AI Industry to Reach $225 Billion, Chip Sector May See 60% CAGR Over Next 5 Years

-

The AI industry is projected to reach $225 billion. How can domestic AI chip manufacturers seize this opportunity?

According to CLS reports, UBS stated in its latest research that the technology sector is just beginning a large-scale growth cycle. By 2027, with the widespread application of AI across economies, AI models and applications will become a $225 billion market segment. The $2.2 billion figure from 2022 will pale in comparison.

This represents a significant leap, implying a compound annual growth rate (CAGR) of approximately 152%. Additionally, researchers acknowledge that UBS's previous projections for AI industry revenue growth may have been too conservative. Consequently, they have raised the total AI industry revenue forecast by 40%, expecting a 15-fold increase from $18 billion in 2022 to $420 billion by 2027, with a CAGR of 72%.

These growths will primarily come from two markets. The first is the software market. The report states: "If the launch of ChatGPT applications was the 'iPhone moment' for the AI industry, then in our view, the recent introduction of numerous applications such as Microsoft's Copilots and OpenAI's Turbo with vision in Q4 2023 signifies that the 'App Store moment' for the AI industry has arrived."

The other is the rapidly growing AI infrastructure market, driven by emerging trends like GPU cloud and AI edge computing. This segment is projected to expand from $25.8 billion in 2022 to $195 billion by 2027, propelling AI to become the defining technological theme of the next decade in global tech. "Because we don't see similar growth trajectories in other technology sectors," the report adds.

The GPU and chip sector will be the biggest beneficiaries of the strong AI spending wave in the coming years, with a projected compound annual growth rate of 60% from 2022 to 2027, increasing industry revenue from $15.8 billion in 2022 to $165 billion in 2027.

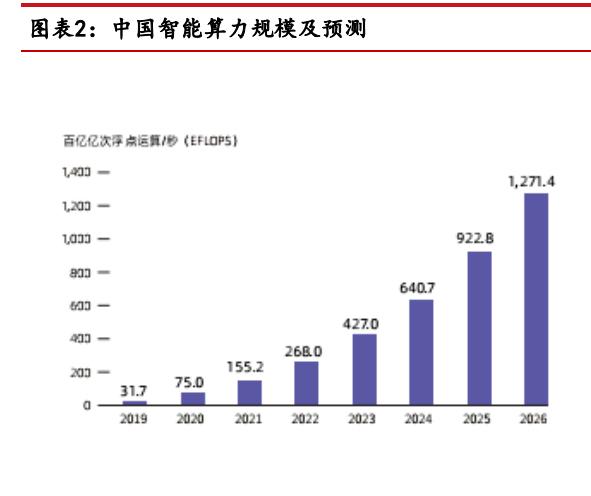

Just as water conservancy was crucial in the agricultural era and electricity in the industrial era, computing power is the key productivity driver in the digital economy era. With AI entering the 'large model' era, the acceleration of computing power is being further propelled.

This is because AI heavily relies on related infrastructure, including computing, storage, and networks. As people's performance requirements for AI increase, the data needed to train AI continues to grow, and the complexity of algorithms is also constantly improving. Therefore, higher demands are placed on computing power.

By the end of June 2023, China's total operational data center rack capacity exceeded 7.6 million standard racks, with total computing power reaching 197 EFLOPS, ranking second globally. The annual growth rate of computing power has been nearly 30% over the past five years.

As AI advances into high-application stages characterized by multi-scenario deployment, large-scale implementation, and integration, the corresponding data volume, parameter size of algorithm models, and the scale of computing power centers focused on accelerated computing will continue to expand.

AI chips, as specialized processors for the artificial intelligence field, are modules specifically designed to handle large-scale computational tasks in AI applications. "No AI without chips"—the rise of AI chips stems from the high demand for computing power in AI. The computing power achieved through these chips serves as an important benchmark for measuring the progress of artificial intelligence. Therefore, the development of China's AI chip industry has attracted significant attention, with new manufacturers and designers continuously emerging, and the market size is expanding rapidly.

With the competition between China and the US in the field of artificial intelligence, the domestication of AI chips is becoming an urgent issue that needs to be addressed.

In the training of large AI models, algorithms mainly depend on the intelligence and inspiration of research teams. In this aspect, there is not a significant gap between China and the US. However, when it comes to training data, China has certain advantages in big data resources. Yet, at the same time, it suffers in terms of computing power, and this is because the key factor determining computing capability is the chip.

