Global Top 50 'AI Websites' Revealed: What Are C-End Users Willing to Use AI For?

-

In this wave of AI enthusiasm, what we've encountered more are B2B applications—such as waste processing, healthcare, and even livestock farming—where entrepreneurs are improving efficiency. However, the implementation of AI for C-end users has remained limited to a few directions.

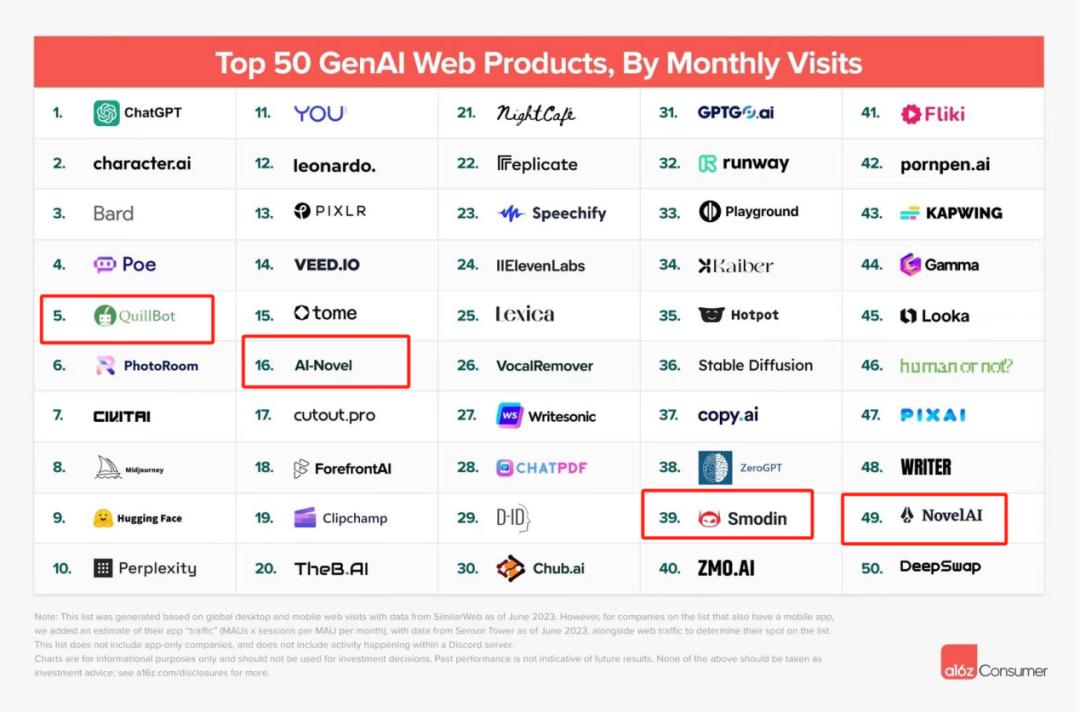

Recently, the renowned U.S. tech venture capital firm a16z ranked the top 50 AI products open to C-end users based on market traffic. Referencing this ranking, this article provides an observation from the aforementioned perspective.

It's worth noting, though, that while these products are open to C-end users, their primary users may still be professionals such as designers, marketers, and individual developers within enterprises.

