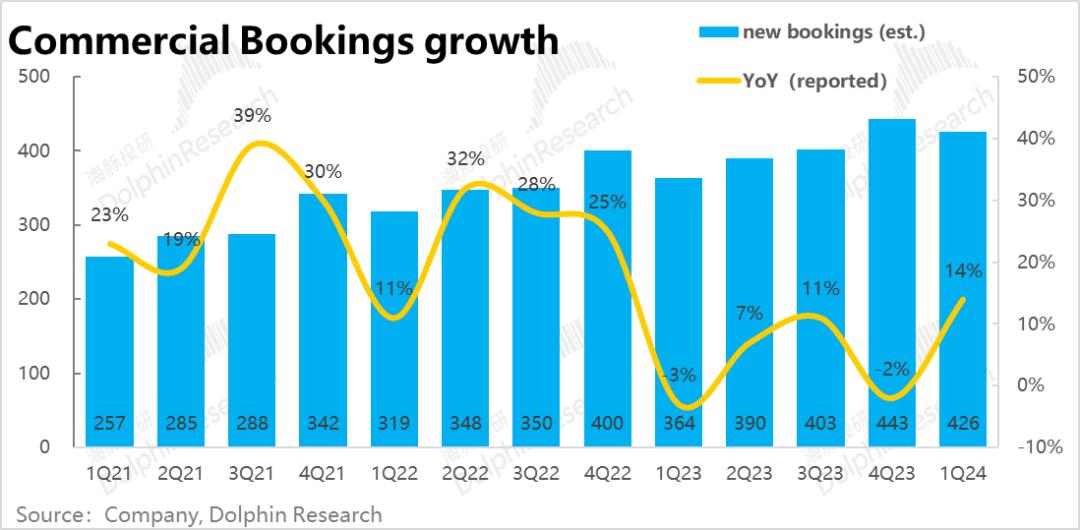

New commercial bookings, reflecting near-term growth, rose 14% YoY. While this was helped by a low base last year, it still signals a rebound in corporate cloud and IT spending.

