Can Ubtech, the 'First Humanoid Robot Stock', Take Off in the AI Boom?

-

The 'first humanoid robot stock' has finally been determined.

Recently, Shenzhen Ubtech Robotics Co., Ltd. (hereinafter referred to as 'Ubtech') has passed the hearing of the Hong Kong Stock Exchange and plans to list on the main board of the Hong Kong Stock Exchange, officially becoming the 'first humanoid robot stock'.

In fact, since its establishment, Ubtech has never been short of funds, attracting heavy investments from numerous star investment institutions. It has received investments from well-known institutions such as Tencent, Qiming Venture Partners, CDH Investments, ICBC, and Easyhome, totaling over 5 billion yuan in financing. Before the IPO, Tencent and Qiming Venture Partners held more than 5% of Ubtech's shares, making them the first and second largest institutional investors, respectively.

Over the past few years, humanoid robots have increasingly attracted the attention of tech giants. Last year, Tesla launched its first humanoid robot, Optimus, and major companies like Xiaomi and Amazon have also been actively researching humanoid robots.

According to research data from Boston Consulting Group, the global robotics market is projected to reach up to $260 billion by 2030, with bionic robots potentially driving a professional service robot market worth nearly $170 billion.

However, Ubtech remains deeply unprofitable. The company's latest IPO prospectus reveals that from 2020 to 2022 and the first half of this year, Ubtech reported revenues of 740 million, 817 million, 1.008 billion, and 261 million yuan respectively. During these periods, the company incurred losses of 707 million, 918 million, 987 million, and 548 million yuan, accumulating total losses of approximately 3.16 billion yuan over three and a half years.

Even with the tailwind of AI development, Ubtech's business story remains challenging to write.

The Robot Business Isn't Easy Money

Specifically, UBTECH has three main business segments: enterprise-level intelligent service robots and solutions, consumer-grade robots and other hardware devices, and others.

Among these, enterprise-level intelligent service robots and customized solutions for education, logistics, and other industries are UBTECH's primary revenue sources. From 2020 to 2022, this segment contributed 89.6%, 90.9%, and 85.5% of the company's total revenue, respectively.

Breaking it down further, education-focused intelligent robots and solutions have historically been the main driver of UBTECH's growth. However, over the past three years, the revenue share from this segment has declined, dropping from 82.7% in 2020 to 29% in the first half of 2023. In contrast, the contribution from logistics robots and solutions has been steadily increasing, rising from 1.7% during the same period to 29.4%.

It is evident that the education and logistics industries have provided UBTECH with significant performance growth and remain the company's key focus areas.

However, making money in these two segments is not easy.

According to Frost & Sullivan's data, in 2022, UBTech ranked third in China's intelligent service robot and solutions industry by revenue, with a market share of 2.8%. Additionally, the company was China's largest supplier of educational intelligent robots and solutions by revenue in 2022, holding a 22.5% market share.

On one hand, although UBTech commands a substantial market share in the robotics sector, a closer examination reveals that this advantage is largely supported by financial backing from major clients. The prospectus shows that from 2020 to the first half of 2023, UBTech's revenue from its top five clients was RMB 493 million, RMB 427 million, RMB 721 million, and RMB 116 million, accounting for 66.5%, 52.2%, 71.5%, and 44.5% of total revenue, respectively. It's evident that, except for the first half of this year, revenue from the top five clients has consistently made up more than half of UBTech's total income.

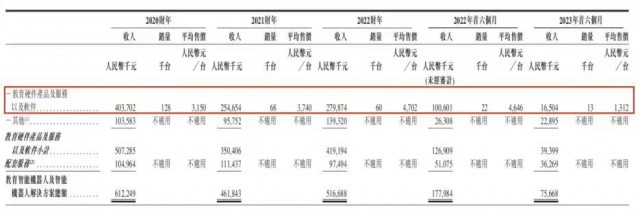

On the other hand, the company's educational intelligent robot products face challenges due to their long usage cycles. Data from the prospectus indicates that sales of its core educational intelligent robots plummeted from 128,000 units in 2020 to 22,000 units by the end of 2022, with only 13,000 units sold in the first half of this year. Meanwhile, the gross profit margin of UBTech's core business has also significantly declined, dropping from 49% in the first half of 2022 to 35.2% in the first half of 2023.

The AI Boom

As early as 2021, Elon Musk publicly stated that essentially, in the future, robots performing physical labor would become an option. This has profound implications for the economy. In the future, everyone will own a humanoid robot, creating a market worth tens of billions of dollars.

Industry insiders have also analyzed that humanoid robots, which require environmental recognition to perform basic operations like transportation and cleaning, share fundamental technological similarities with autonomous driving. Once car companies can use robots as test subjects to collect more complex road condition data on a broader scale, it will significantly enhance their core smart car business, particularly advancing mature autonomous driving technologies.

It's not just car manufacturers; many internet giants have also entered the field, such as Xiaomi. When Xiaomi's bionic robot CyberDog, nicknamed "Iron Egg," was officially released in August 2021, Lei Jun stated that quadruped robots have immense commercial potential, applicable in disaster rescue, medical assistance, home companionship, and more. Importantly, "Iron Egg" features Xiaomi's AI assistant Xiao Ai, enabling seamless integration with Xiaomi's ecosystem to control various smart home devices.

