Adobe Emerges as the Biggest Winner in AI Applications

-

In October this year, Time magazine released its 'Best Inventions of 2023'. Among the 14 AI applications selected, Adobe's Generative Fill outperformed OpenAI's GPT-4, securing the top spot in its category.

When Midjourney emerged with an AI-generated couple photo, it was once regarded as the 'mysterious force behind Photoshop.' But nearly a year later, people suddenly realized that compared to trendy AI startups, Adobe is the real hot commodity in the capital market.

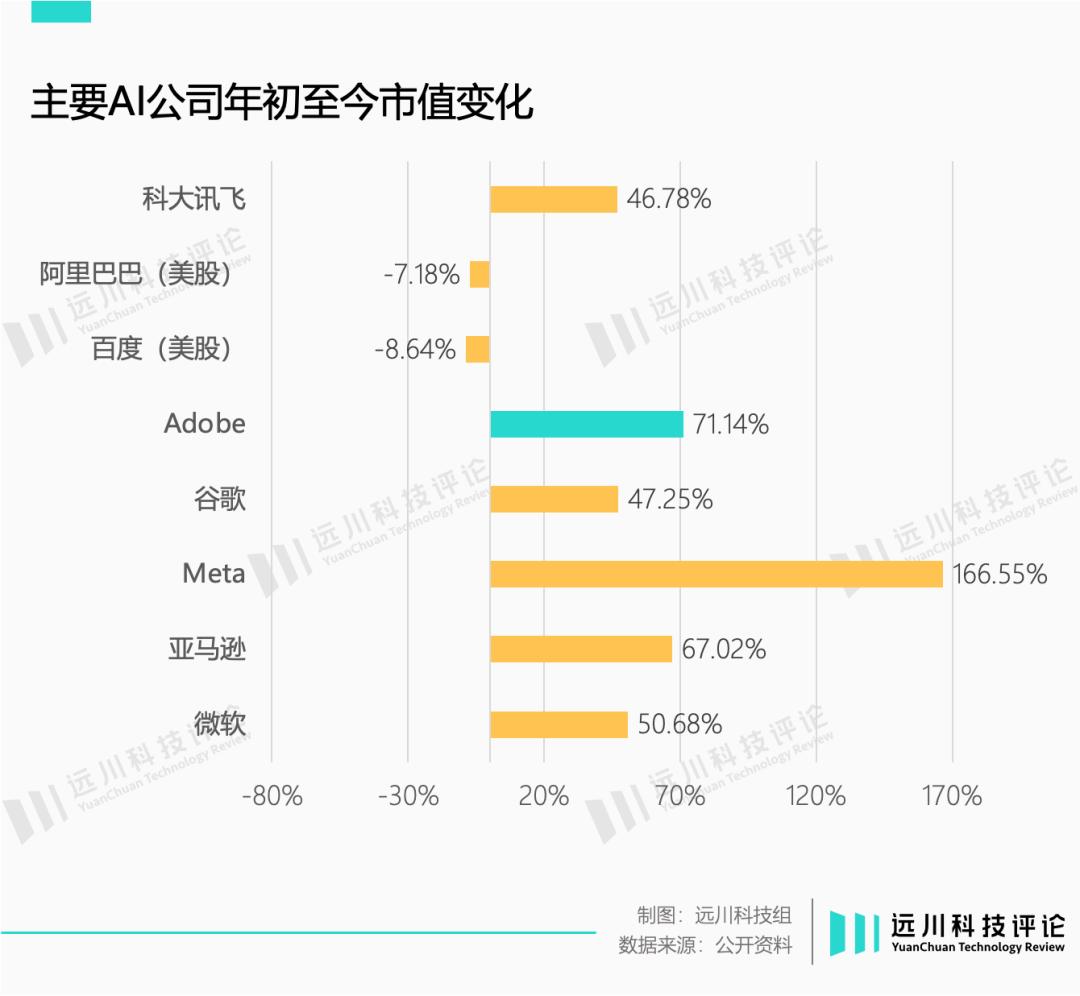

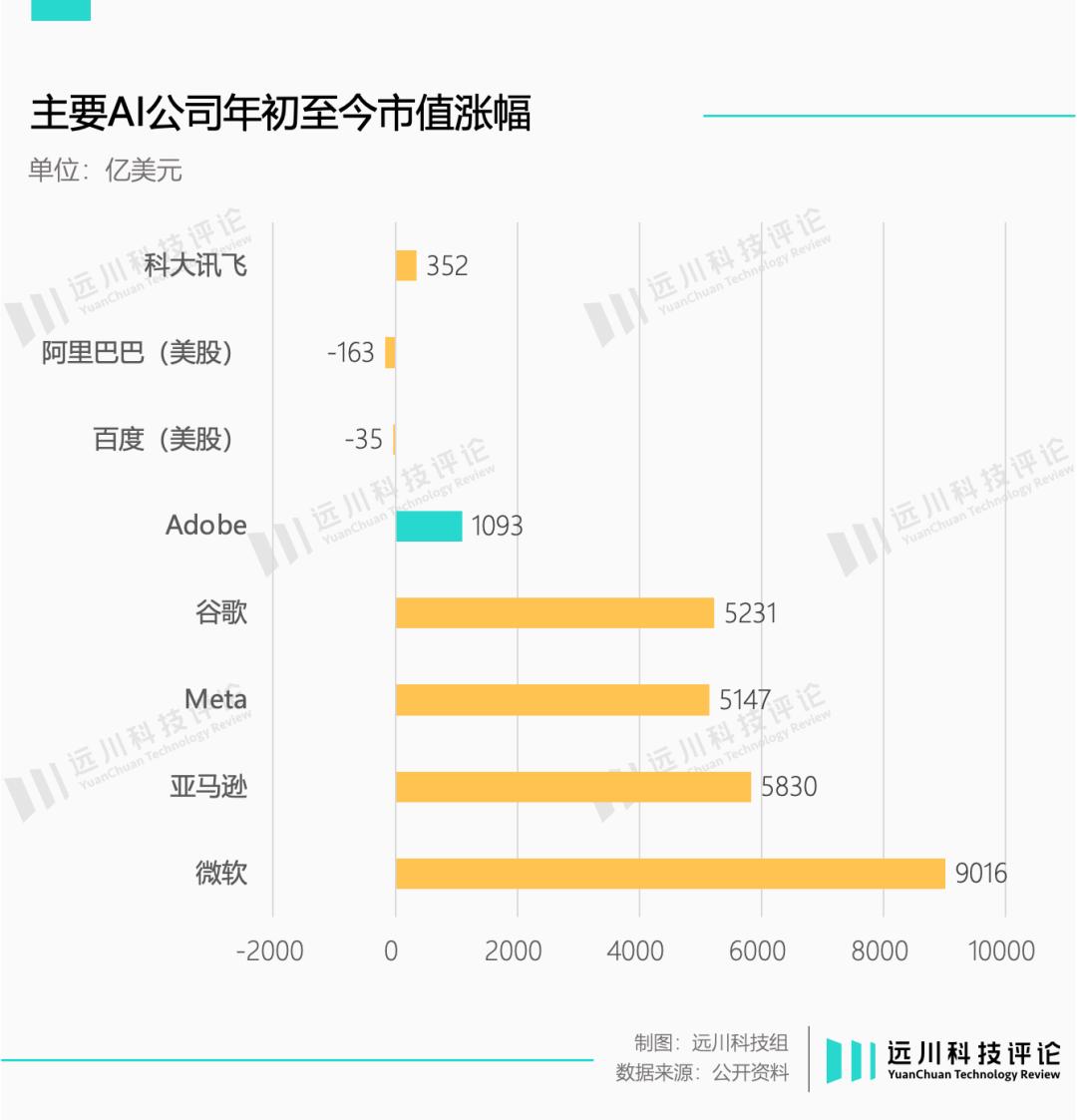

Since the beginning of the year, Adobe's stock has risen by 71% in the U.S. market, adding a full $100 billion to its market capitalization.

