When Will Baidu's All-in Large Model Start Making Money?

-

In the book 'Crossing the Chasm,' hailed as the 'bible of tech marketing,' Geoffrey Moore writes: 'The most dangerous and critical point in the launch of high-tech products is the transition from an early market dominated by a few visionaries to a mainstream market ruled by pragmatists.'

Among the many industries in China today, generative AI (AIGC), which has rapidly developed over the past six months and is now testing commercialization, is facing this critical transition phase.

In this phase, internet companies, AI firms, and small startups are all diving into the competitive wave of the generative AI market. Leveraging their user resources, ecosystem advantages, and innovative ideas, they aim to provide users with more personalized, intelligent, and convenient products and services.

However, large models, as projects requiring billions in investment, inevitably start with tech giants. As one of the key players in this large-model competition, Baidu, which was the first to release ERNIE Bot, is undoubtedly a leader. Building on its years of exploration in the AI field and its enterprise application channels for large models, Baidu has focused on general-purpose large models, industry-specific large models, and ecosystem development. Its strategies are evident in the statements of its executives.

Shen Dou, President of Baidu Intelligent Cloud Group, outlined three main approaches for enterprises to apply large models. The first is building foundational large models, which only a few companies can undertake due to the high costs and technical barriers involved.

The second is developing industry-specific large models. Companies familiar with their industries can fine-tune foundational models with their proprietary data to create models better suited to real-world scenarios. 'Building an industry-specific model from scratch is a false proposition. A strong foundational model is essential for developing a good industry-specific model, which can then be iterated upon.'

The third approach is developing AI applications on top of foundational or industry-specific models. Most companies fall into this category, focusing on prompt engineering to solve specific problems and selecting the right large model based on performance, iteration speed, and toolchain.

Baidu is indeed pushing forward on all three fronts: foundational models, industry-specific models, and AI-native applications. But what efforts has Baidu made in these areas? What platforms and strategies has it introduced? And what challenges remain? In the process of translating technology into productivity, what are the potential commercialization hurdles?

1

Early Movers Prove Foundational Model Strength

But Advantages Don’t Guarantee Victory

As a product of 'big data + massive computing power + strong algorithms,' the effectiveness of large models depends on high-quality training data. This places higher demands on preparing domain-specific training data, especially for cognitive scenarios. The combination of high-quality data and exorbitant computing costs makes general-purpose large models a game for big companies.

In terms of training data scale, according to IT Home, the recently released ERNIE 4.0 has the largest publicly disclosed parameter count among large language models, potentially exceeding trillions.

Such a massive model naturally requires even greater computing power. Reports indicate that ERNIE 4.0 was trained on a 10,000-card AI cluster, likely the first large language model in China to use such a setup. Currently, only Huawei and Alibaba have revealed they’ve built 10,000-card AI clusters, but no specific models have been released based on them.

Beyond vast training data and parallel computing power, over the nearly five years since ERNIE 1.0, Baidu has fundamentally restructured its IT stack from a three-layer architecture ('chip—OS—application') to a four-layer one ('chip—framework—model—application'). Strict optimization at each layer has laid a solid foundation for deep learning and large models, making it the bedrock for industrializing large-model capabilities.

As of now, Baidu is one of the few AI companies globally with a full-stack layout across these four layers. Whether it’s the Kunlun high-end chips, the PaddlePaddle deep learning framework, or the ERNIE pre-trained large model, each layer features industry-leading proprietary technologies. The chip, framework, large model, and application layers form an efficient feedback loop, enabling continuous optimization and improved user experiences.

At Baidu World 2023, Robin Li stated that ERNIE 4.0 represents a comprehensive upgrade in foundational models, with significant improvements in understanding, generation, logic, and memory. He claimed its overall performance is 'on par with GPT-4.'

In terms of general-purpose large-model capabilities, ERNIE undoubtedly ranks among the top in China. But such strength doesn’t guarantee easy profits—it’s more like Baidu’s 'last stand.'

From an R&D perspective, the resources required for trillion-parameter training data and 10,000-card clusters are staggering. Industry experts estimate that the inference costs for ERNIE 4.0 are about 10 times higher than for version 3.5.

Statistics show that over the past decade, Baidu has invested over 140 billion yuan in R&D. This year’s model updates have intensified the 'burn rate,' pushing Baidu to a point of no return. Regardless of commercialization outcomes, as long as there’s potential, Baidu must charge ahead on the large-model path.