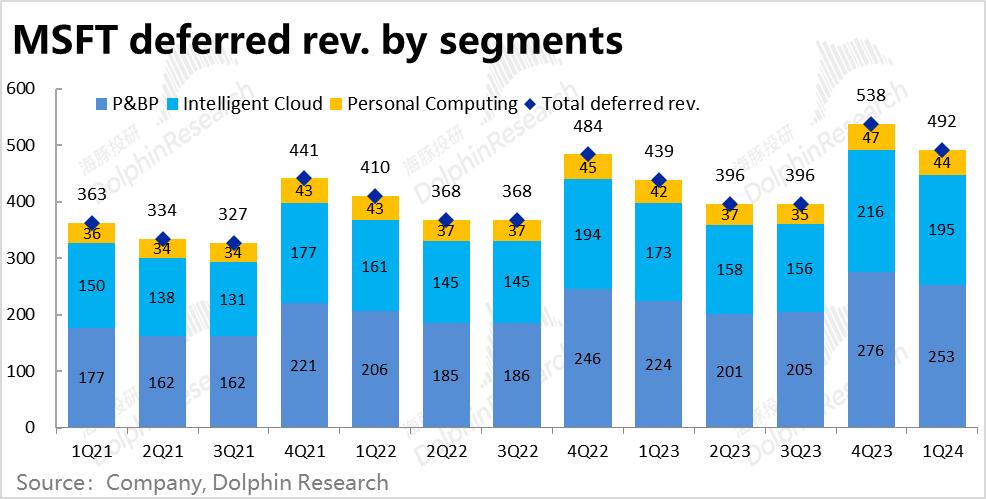

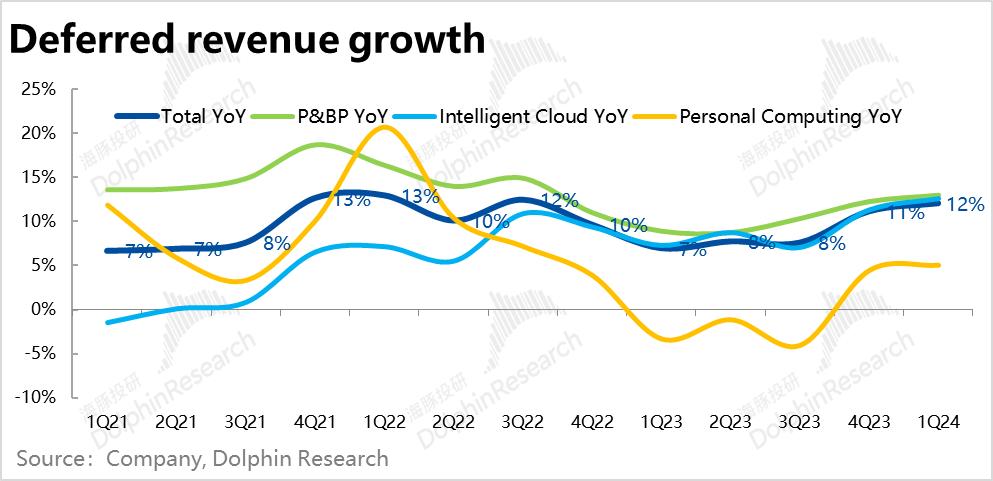

Short-term "pipeline"—deferred revenue—reached $49.2 billion (mostly to be recognized within a year), up 12% YoY, slightly improving from last quarter and aligning with revenue trends.

By segment, deferred revenue growth improved QoQ, though the More Personal Computing segment, which saw the strongest revenue recovery, lagged in deferred revenue improvement.

AI's contribution to revenue is finally visible, with growth recovering across segments. But the most notable improvement was in profitability, aided by cost-cutting, easing inflation, and FX tailwinds.

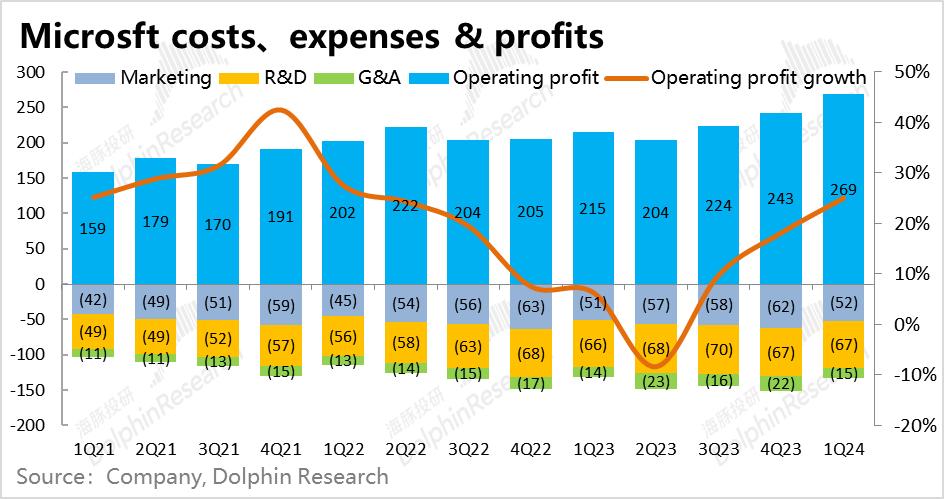

1) Gross profit reached $40.2 billion, with margins rising sharply to 71.2%, improving both YoY and QoQ. Microsoft attributed this to higher-margin revenue mix and price hikes for cloud and productivity products post-AI integration.

- Operating expenses declined across all three categories. Sales and marketing expenses fell to 9.2%, the first time below 10% since 2021, marking the sharpest drop. R&D and G&A expenses also dipped slightly, showing ongoing efficiency gains.