So, what exactly are people looking forward to?

In March this year, Adobe introduced its generative AI tool 'Firefly'. Similar to tools like Midjourney and Dall-e, Firefly features text-to-image generation, AI text effects, and recoloring capabilities, with later additions including generative fill, text-to-video, and poster generation.

Firefly's generation quality is actually not as strong as similar products, and its popularity on social media is far less than that of peers like Midjourney and Stable Diffusion. However, Firefly has made Adobe score big in the capital market.

An important reason is that Firefly solves the copyright issues faced by the commercialization of generative AI.

First, the training data for the Firefly large model comes from Adobe's image library, Adobe Stock, which contains publicly licensed images or those with expired copyrights. Creators can upload their works to the library, and if others download them, it is considered a transaction, with the author receiving corresponding royalty income.

Although Adobe Stock's market share in the stock photo industry falls under the 'others' category, the benefit is that it avoids copyright issues.

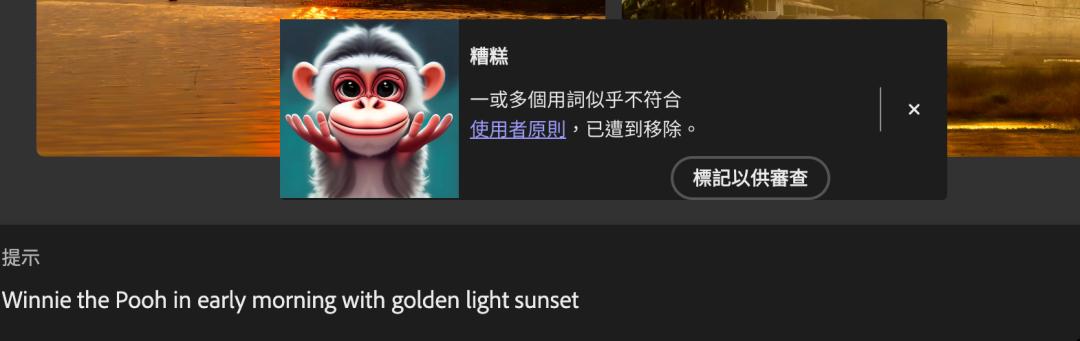

For well-known intellectual properties, Firefly proactively intercepts image generation before it occurs, completely eliminating the possibility of receiving cease-and-desist letters from major corporations. Moreover, Adobe has pledged to assume full responsibility for any copyright disputes that may arise, which is a significant boon for large companies that prioritize legal compliance.

Firefly识别到了“Winnie the Pooh”是迪士尼的IP

This October, Adobe announced an updated version of its Firefly model, along with over 100 AI feature updates for Creative Cloud (a subscription package that includes Illustrator, Photoshop, Lightroom, and Premiere Pro). For example, in Photoshop, AI can now intelligently expand images.

The significance of these updates lies in enabling AI-generated images to seamlessly integrate into Adobe's suite workflow.

The core of AI image generation is the prompt (prompt), and different prompts can produce vastly different images, making it a complete mystery for users. Even when reciting the same "spell" each time, the generated images may still differ greatly.

Applications like Miaoya Camera essentially functionalize prompt words, sacrificing some customization freedom but significantly lowering the threshold for using prompts. However, neither approach is acceptable for commercial purposes.

Another issue is image editing. For example, when a designer generates an image using Dall-e and needs to edit it in Photoshop, the designer must also vectorize the image—vector graphics are described by mathematical formulas rather than pixels, allowing them to be infinitely scaled without distortion, enabling designers to edit freely.