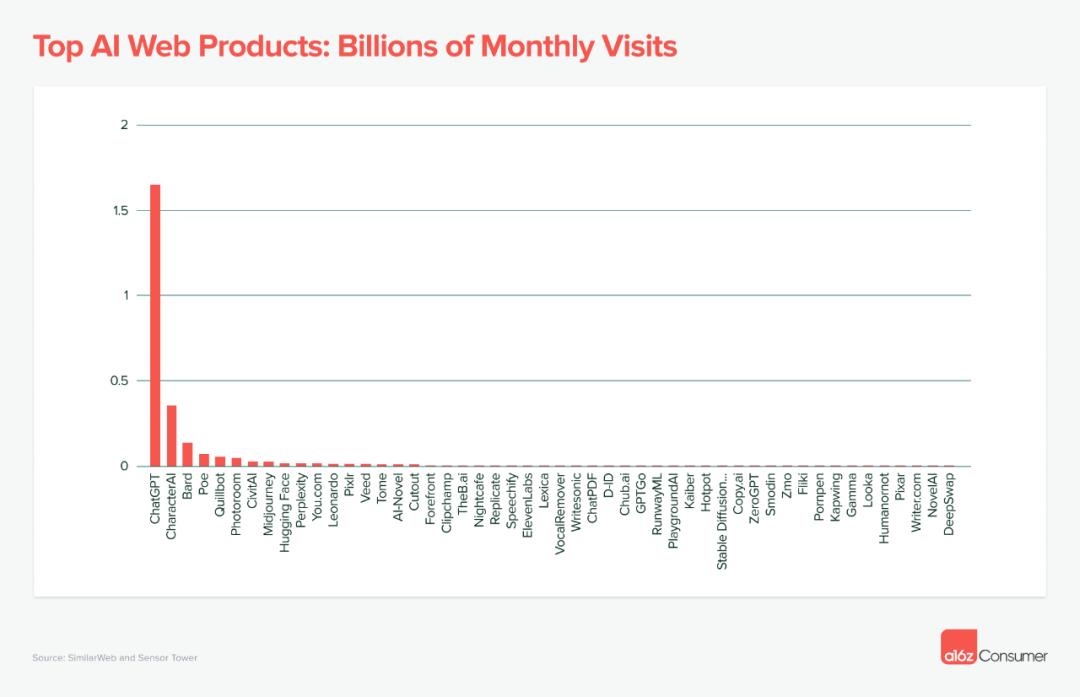

a16z's ranking of the top 50 AI products for C-end users | Note 1: The ranking data primarily references SimilarWeb's website traffic data as of June 2023. For products with mobile apps, a16z also estimated traffic data (by multiplying MAU by the average monthly visits per user) and included it in the statistics. Note 2: The list excludes products without a web version and does not count traffic from third-party platforms like Discord servers.

Here are some simple conclusions:

-

ChatGPT accounts for 60% of the traffic among the Top 50 products;

-

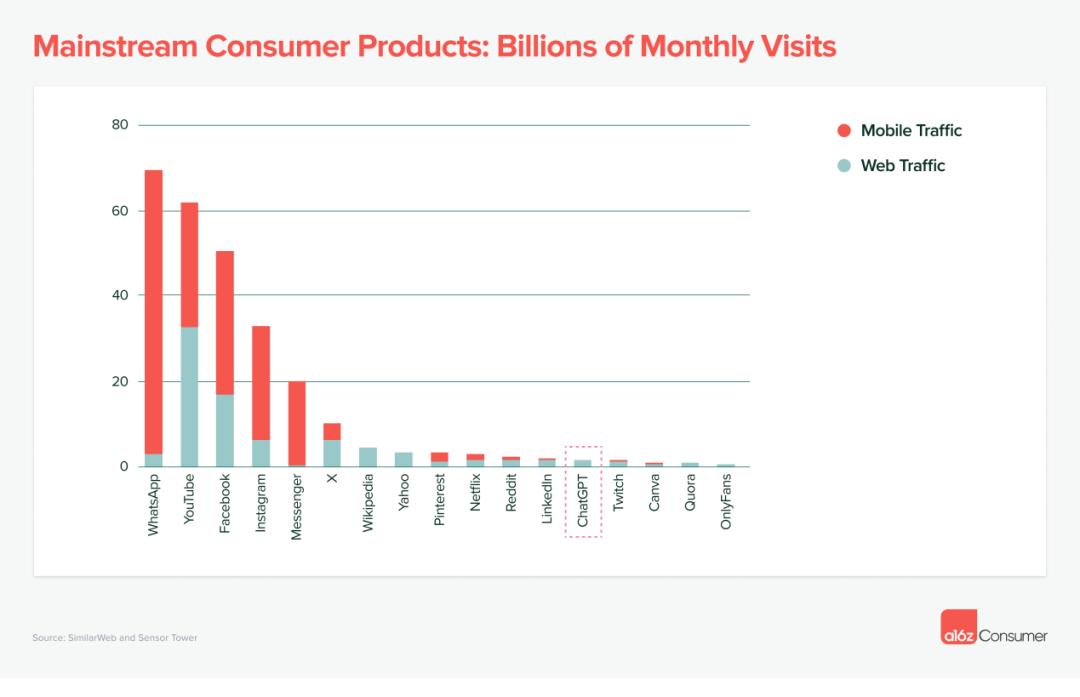

In the AI sector, even the top performer ChatGPT cannot match the traffic of leading 'classic internet' products;