This year, catalyzed by AI technology, the humanoid robot sector has witnessed significant progress. Just nine months after the debut of Tesla's first-generation Optimus humanoid robot, the company recently showcased its second-generation version. In a newly released video, the updated robot demonstrates greater flexibility—including more graceful walking postures and more dexterous hands capable of performing delicate tasks like boiling eggs.

In October, NVIDIA's AI system Eureka, which combines large language models (LLMs) with robot training, improved average training efficiency by over 50%. Huaxi Securities suggests that embodied intelligence is a viable path toward AGI. Optimus' increasingly refined sensors and heightened anthropomorphic features theoretically enable the training of multimodal robot models today.

Building on this, Ubtech is harnessing emerging AI technologies to make its humanoid robots "smarter." In early November, the Beijing Humanoid Robot Innovation Center Co., Ltd., in which Ubtech holds shares, was officially established. The center aims to tackle five key tasks, including developing general-purpose humanoid robot prototypes and large-scale models, using AI to enhance robots' autonomous decision-making in real-world scenarios.

However, the current revenue contribution from humanoid robots remains minimal. According to the prospectus, UBTECH's humanoid robot product series Walker and other related products generated 2.301 million yuan in 2020, accounting for only 0.3% of total revenue. By the first half of 2023, this figure increased to 7.243 million yuan, representing 2.8% of total revenue.

The 'Two Major Mountains' UBTECH Needs to Overcome

Undeniably, the simultaneous entry of numerous brands into the robotics sector within a short period appears related to industry trends, which has to some extent accelerated the commercialization of service robots.

In the short term, robots have developed and consolidated applications in education, industrial manufacturing, and even household commercial scenarios, while also expanding into special scenarios like assisting visually and hearing-impaired groups. In the long term, they have allowed ordinary people to experience robotic technology services and recognize their promising commercial value.

Of course, the prerequisite for achieving this is that robots can enter "thousands of households." However, at this stage, robots still have two major hurdles to overcome.

The first is the issue of cost. Taking Ubtech as an example, data shows that from 2020 to the first half of 2023, Ubtech's sales and marketing expenses were 313 million yuan, 358 million yuan, 361 million yuan, and 190 million yuan, respectively, with the sales expense ratio significantly increasing to 42.3%, 43.82%, 35.81%, and 72.8%. General and administrative expenses were 212 million yuan, 326 million yuan, 398 million yuan, and 178 million yuan, accounting for 28.65%, 39.9%, 39.48%, and 68.2% of total revenue, respectively. R&D expenses were 429 million yuan, 517 million yuan, 428 million yuan, and 224 million yuan, with R&D expense ratios of 57.97%, 63.28%, 42.46%, and 85.82%, respectively.

Ubtech's revenue growth has completely failed to cover the substantial increase in its period expenses, especially in the first half of 2023, when the combined ratio of the above three expenses to revenue reached as high as 226.82%. The significant rise in period expenses is also the direct reason why Ubtech remains deeply unprofitable and has yet to achieve profitability.

The prospectus also mentions this risk: "If UBTECH cannot generate sufficient revenue and manage its expenses, the company may continue to incur significant losses in the future and may not achieve or maintain profitability."

Another often overlooked hidden cost is that while the ideal operational model for robots is to sell them to customers and then exit the operational phase, the reality is that all commercial robot projects currently require maintenance engineers to be involved throughout, ready to address technical issues that may arise at any time during operation.

Beyond costs, high prices represent another core obstacle to the widespread adoption of robots.

In recent years, as UBTECH continues to launch new products and upgrade its robot offerings, product prices have steadily increased. Taking educational robots as an example, the average selling price rose from 3,150 yuan per unit in 2020 to 3,740 yuan in 2021, and further increased to 4,700 yuan in 2022. Among these, the humanoid Yanshee robot saw its average price surge from 11,790 yuan per unit in 2020 to 15,950 yuan in 2022.

Indeed, this represents a common challenge faced by brands across the entire robotics sector. For instance, in 2021, Xiaomi developed the bionic robot CyberDog ("Tiedan"), initially priced at 9,999 yuan with limited availability. In August this year, it was officially upgraded to "CyberDog 2," featuring gesture interaction, voice control, facial recognition, AIoT connectivity, and integrated follow-and-avoid functions, with a significantly higher price tag of 12,999 yuan.

In summary, judging from Ubtech's current overall development trajectory, its humanoid robot business model has begun to take shape, and its technology can already meet the needs of certain scenarios. However, further refinement is still required in terms of large-scale commercial deployment and cost control. Now, riding the momentum of its IPO, Ubtech will be better positioned to secure more financial support, which in turn can fuel further innovation in R&D and accelerate the deployment of humanoid robots. Going public is not the end goal but rather a brand-new starting point. We look forward to seeing Ubtech overcome these challenges, scale new heights, and usher in a new chapter.