This is why Adobe specifically launched the Firefly vector model, allowing AI to directly generate editable vector graphics. Adobe's Illustrator has also rolled out a feature test for generating vector graphics from text.

This means that from image generation to editing, users can complete the entire process within the Adobe suite, with very low migration costs.

Therefore, although all are AI-generated images, applications like Midjourney and Dall-e focus more on pure generation, with extremely limited editing capabilities, and cannot integrate with professional tools like the Adobe suite.

Therefore, Midjourney primarily replaces stock image platforms like Flickr and Shutterstock. In professional commercial scenarios, Adobe remains the unrivaled leader.

In fact, Adobe's technical capabilities may not be particularly outstanding. Firefly's image generation still lags behind competitors like Midjourney in some details, and the development of its large models relies on NVIDIA's technical assistance.

But Adobe's core strength lies in: they were already a wealthy software company before the technological wave of AICG emerged.

Adobe's core business is divided into two segments: Digital Experience and Digital Media. The former focuses on enterprise digital marketing, while the latter consists of the well-known software suite including Photoshop and Illustrator, which has consistently accounted for over 70% of the company's revenue.

Among them, the Digital Media segment consists of two flagship products: Creative Cloud for image editing and design, contributing 80% of the revenue in the digital media business; and Document Cloud, centered around PDF documents, catering to scenarios like document management.

In these business scenarios, Adobe's coverage is extremely broad. Beyond the familiar Photoshop, there's also Indesign for UI design, Lightroom for photo editing, and Illustrator for vector graphics processing.