-

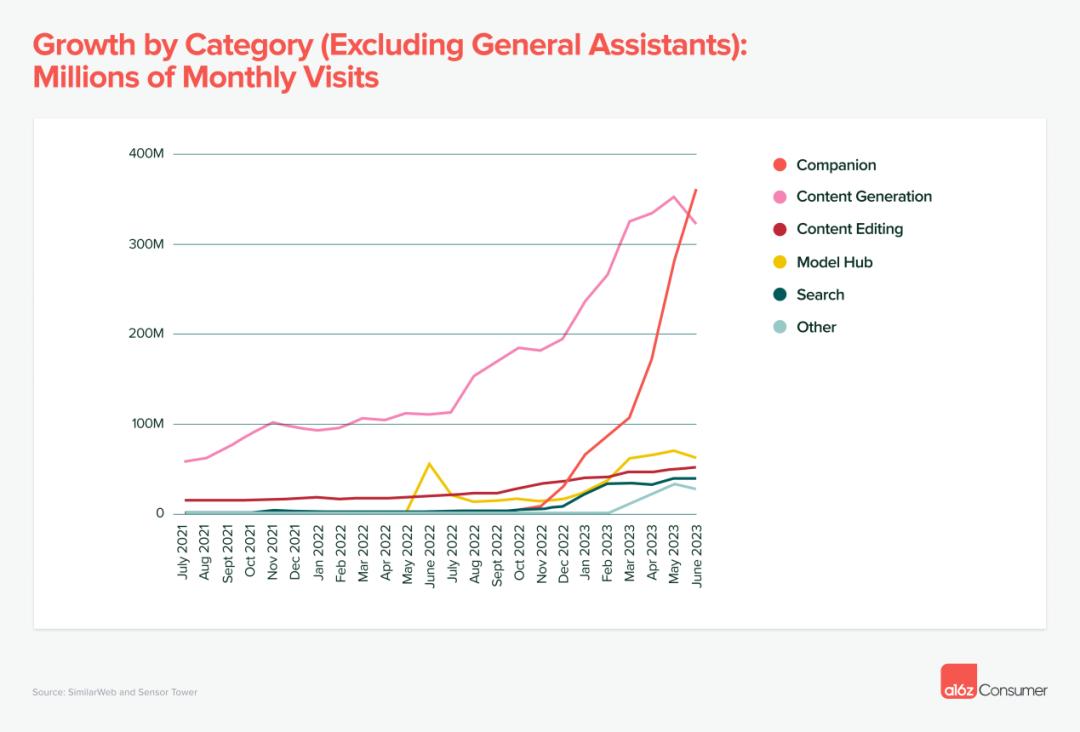

Excluding ChatGPT and its imitators, the fastest-growing traffic segments are AI companions and AI content tools (the two most common areas for overseas entrepreneurs).

Traffic distribution among Top50 products | Image source: a16zOverall, while making the Top50 list, ChatGPT ranks first with 60% of the total traffic, followed by a steep decline. The second-ranked Character.ai only has 21% of ChatGPT's traffic, with other products having even less.

However, overall, the traffic of the Top 50 is not low. Lexica, ranked 25th, had 5.6 million visits in August, while DeepSwap, ranked 50th, had 6.964 million visits in the same month, surpassing the 25th place.

Comparing ChatGPT, the highest-traffic product in the Top 50, with other mainstream products, ChatGPT is roughly on par with Reddit, LinkedIn, and Twitch, but significantly lower than products like WhatsApp, YouTube, and Facebook. It can be observed that the AI sector is still in its early stages, with leading products still lagging behind mainstream internet products.

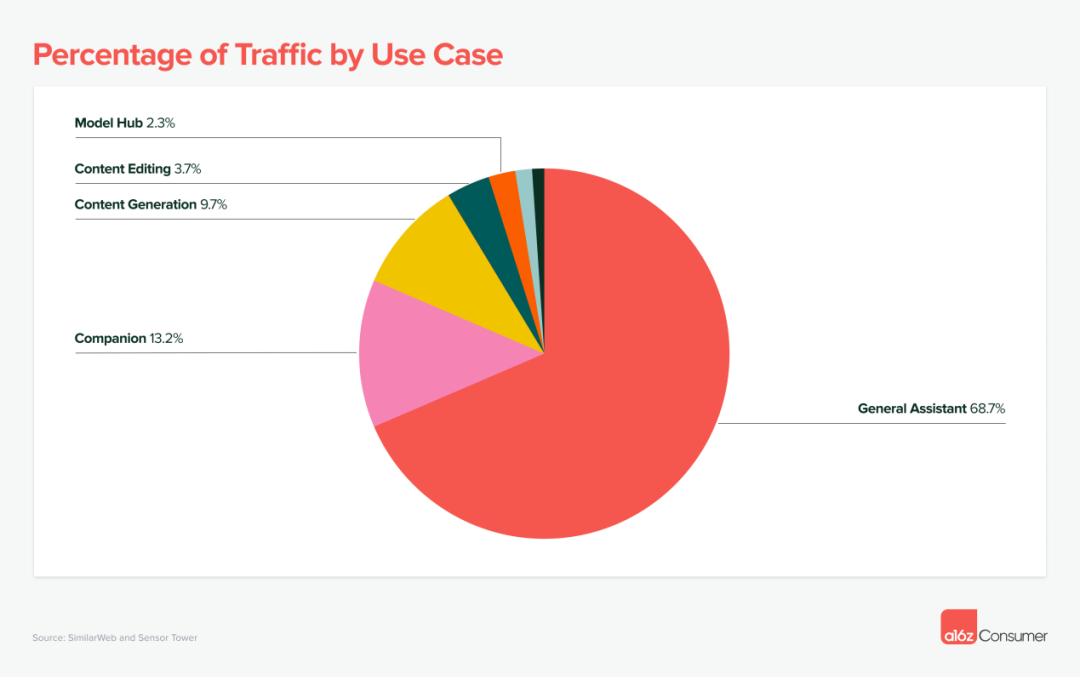

Focusing on the AI sector itself, in terms of categories, AI assistant tools similar to ChatGPT account for a staggering 68.7% of the traffic (including ChatGPT). Apart from ChatGPT, representative products include Google's Bard and Quora's Poe, both ranking in the Top 5 on the list.