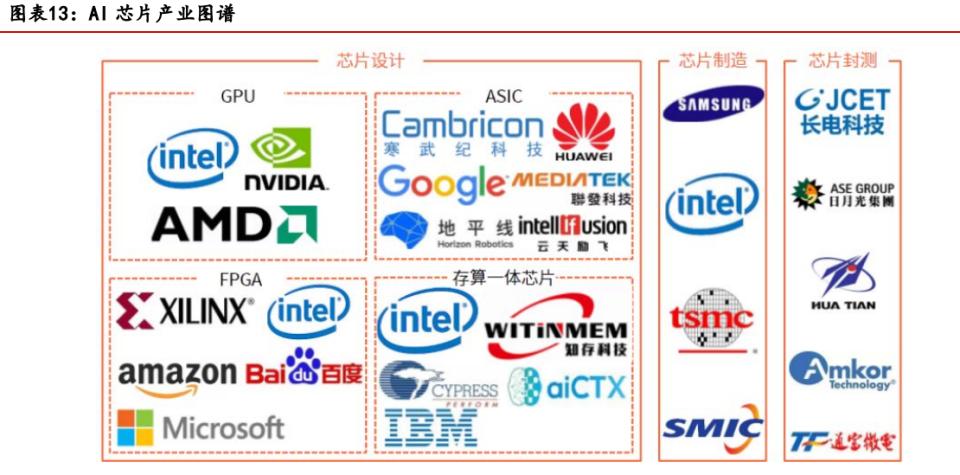

Currently, in the field of AI chips, foreign chip giants occupy the majority of the market share. Globally, the main companies involved in AI chip development include NVIDIA, Intel, Qualcomm, and Google. Therefore, in the AI chip sector, the United States holds advantages in both talent aggregation and corporate mergers, maintaining a leading position and serving as the industry's frontrunner.

Domestic AI chips started relatively late, with a considerable gap compared to the world's advanced levels, while the market is also highly fragmented with low concentration. Due to the extremely high demands of internet companies for computer software and storage equipment, they place greater emphasis on the layout and enhancement of underlying technologies for AI penetrating various industries. As a result, they have long been deploying in the field of AI chips.

For example, Alibaba established Pingtouge, focusing on the AI chip market; Baidu founded Kunlunxin to explore the chip field; Huawei has been consistently laying out in the AI chip sector, launching the Ascend chip as early as 2017, followed by the Ascend AI processor, Atlas AI computing platform, and Ascend series products.

Currently, domestic AI chip manufacturers are primarily small and medium-sized companies, such as Cambricon, a unicorn startup in the global AI chip field.

Although GPU chip giant Nvidia holds a monopolistic advantage in the global AI chip market, the localization process of domestic AI chips will continue to accelerate due to U.S. restrictions. In recent years, the U.S. has gradually tightened China's ability to obtain advanced international chips, imposing not only restrictions on chip imports but also on the acquisition of chip manufacturing tools.

Meanwhile, China faces a significant talent gap in the field of artificial intelligence. The supply-demand ratio for positions across various AI technical directions is below 0.4, with AI chip positions having the lowest ratio at just 0.32. As a result, we are continuously increasing investments in education and industrial development, while also attracting overseas talent to start businesses or seek employment.

In recent years, despite restrictions, a number of AI chip startups have emerged in China, accelerating the implementation of computing power industry chains. Examples include domestic CPU+DPU leader Hygon, ASIC pioneer Cambricon, Jingjia Micro, and Biren Technology. In December 2023, Moore Threads unveiled China's first domestically produced thousand-card, trillion-parameter model training platform - the Moore Threads KUAE Intelligent Computing Center, marking the official launch of the country's first large-scale computing cluster based on fully functional domestic GPUs.

Beyond manufacturing, the development of domestic AI chips also requires attention to ecosystem construction. Companies are currently focused on building their own ecosystems, while academia proposes open source as an innovative path for development. For example, Liang Xiaoxiao's team introduced the open-source GPGPU (General-Purpose GPU) platform "Blue and White Porcelain"; Tsinghua's He Hu team launched an open-source GPGPU implementation based on RISC-V (an open and free instruction set architecture).

Believing that the innovative path of open source provides new ideas for the domestic production of AI chips, many companies have already joined the collaborative construction of the open-source ecosystem.