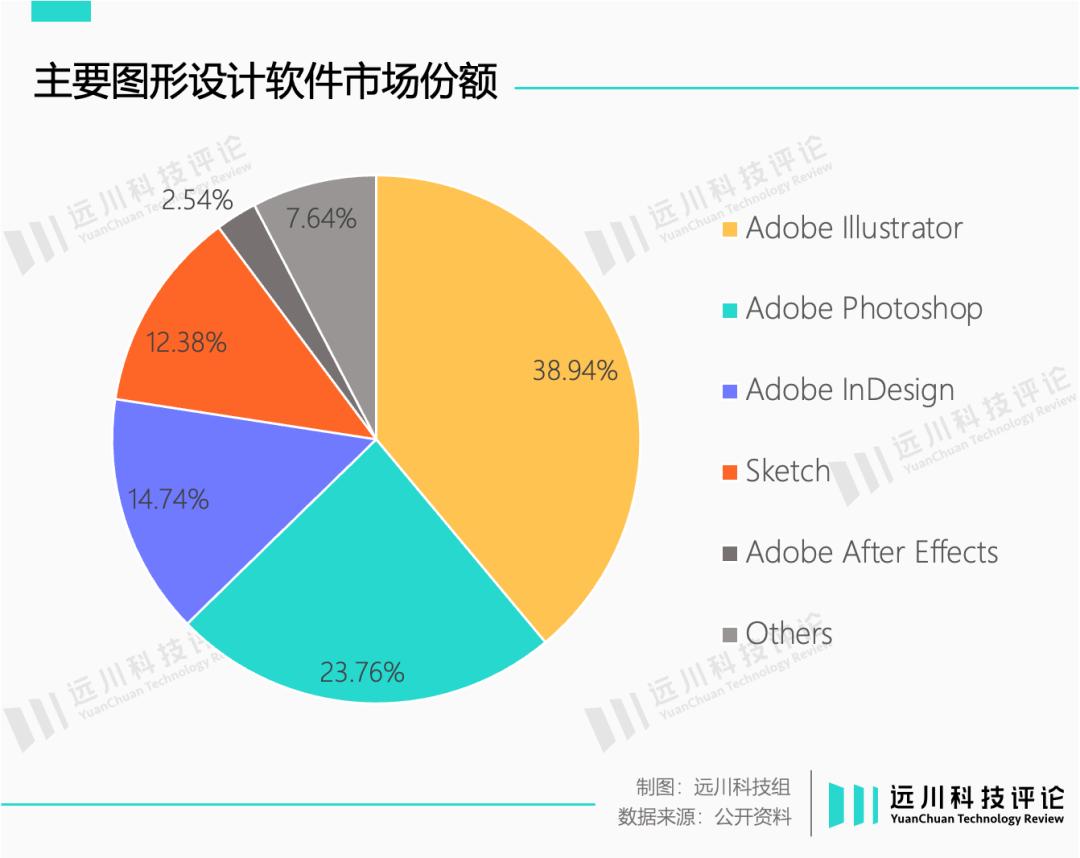

This vast software landscape has established Adobe's absolute dominance in the niche market of graphic design. In 2023, four of the top five global graphic design software products came from Adobe, collectively holding nearly 80% of the market share. The only competitor, Sketch, is limited to the macOS platform.

Adobe's exceptionally high market share has built its moat: What impresses capital markets is not how advanced Adobe's technological capabilities are, but rather its entrenched position in the highly lucrative niche of graphic design, where it has already secured a dominant position to generate substantial profits.

After the chaotic era of large models, the industry has gradually realized that the implementation of AI applications is a more critical issue. High-value scenarios such as office work and graphic design remain scarce.

OpenAI founder Sam Altman once expressed a viewpoint: The future application trend will be embedding large model functionalities into more APPs, rather than growing numerous plugins on ChatGPT, because most plugins in reality haven't demonstrated PMF (Product/Market Fit).

That is to say, at least for now, AI implementation focuses more on transforming existing application scenarios rather than creating new ones.

According to this argument, companies that can grab a share of the pie today likely made huge profits even before the AIGC boom. Adobe is one such example.

In 2008, Adobe embarked on the most substantial transformation since its inception: shifting from perpetual software licensing to subscription-based product bundles as its sales model.

Although this transformation is labeled as 'SaaS cloud services,' its core essence lies in replacing traditional one-time purchases with periodic subscription payments. In the first quarter of 2014, Adobe's subscription revenue surpassed its one-time purchase revenue for the first time.

Meanwhile, Adobe led a series of defensive acquisitions. In 2009, Adobe acquired several companies positioned in 'marketing technology' at once, including Omniture, Efficient Frontier, and ComScore, establishing its second major business segment beyond creative design.

After 2018, with the rapid rise of Shopify, Adobe utilized its financial capabilities to acquire Shopify's competitors, Magento and Marketo, while gradually reducing its stake in Shopify, thereby completing its coverage in areas such as e-commerce and AI. Last year, Adobe once again generously spent $20 billion to acquire Figma, an online design collaboration software.

The advantage of this approach is that once a threatening competitor emerges in the market, Adobe can acquire it immediately. At the same time, the acquired products can be incorporated into its subscription service portfolio, strengthening the competitiveness of its own products and further capturing market share.

The Experience Cloud, which contributes 20% of revenue, has a product portfolio that is almost entirely acquired.

Thanks to its disproportionately large market share, Adobe has effectively become a certain "standard" in the design and creative industry, which explains why its acquisition of Figma alarmed U.S. antitrust authorities.

Therefore, Adobe's core competitiveness is not about how advanced its technology is, but rather that it has brought under its wing almost all the customers with the strongest payment capability and willingness in the high-value scenario of "creative design."

In the AIGC era, Adobe's dominance becomes even more valuable.

The same logic also applies to Microsoft. As the global leader in office software, what the capital market is eyeing is not Microsoft's technological sophistication, but the working people who dutifully pay for Microsoft 365 every year.

However, even industry leaders like Adobe and Microsoft face a serious issue: the high cost of computing power.

The current chaotic landscape of large AI models can all be traced back to the 2017 paper Attention Is All You Need by eight Google computer scientists. This paper introduced the Transformer algorithm, effectively pulling the trigger on the current AIGC boom. In other words, the Transformer is the foundational architecture behind all modern large AI models.

