AI Empowers the Trillion-Dollar Education Market as Companies Vie for Dominance

-

With the shift of large models from general to industrial applications, leading domestic companies are crowding the track, and startups in both general and vertical large models are flourishing.

Many technology companies, smart learning firms, and online education providers have launched their own large models, integrating them into their business scenarios to develop a variety of AI-powered educational products, such as learning tablets, translation pens, and virtual speaking tutors.

For example, Zuoyebang recently introduced its "Gold Tutoring Method" learning tablet, marketed as featuring "AI cutting-edge technology." A month earlier, Zuoyebang also joined the "large model competition" by releasing its self-developed Galaxy large model.

NetEase Youdao's virtual speaking tutor "Hi Echo" is now available as an app and mini-program, currently free for users. When English learners open the software, a "female teacher" appears for one-on-one oral practice. Users have affectionately dubbed it the "Chinese Call Annie," though "Call Annie" is more of an AI assistant, while this product is a dedicated learning tool.

All these developments indicate that in the "large model competition" among numerous players, AI technology is continuously expanding into diverse educational scenarios.

In May this year, iFlytek released the Spark Cognitive Large Model 1.0. At the event, Liu Qingfeng, Chairman of iFlytek, explained that "large models + AI learning tablets" enable AI to grade essays like a teacher and engage in real-life conversations like a speaking tutor. "These upgrades will elevate language learning to a whole new level."

Three months later, iFlytek upgraded its large model to V2.0, adding features like a programming space and creative drawing board to the AI learning tablet, alongside existing functions such as oral dialogue, essay assistance, encyclopedia Q&A, and math support.

Baidu (9888.HK), which has maintained long-term leadership in AI technology with its "ten years of sharpening one sword" approach, entered the smart learning sector in May. Its subsidiary Xiaodu Technology officially launched the "Xiaodu Qinghe" smart learning phone, equipped with the Xiaodu Lingji large model specifically designed for youth extracurricular education. At the Baidu World Conference in October, Xiaodu Technology further introduced the "Xiaodu Qinghe" learning all-in-one device for family education, expected to hit the market in summer 2024.

While tech companies developing learning hardware based on large models might consider education as just one application scenario, the trend of intensified AI education competition becomes evident as smart learning companies, online education firms, and even traditional learning hardware manufacturers are launching their own large models.

At the end of July, NetEase Youdao (DAO.US) introduced its vertical education large model "Ziyue". In August, it released three hardware products featuring this model: the Youdao Dictionary Pen X6 Pro, Youdao Dictionary Pen S6, and Youdao Listening宝 Pro.

In August, during TAL's 20th anniversary live event, CTO Tian Mi officially announced the public beta of the company's self-developed trillion-parameter math-focused large model MathGPT. In October, traditional learning hardware manufacturer Readboy held a press conference for its education large model, launching the new AI learning tablet C60 equipped with the large model.

In just half a year, the smart learning market has entered a new phase of intense competition driven by the application of large models. The rush among companies to launch products equipped with these models is closely tied to the sector's enormous market potential. According to the 2022 China Education Smart Hardware Industry Report released by Duojing Capital, learning tablets have become a focal point in the education smart hardware market due to their adaptability to home learning scenarios and high penetration rates. China's K12 education smart hardware sector shows tremendous growth potential, with an estimated market size nearing 100 billion yuan by 2024.

E-commerce data further highlights the soaring popularity of AI-powered learning tablets. JD.com's data reveals that during this year's "618" shopping festival, sales of learning tablets surged by over 100% within the first 10 minutes. Similarly, Douyin's e-commerce rankings show that, as of June 18, Xueersi topped the learning tablet sales chart with 55,000 units sold, generating 250 million yuan in revenue. The momentum continued during the "Double 11" shopping event, with JD.com reporting a threefold year-on-year increase in learning tablet sales within the first 10 minutes of the sale period on October 23.

Image source: Douyin screenshot

With such impressive market performance in just one application area like learning devices, it's no wonder many companies are strongly 'attracted' to large AI models.

Although the market outlook appears bright, educational AI models still face challenges in commercial applications.

Currently, apart from a few software products like NetEase Youdao's virtual oral tutoring, the main application scenarios for educational AI models remain hardware products targeting the C-end consumer market. However, when numerous companies launch learning devices simultaneously, product homogenization becomes inevitable.

According to Frost & Sullivan's projections, domestic learning device shipments will reach 7.26 million units by 2025 to meet surging demand. But while companies provide abundant products, this actually worsens parents' 'choice paralysis'.

"I've reviewed all market products from BBK, Xiaodu, iFlytek, Xueersi, Zuoyebang, etc., comparing price, educational resources, and features to find the best value. But as someone unfamiliar with tech products, judging advertised features is difficult - selection based on specifications alone remains challenging," said Ms. Li, a Beijing parent.

In the eyes of consumers, learning devices on the market are largely homogeneous, primarily focusing on features such as high-quality content, AI, and eye protection. However, for companies producing AI learning products, the biggest competition lies in the homogenization of sales channels.