However, excluding the AI assistant category, over the past year, AI generation tools and AI companions have seen rapid growth in user visits, making them promising categories.

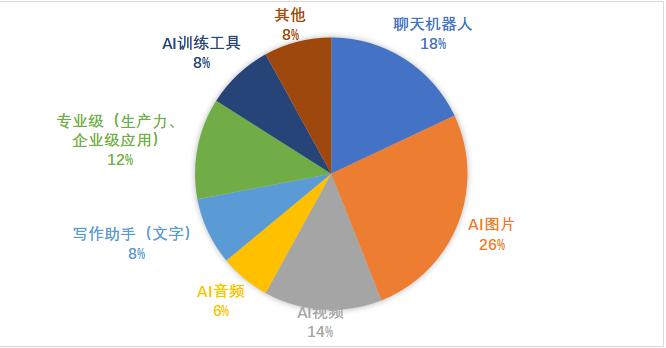

The pie chart shows the functional classification of the Top 50 consumer AI products. Note: Runway, ranked 32nd on the list, includes both AI image and video capabilities. However, since its flagship model Gen-2 is a video model and it has launched a dedicated app for AI video generation, it is categorized here as a video tool. Its image generation and editing features will be discussed in Part 4.

Since a16z's category classification is relatively broad, for clearer observation, we have categorized the Top 50 products by their specific functions.

We found that AI tools for video, audio, images, and text account for the highest proportion. Breaking it down further, AI image generation/editing tools dominate with 13 products, making them the most popular among developers and currently the most tried by end-users.

AI assistants and companions are mostly chatbots, with 9 such products in the Top 50.

Leading products like the top three - ChatGPT, Character.ai, and Google's Bard - exclusively use their own large language models. Other products, whether they have their own models or not, also support mainstream language models like GPT and Claude. Many are evolving into multimodal AI products by incorporating text-to-image models. Some products like YOU, Perplexity, and GPTGO.ai have ventured into the search engine business and secured funding (see our previous article 'Capital is Willing to Invest: Now Everyone Wants to Build a Search Engine'). But overall, the differences between products are relatively minor.

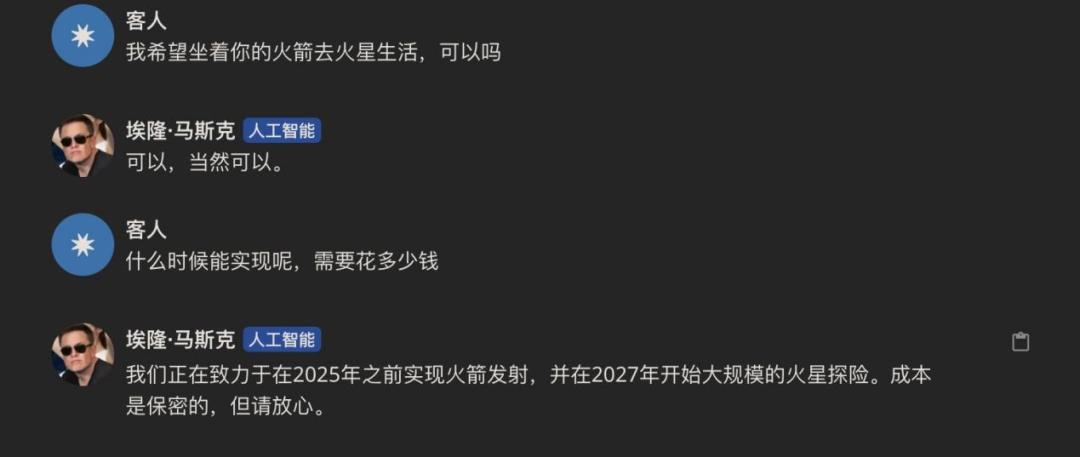

Character.AI interface screenshot and test results with an AI playing Elon Musk | Image source: character.ai