Competitively, as large-model technology advances, more players are entering the field. While general-purpose models have fewer competitors, each is a top-tier internet giant. Whether it’s Alibaba’s Tongyi Qianwen, Tencent’s Hunyuan, or Huawei’s Pangu, all pose significant challenges to ERNIE. Moreover, these models leverage their parent companies’ existing business scenarios, adding competitive pressure.

On profitability, Baidu believes expecting immediate returns from large models is unrealistic. Given the massive, long-term investments, single-point cost-benefit analysis doesn’t apply. For now, the focus is on ensuring usability and outperforming rivals—a goal Baidu claims to have achieved.

Long-term monetization will come in many forms, not just as a tech supplier. Empowering existing businesses is another avenue. Baidu’s past decade of AI investments, like its AI-powered search, has been profitable. Without AI, its search business—and its billion-dollar revenue—might not exist today.

In summary, ERNIE’s technical prowess is undeniable. But commercialization, ecosystem formation, and competitive pressures present formidable challenges.

2

Industry Models Show Strength,

But Application Impact Is Key?

If general-purpose large models are "encyclopedias" capable of handling multiple tasks—broad but not specialized—and thus unsuitable for direct application in production and daily life, then industry-specific large models are "operational manuals" optimized for particular domains or tasks. Their audience may be limited, but their professional precision is unparalleled.

In late September, Baidu launched China's first "industrial-grade" medical large model—Lingyi. It has already partnered with Gushengtang and Lingjiashe, offering trial access to over 200 medical institutions, including public hospitals, pharmaceutical companies, internet hospital platforms, and chain pharmacies, providing AI-native applications for patients, hospitals, and enterprises.

Prior to this, Baidu had already tailored model services based on client needs atop its general-purpose models. Public data shows Baidu's Wenxin now offers 11 industry-specific models spanning energy, finance, aerospace, media, film, automotive, urban management, gas, insurance, electronics manufacturing, and social sciences.

Baidu's strategy to advance industry-specific models is easily understood.

For small businesses, existing AI applications suffice. For large enterprises, building foundational models from scratch is optimal. But for mid-sized industry players—where AI applications fall short yet foundational models are overkill—fine-tuning specialized models is the prime choice. This segment represents the largest customer base with the brightest commercialization prospects.

However, the flip side of this potential is the complexity of aligning with diverse industrial scenarios. Variations across sectors and company sizes make large-scale model implementation increasingly challenging.

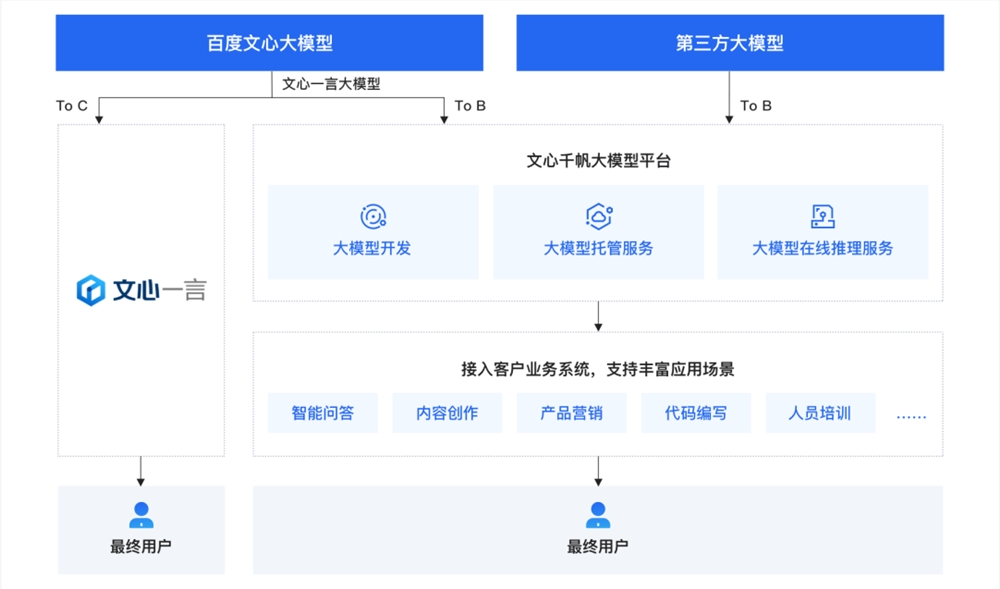

Baidu's solution? Empowering enterprises through its Qianfan platform, allowing clients to freely access third-party models while developing customized services with proprietary data. Qianfan now hosts 103 pre-built Prompt templates across dialogue, programming, e-commerce, healthcare, gaming, translation, and more—drawn from Baidu's industrial practice and Wenxin user data.