Traditional learning hardware companies like BBK and Readboy fiercely compete offline, while tech firms, smart learning companies, and online education platforms clash directly in online channels—examples include iFlytek, Xiaodu, NetEase Youdao, TAL Education, and Zuoyebang. Homogenized channels lead to issues like high marketing costs, high return rates, and chaotic pricing, creating competitive pressures and challenges for businesses.

Under the homogeneous competition in products and channels, companies investing in self-developed large models have shown mixed fortunes, with some thriving and others struggling.

According to the 2023 interim financial report released by iFLYTEK (02230) in August, the company's revenue from education products in the first half of the year reached 2.421 billion yuan, a year-on-year increase of 4.0%. Among this, revenue from education product services was 2.29 billion yuan, up 3.6% year-on-year.

iFLYTEK stated that 'after the launch of the Spark Cognitive Large Model, the GMV (Gross Merchandise Volume) of our C-end hardware reached a record high from May to June 2023, doubling year-on-year. Specifically, the GMV of iFLYTEK's AI learning tablets equipped with the Spark Cognitive Large Model grew by 136% and 217% in May and June, respectively.'

On October 26, TAL Education (TAL.US) released its unaudited financial report for the second quarter of fiscal year 2024, ending August 31, 2023. Net revenue rose from $294 million in the same period last year to $412 million this quarter, a year-on-year increase of 40.1%. Net profit attributable to TAL was $37.902 million, compared to a net loss of $787,000 in the same period last year.

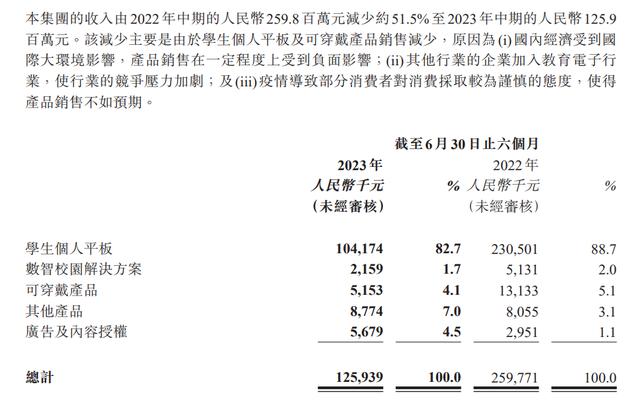

However, Reading Boy, which has also "doubled down" on large-model AI learning tablets, isn't faring as well. According to Reading Boy's (2385.HK) interim report, the company achieved revenue of 126 million yuan in the first half of 2023, a year-on-year decrease of 51.5%. Both its student tablet business and wearable products business saw declining revenues, with student tablet revenue dropping 54.8% year-on-year to 104 million yuan.

Reading Boy "didn't shy away" from attributing the revenue decline in these two product lines to "other industry players entering the education electronics sector, intensifying competitive pressures."

Not only is the industry highly competitive, but for companies, developing large AI models in-house is also a process of 'competing with oneself.' It is almost equivalent to a costly, time-consuming, and labor-intensive endeavor with no guarantee of profitability.

Zhou Feng, CEO of NetEase Youdao, once said, 'The biggest challenge in developing large models is the cost, which remains quite high. For example, the internal version of Youdao's translation model is 20 times more expensive than the original translation service. Costs can only be reduced through continuous engineering efforts and innovation with partners.'

Image Source: Canva Gallery

But despite the 'high' costs and uncertain returns, why do so many players still insist on investing heavily in in-house development?

First, educational large models indeed possess high value. As stated by Wang Huaimin, Academician of the Chinese Academy of Sciences and Professor at the National University of Defense Technology, "Large language models represent the latest technological means to support intelligent education and deserve sustained attention."

Guo Yike, Provost of the Hong Kong University of Science and Technology and Fellow of the Royal Academy of Engineering, also highlighted the fundamental impact of artificial intelligence on education. He once shared: "We intelligent humans should use the intelligent machines we create to cultivate even smarter individuals, who can then build even more intelligent machines. This is a virtuous cycle and represents human progress."

Second, companies must keep up with innovation trends to avoid falling behind. In Zhou Feng's view, continuous innovation may create competitive advantages, but stagnation for even six months can erase any first-mover advantage. "Developing large models requires teams to persist in their efforts. If someone can train a truly defensible model, it will form a competitive advantage. Whether this becomes a lasting advantage is something we're still observing," he noted.

Third, there is still no 'optimal solution' for educational large models, which is the fundamental reason for independent development. "Youdao closely follows this technological trend. We believe large models are crucial and decided early on to focus on their application in intelligent learning. However, after researching all available options and consulting with various companies, we found no suitable solutions, so we chose to develop our own," Zhou Feng expressed with some frustration. However, he added, "Youdao fully embraces open-source. If mature open-source projects become available, we will certainly adopt them."

From this perspective, due to the "complexity" of education, large models applied in this field seem difficult to fully standardize, leading many companies to pursue independent research. Simultaneously, they naturally hope to ride the "wave of large models" to shape future brand potential and pursue higher corporate profits.

Ultimately, the industry must remain vigilant against the 'large model bubble', especially for companies experiencing slowing revenue growth, which should carefully consider whether heavy investment in self-developed large models is necessary.