Simply put, the Transformer model relies on brute force to achieve miracles, generating emergent capabilities through nearly pathological consumption of computing power and data. However, the price is high costs, which is why some jokingly say: Money Is All You Need.

With the proliferation of large models and the distant prospect of practical applications, the gap between costs and revenue has become an urgent issue. This is also why Sequoia Capital's blog post titled AI's $200B Question has garnered significant attention.

Sequoia has calculated the financials for the AI industry. Based on the current revenue status of AI companies and their investments in costs such as GPUs and cloud services, it's estimated that the entire industry still needs to earn at least $125 billion to break even.

The calculation may be rough, but the message is clear: if a sustainable monetization model cannot be found, the AIGC trend may not last.

Venture capital firm Theory Ventures' research data shows that 95% of AIGC companies have average annual revenues below $5 million, with some startups valued at hundreds of millions yet to generate any income.

This May, the ChatGPT iOS version was officially launched, priced at $20 per month. However, it attracted fewer than 50,000 new users in its first month, with paid users accounting for only 1.6% of the active user base. Recently, OpenAI has been actively seeking funding, which clearly indicates that its financial situation is not very optimistic.

According to The Information's report, the high-profile AI company Midjourney's revenue this year is "only" $200 million. While this is not insignificant, it still falls short of paving a smooth commercial path for AIGC.

In this context, Adobe carries strong symbolic significance.

Adobe possesses an almost perfect business model: dominant market share; a massive base of paying users; exceptionally high profit margins; and business scenarios that align perfectly with AIGC. If such a company struggles to make money from AI, it will undoubtedly dampen industry expectations for AIGC in the short term.

However, from Firefly's payment model, one can still glimpse the enormous cost pressures Adobe is facing.