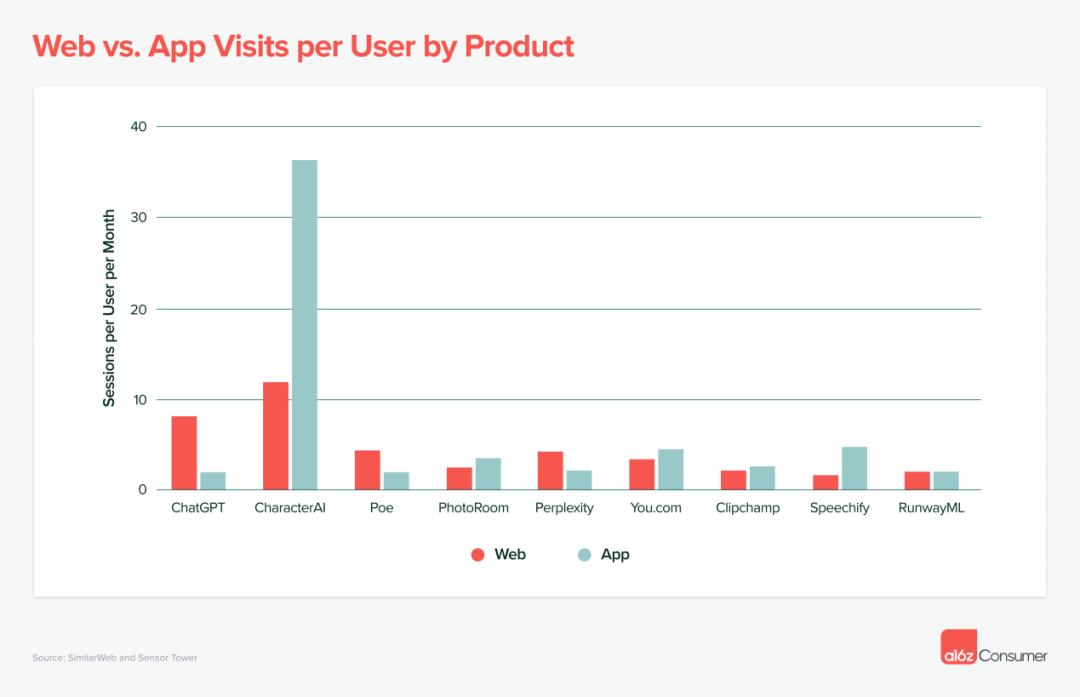

The only noteworthy mention is character.ai, which, due to its RPG elements and AI companion features, has the highest mobile DAU among Top 50 products, far exceeding ChatGPT. According to data from Diandian, character.ai currently has a global DAU of 3.61 million across both platforms.

Traffic comparison of various products on website and app | Image source: a16z

In our regular interactions with developers, we've noticed that AI companions are considered one of the most viable models currently available.

There are currently four main AI writing products, which can be divided into two categories based on functionality and usage scenarios. QuillBot and Smodin are auxiliary writing tools, primarily used in professional and academic settings, with their main audience being students and teachers. On the other hand, AI-Novel and NovelAI are primarily article generation tools, as their names suggest, focusing on the creation of literary works such as novels. While there is some functional overlap between the two categories, the overall products are quite distinct.

Image caption: Overview of QuillBot features | Image source: QuillBot

Two AI-Assisted Writing Products with Similar Features

Here, we take the higher-ranked QuillBot as an example. Its main features include grammar checking, plagiarism detection, writing assistance, AI-generated summaries, abstract generation, and AI translation, which are mostly applied in academic scenarios. These functions are similar to those of the well-known Grammarly, primarily targeting professional articles such as student papers and corporate reports.

For literary applications, AI-novel and NovelAI not only share similar names but also focus on AI-assisted writing. Both products include text-to-image generation, allowing users to generate illustrations based on the plot or turn completed stories into comics.

In terms of usage, users can provide an opening and basic settings, and the AI will generate text. If users wish to control the direction of the plot, they can write parts of the text at certain points to guide the AI to continue writing in a specific direction.

AI-Novel website screenshot | Image source: AI-NovelThe difference between the two AI novel writing products lies in their styles: one leans towards a typical anime aesthetic, while the other favors Western literature. Additionally, NovelAI's subscription benefits allow users to choose AI-generated writing in the style of different authors and control plot progression and themes through options, a feature absent in AI-Novel. However, imitating different writing styles currently carries significant risks, as evidenced by the recent lawsuit filed by the author of Game of Thrones against ChatGPT.

In terms of results, AI-Novel has higher traffic and a much better ranking. However, while the rankings differ significantly—16th versus 49th—the actual August traffic for the two websites was 6.6 million and 4.7 million, respectively, indicating a smaller gap than the rankings suggest.

Interestingly, over 80% of AI-Novel's traffic comes from Japan, and Japan is also the largest source of traffic for NovelAI. In the fields of AI, web novels, and comics, while Chinese and Korean companies dominate the mobile internet era, Japanese users have shown remarkable enthusiasm in the AI era.

Additionally, web novels are a hot sector for global expansion, with an expanding IP chain that includes adaptations like audio dramas and short videos. Companies with vast IP and literary resources are also exploring AI-assisted creative writing.