The platform also integrates 33 rigorously vetted third-party models with enhanced performance and security, granting enterprises "model freedom." This versatility positions Qianfan as the bridge between foundational models and businesses, accelerating AI product development.

Yet beyond technological prowess, competition in industry models remains fierce.

With lower data and technical barriers, tech giants like Huawei, Tencent, Alibaba, and ByteDance are all pivoting to industry models. Tencent Cloud showcased 10 sectoral implementations at WAIC2023, while Huawei's Pangu 3.0 model bluntly stated: "It doesn't write poetry—it gets things done."

Startups with niche datasets also compete uniquely, leveraging focused domain expertise and innovation.

Given the data-intensive, experience-driven nature of industry models—where no single player can monopolize—ecosystem collaboration becomes imperative. Baidu's approach? Cultivating a developer "garden" at the application layer.

Globally, applications thrive on general and industry model foundations. Microsoft's Azure OpenAI serves 11,000 enterprises (up from 200), while Salesforce embraces generative AI via Einstein GPT. Domestically, Tencent integrated its Hunyuan model across 50+ services, and iFlytek deploys models in education, healthcare, and finance.

Baidu, recommitting to AI, is rebuilding all products with Wenxin 4.0—from search (now multimodal) to Wenku (a "productivity tool") and GBI (enabling "conversational insights").

At Baidu World 2023, its Qianfan AI-Native Development Workbench debuted, offering RAG and Agent frameworks with templates for streamlined app creation. Plugins further democratize development, addressing SMEs' resource gaps while preserving their innovative edge.

The areas where developers often struggle are precisely where Baidu excels, leading to the creation of the Lingjing Matrix platform. As Baidu's Wenxin plugin development platform, it supports developers in selecting various development methods and template components tailored to their industries and application scenarios, aiming to build more contextualized, industry-specific, and customized AI application plugins.

From the launch of Qianfan and Lingjing, it's clear that Baidu is determined at the application level. After all, whether it's the billion-dollar investment in foundational large models or the push for industry-specific large models, without applications closely tied to production scenarios, they would become the biggest bubbles, let alone achieve commercialization. As Robin Li said, 'Only when enough AI-native applications are built on large models can we have a healthy ecosystem.'

However, Baidu's emphasis doesn't guarantee absolute success at the application level.

Compared to other large model providers, Baidu's advantages in industry implementation lie mainly in customer delivery assurance and end-to-end service capabilities. So far, nearly 500 scenarios have achieved good results through co-creation with customers. It can be said that the first phase of trials and validation has largely concluded, entering the second phase of actual industrial implementation.

Yet, from the perspective of Baidu's own business scenarios, its search-based scenarios appear limited compared to Huawei's industrial scenarios, Tencent's entertainment scenarios, and Alibaba's shopping, payment, and lifestyle scenarios. Even with AI reconstruction, the extent of commercial profitability remains to be seen.

Beyond its own business scenarios, how many users will be attracted by the open application and plugin development capabilities? How much revenue can be generated from certain user groups? These remain unknowns. The biggest challenge for generative AI applications isn't finding use cases, demands, or distribution channels, but proving their value. In the current AI ecosystem, the value of application-layer iterations is still uncertain.

However, as investors or observers, there's no need for excessive pessimism. After all, Baidu is a top-tier AI company with strong technical capabilities and a clear strategy, which is already commendable. As for the specifics of implementation and the ceiling of commercialization, perhaps we should give Baidu more time before making judgments.

In Conclusion

As the once top-valued Chinese internet company surpassing Alibaba and腾讯 a decade ago, Baidu has now been overtaken by many 'younger' competitors. Why hasn't the technically strongest Baidu achieved corresponding market value? This is a question worth pondering.

Aside from tactical missteps like not quickly entering the cloud sector or limited results from heavy investments in autonomous driving, Baidu's fundamental issue is the lack of a truly disruptive product during the mobile internet era. In contrast, the rapid rise of new internet giants shows that user experience and application implementation were paramount in that era.

At the dawn of the AI era, Baidu has declared an 'All in AI' strategy, aiming for breakthroughs in key industries and leveraging technological leadership to drive other business lines—a correct approach. But the right path is often fraught with challenges and obstacles.