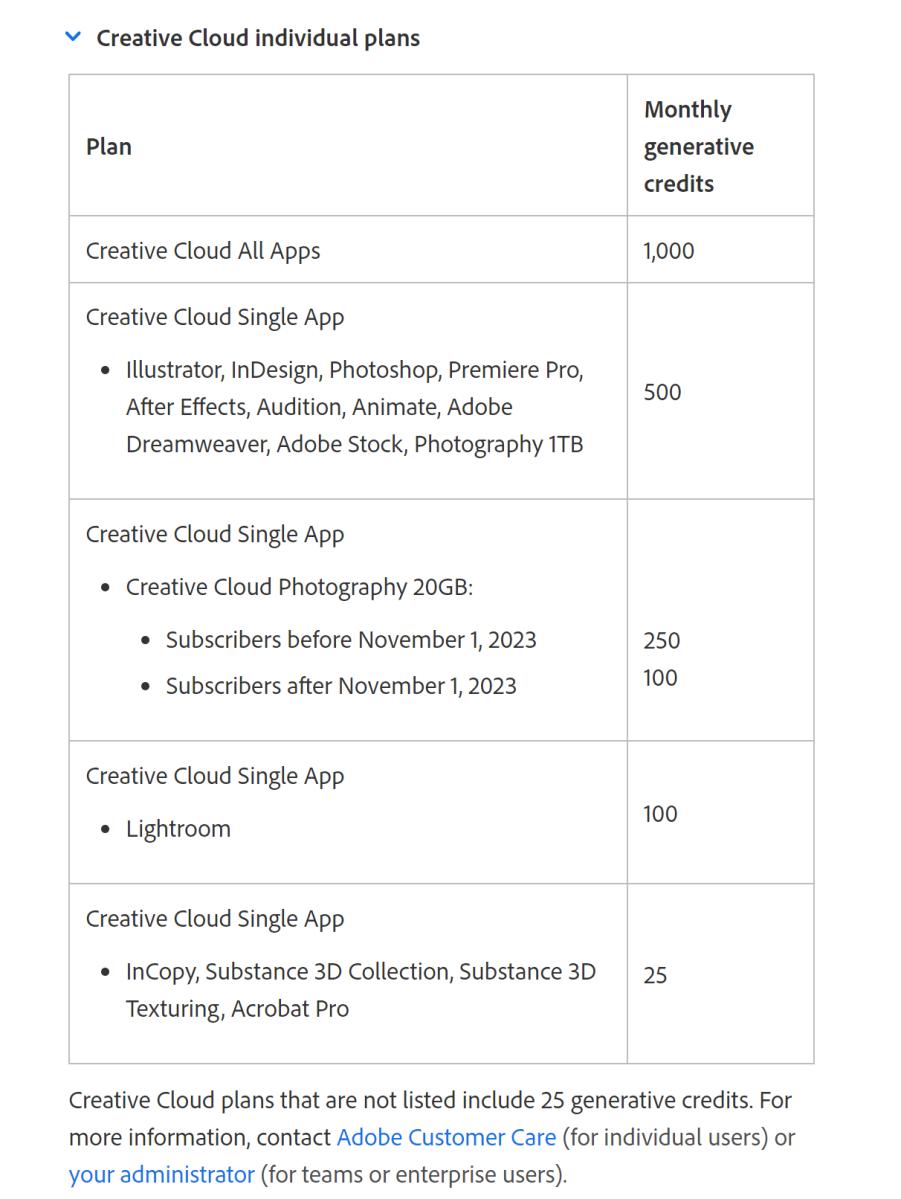

In simple terms, Adobe has designed a complex pricing model for Firefly: a point-based charging system. Essentially, one point can be used to generate one image. Users receive 25 free points per month, with additional points available for purchase if needed. Users can opt to purchase the Firefly service individually or as part of the Creative Cloud suite, with payment options available monthly or annually. Discounts vary for individuals and businesses.

To prevent financial losses caused by users' heavy usage, Adobe will throttle the service speed once any user exceeds their monthly allocated credits.

Firefly收费标准

Whether it's the seemingly mysterious special pricing structures or Adobe's deliberately vague practices, they all point to one fundamental issue with AIGC costs - poor economies of scale.

In the cost structure of most internet products, a substantial portion comprises relatively fixed operational costs, including cloud services. These costs become increasingly diluted as the user base expands.

However, AIGC products operate differently. Each user interaction—whether chatting with ChatGPT or generating images with Firefly—triggers a cloud-based computation, incurring corresponding costs. The more users engage, the higher these costs become. Developers can only optimize the computational resources consumed per interaction through software improvements, but the fundamental "pay-per-use" cost structure remains unchangeable.

Moreover, most AI applications are situated in productivity scenarios, making it difficult to adopt the internet business model of burning money first and profiting later—after all, having designers view ads while creating graphics would be somewhat performative art. This is why the product lead of Miaoya Camera stated: In the era of AIGC, if you can't charge users from day one, you may never be able to collect money from them.

Microsoft's GitHub Copilot isn't faring much better either. This application, mainly designed to assist programmers with coding, has clear scenarios and functionalities similar to Adobe. Its pricing is relatively affordable at $10 per month or $100 per year. Before even implementing charges, it already secured a user base of 1.5 million, indicating a very bright future for monetization.

However, the reality is that due to computing power costs, on average each user actually causes Microsoft to lose $20, and heavy users can even make Microsoft lose $80 per month. Based on this, it's speculated that the $30 Microsoft 365 Copilot might result in even greater losses.

In the mobile internet era, large companies would go to great lengths to keep users engaged within their products. Nowadays, however, they eagerly hope users will minimize usage after making payments.

Today, the scarcity of computing power seems to have become a huge obstacle to the implementation of AIGC applications—if running an air conditioner for a day costs 500 yuan in electricity, no matter how many advantages the air conditioner has, people would still prefer to use a fan.