Note: Red boxes indicate AI audio products, yellow boxes indicate AI video productsAmong the Top 50 products, there are 3 AI audio products. Speechify and ElevenLabs are AI text-to-speech tools that allow users to upload text materials and have realistic AI voices read them aloud, offering various voice styles and supporting multiple languages. Functionally, the two products are quite similar, but Speechify performs better on mobile apps, with an average of 24,000 daily active users (DAU) globally across both platforms in the past 30 days. ElevenLabs, on the other hand, does not have an official app (there is an app with the same name, but it appears to be a shell application that merely calls ElevenLabs' API).

In terms of performance, we tested Speechify and found that the voice presentation has significantly improved compared to before, with English performance being particularly better.

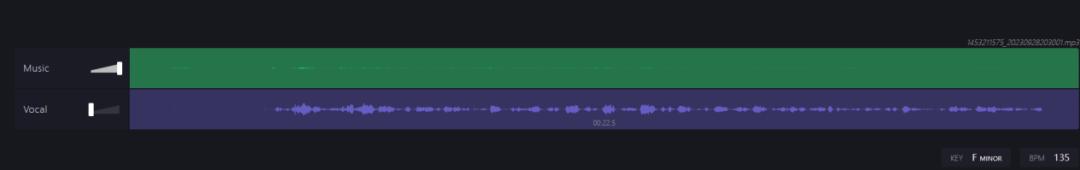

Image source: VocalRemoverVocalRemover has a narrower application scope, primarily in the music domain. As the app's name suggests, it can separate vocals from music to create instrumentals, and it also offers advanced features for isolating vocals, drums, and other instruments. Additionally, it includes standard music editing functions such as track merging, clipping, and pitch adjustment, making it the only AI music product in the Top 50 list.

AI video tool features summaryThere are 6 AI video tools in total. Overall, video generation and editing are the two main functions, with differences primarily in content style and use cases.

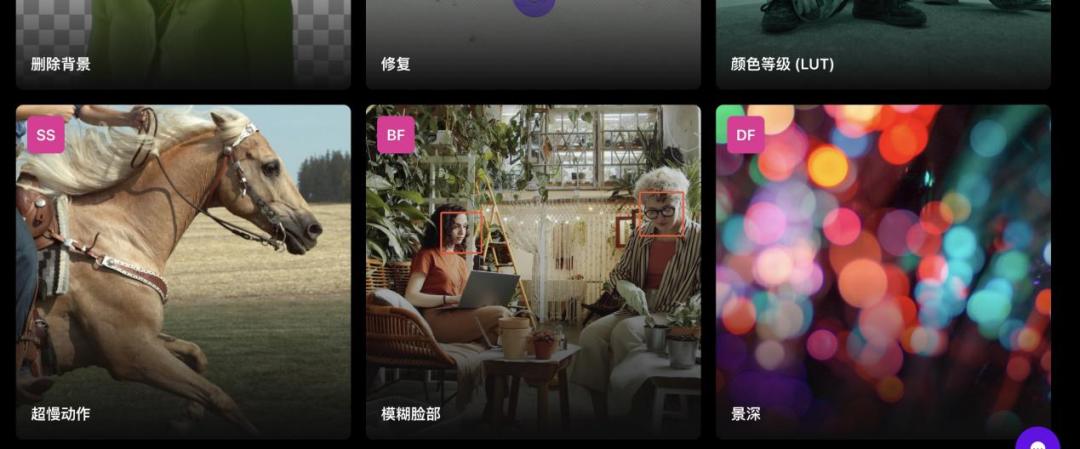

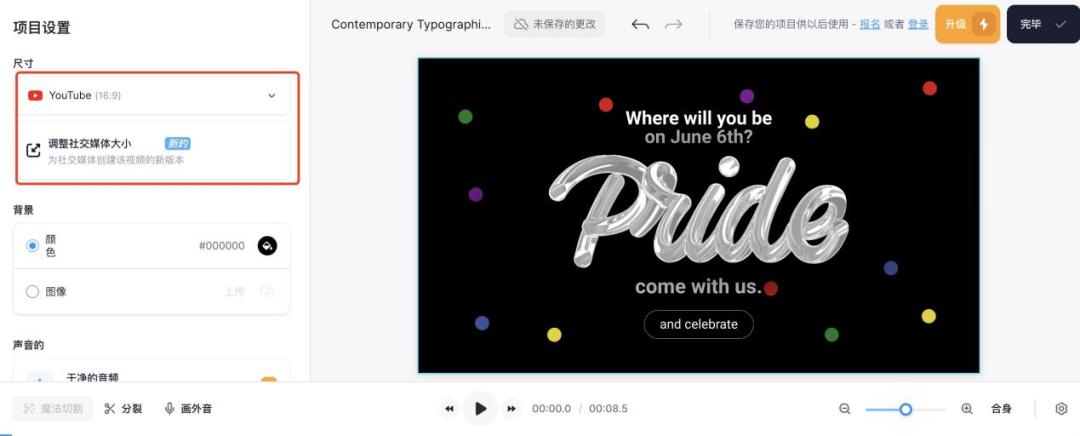

Runway's video editing features

Kaiber and Runway are both oriented towards artistic scenarios, with their main feature being AI-generated video capabilities. Their overall user interfaces are quite similar, but Kaiber offers more options, allowing for more precise video generation tailored to user needs. In terms of artistic style, based on other users' works, Kaiber tends to lean more towards an animated style, while Runway is more realistic. Additionally, Runway includes video editing features such as background removal and image quality restoration, whereas Kaiber emphasizes the transformation of realistic styles into animated ones.