- Operating profit hit $26.9 billion, up 25% YoY, far surpassing expectations of ~$24.1 billion. Profit growth again outpaced revenue growth, putting Microsoft back on track to deliver stronger earnings through scale and pricing power, even with modest revenue growth.

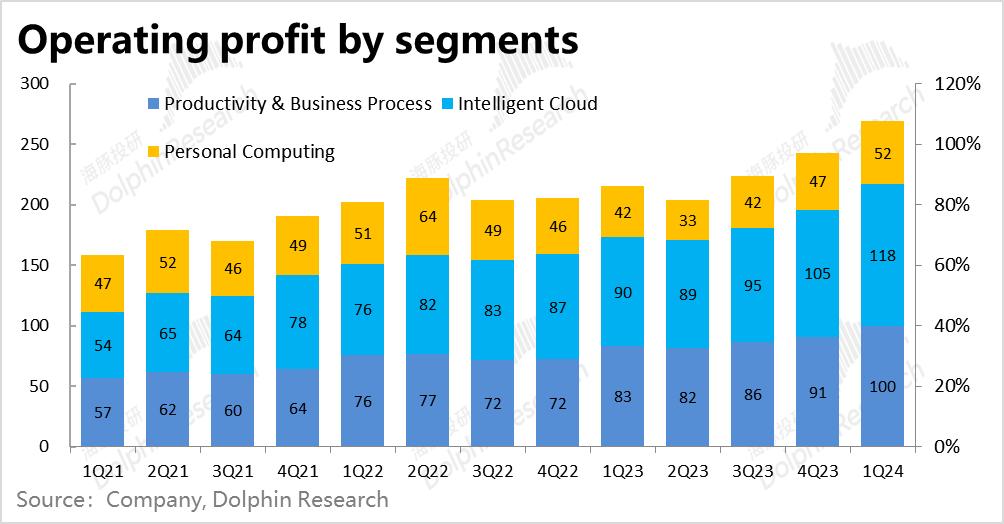

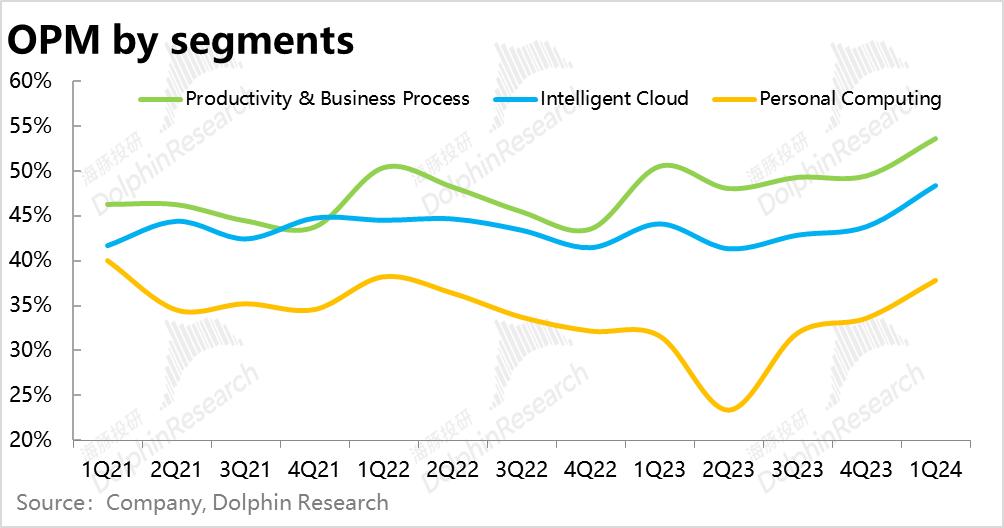

- All segments saw margin improvements of 4-5 percentage points QoQ. In absolute terms, Intelligent Cloud and Productivity contributed $11.8 billion and $10 billion, respectively, while More Personal Computing added $5.2 billion. Each segment exceeded expectations by ~$1 billion.

-