Furthermore, Runway has launched RunwayML on mobile devices, offering video generation features similar to the web version but without the video editing capabilities. Its average daily active users (DAU) across both platforms globally over the past 30 days is 35,000.

The remaining four products are clearly geared towards commercial scenarios. Apart from VEED.io, all of them combine video generation and video editing functionalities, but each product has distinct primary features and use cases.

Among these four products, two primarily focus on video generation: Fliki and D-ID.

D-ID generated virtual speaker | Image source: D-IDD-ID's primary function is AI digital human generation. Users only need to upload a photo to create a speaking AI digital human. Regular users can generate digital human speech videos, while enterprise users can utilize D-ID's API for digital human livestreaming. AI digital humans have become relatively mature in China, with companies like Xiaoice Technology and Meitu launching similar products that have been applied in fields like live commerce. However, currently they mostly serve as substitutes for real humans.

Fliki's video generation feature (translated) | Image source: FlikiFliki appears to be a more familiar text-based AI video generation tool. Users can not only input text but also convert social media content or PPTs into videos. It primarily serves businesses and creators for commercial scenarios such as social media marketing, corporate introductions, product demonstration videos, and training videos.

VEED.io video editing interface | Image source: VEED.ioKAPWING and VEED.io are more akin to traditional video editors, with AI only participating in certain functions such as smart editing, translation, adding subtitles, script generation, and background removal. Only KAPWING has video generation capabilities, primarily for creating summary clips, while VEED.io does not offer AI video generation and is a more straightforward editing tool.

In terms of traffic, VEED.io leads with 15 million visits in August, while the other three products had only one-third or fewer visits compared to VEED.io. It's evident that although products like Runway are well-known, commercial AI video tools with practical features like assisted editing have higher user demand.

Image-Oriented AI Products Legend:

- Red boxes indicate image generation products

- Yellow boxes represent AI-powered image processing tools

- Blue boxes denote products with both functionalities

Note: Runway's AI imaging features will be discussed in this section, hence its inclusion in the diagram.

Market Insights:

Among the Top 50 products, 14 specialize in image-related functionalities – the highest proportion across all categories. This demonstrates both the intense competition and validated market demand in AI imaging solutions.Product Classification:

Our analysis divides AI imaging products into two main categories:- Image Generation: 9 dedicated products

- Hybrid Solutions: 4 products combining both generation and editing

- Editing-Focused: Only PhotoRoom primarily offers editing (though technically it does include AIGC capabilities for commercial applications like text-to-background generation).

PhotoRoom feature list and background transformation demo | Image source: PhotoRoom

Among the Top 50 AI photo editing websites, a notable difference from mobile apps is that while both are open to the public, the web versions are more commercially oriented. Taking the highest-ranked PhotoRoom as an example, it primarily targets small B2B merchants. When uploading a casually taken photo, after removing the background with PhotoRoom, users are presented with a full screen of template samples suitable for different product categories (such as shoes, clothing, electronics, or daily necessities), various social media platforms, and different scenarios. The web version offers more comprehensive features.

Another interesting point is that although PhotoRoom ranks 6th on the list—already very high—according to a16z data, over 80% of its traffic comes from mobile devices. This indicates that despite being geared toward commercial use, where one might assume such work would be done on the web, the data shows that small business owners or creators predominantly use their phones to take and edit photos. For readers interested in learning more about PhotoRoom, please refer to the Baijing Chuhai article 'Where is the Future of Photo Editing Apps in the AIGC Trend? PhotoRoom Demonstrates How Monthly Revenue Surpassed Tens of Millions.'

ZMO.AI feature list | Image source: ZMO.AI

4 Apps Combining AI Photo Editing and Generation Features serve both B2B and B2C markets. Among these four apps, two are developed in China:

- cutout.pro (Ranked #17) - Headquartered in Hong Kong, developed by LibAI who also created promeAI

- ZMO.AI (Ranked #40) - Developed by a Hangzhou-based company

These are currently the only two Chinese-developed products in the Top 50 list.

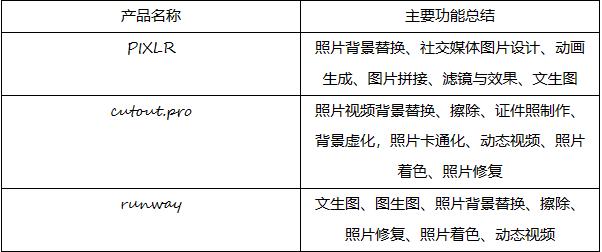

Products combining AI photo editing and generation features: PIXLR, cutout.pro, runway feature summary

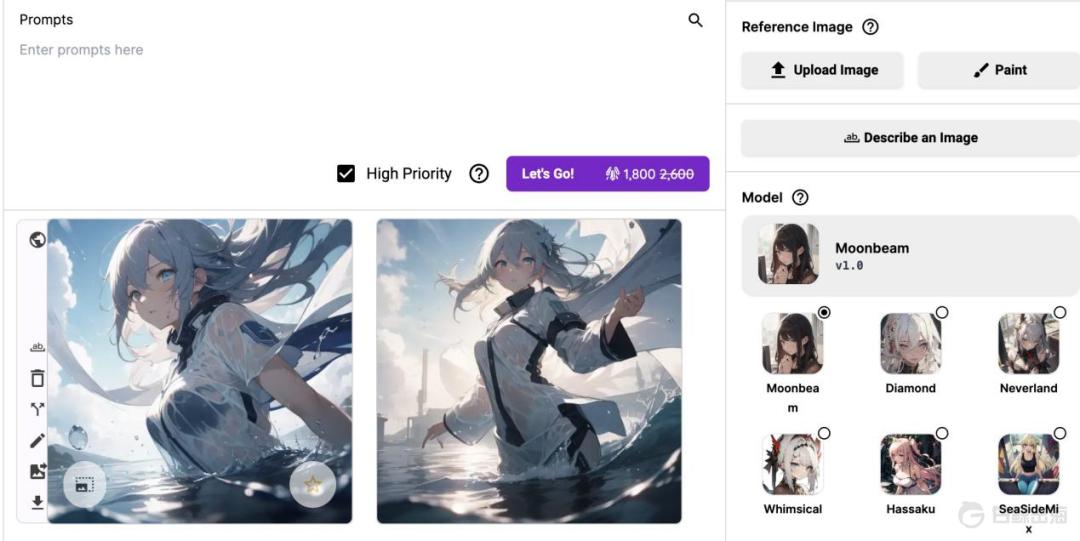

Image generation product traffic summary for August | Data source: SimilarWebFor image generation apps with the highest product count, functional differences are minimal, with variations mainly in the specialization and style of different generation models. Currently, Midjourney still holds the highest traffic, but according to data from a16z's list and SimilarWeb, the traffic gap between products is narrowing.

Midjourney traffic trends | Image source: SimilarWebFrom a trend perspective, Midjourney's traffic has declined significantly. Within six months, website visits have halved, with much of this traffic shifting to more niche image generation products. For example, Leonardo, which specializes in game illustrations, now reaches 75% of Midjourney's traffic.

Example comic-style (left) and fantasy-style (right) images | Image source: PlaygroundAmong several mid-tier products, these platforms primarily generate images in fantasy and manga styles. Since their largest user base comes from the United States, these styles likely appeal to American preferences. However, some products have successfully entered the market by offering unique artistic styles or specialized features.

For example, PIXAI, ranked 47th on the list, is a platform focused on anime-style artwork. In August, it recorded 8.47 million visits, solidifying its position in the second tier, with particularly noticeable growth in the Japanese market.

DeepSwap Traffic Trends | Image Source: SimilarWeb

Additionally, DeepSwap, ranked 50th on the list, is the only AI face-swapping product featured. Amid the mainstream text-to-image models, it represents a rather unique product category. Moreover, its traffic has seen notable growth recently. While AI face-swapping remains controversial in terms of legality and privacy, user demand for it has consistently existed.

DeepSwap Interface | Image Source: DeepSwap

Beyond its AI face-swapping feature, this product also offers simple image generation (primarily featuring sensual female images) and image editing tools. While image generation is free, other functionalities require payment—$19.99 per month or $99.99 annually (with a 50% discount for first-time subscribers). Overall, the pricing is relatively high.

Upon review, it becomes evident that the generative AI sector is still in its early stages. Apart from ChatGPT's unshakable dominance, the gaps between other products are not particularly wide. For non-top-tier products, specializing in a niche area makes it easier to enter the market and establish a foothold. From a user perspective, products with practical functionalities—such as enhancing work efficiency or boosting the appeal of "creations"—hold a significant share. Conversely, products with "fantastical" features but limited practical applications are seeing declining traffic. Notably, the AI image sector appears to be the only one where Chinese developers hold an "entry ticket." Will new players emerge in the future, and how will they carve out their niche? We will continue to monitor developments.

-